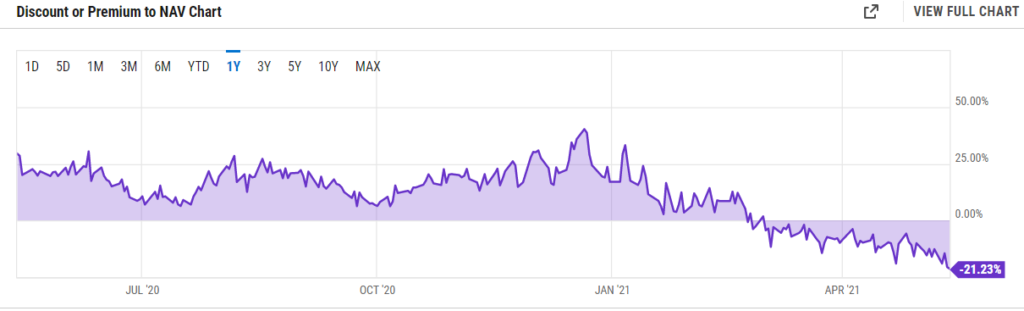

Grayscale’s GBTC discount exceeds 20%

On May 13, the Grayscale Bitcoin Trust (GBTC) traded at a discount of 21.23% to net asset value (NAV). The discount has persisted since February 23.

In May 2021, Digital Currency Group (DCG), led by Barry Silbert, announced increase in the GBTC stock purchases limit from $250 million to $750 million. As of April 30, 2021, DCG had spent $193.5 million on these purposes.

According to the latest data, investors directed $32.7 billion into the Bitcoin Trust.

05/13/21 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

Total AUM: $47.6 billion$BTC $BCH $ETH $ETC $ZEN $LTC $XLM $ZEC $BAT $LINK $MANA $FIL $LPT pic.twitter.com/XbCxiR5FGJ

— Grayscale (@Grayscale) May 13, 2021

One reason for the discount was Grayscale’s temporary decision to halt accepting deposits into GBTC.

In April, the holder of the Bitcoin Trust’s shares, the investment firm Marlton, wrote an open letter to the management urging to restore the ability for clients to invest in this product.

Arcane Research, among other reasons for the discount, cited the emergence of alternative instruments, the launch of bitcoin funds, and the acquisition of the first cryptocurrency directly by certain companies.

Canada’s regulator recently approved the third bitcoin-ETF, available to investors including in US dollars. A similar instrument also gained listing in Brazil.

In spring 2021, the U.S. Securities and Exchange Commission began reviewing two applications to launch ETFs from WisdomTree and VanEck. In April, the regulator extended the review period for the latter to June 17, 2021.

Grayscale plans to convert GBTC into an exchange-traded fund backed by digital gold. In March, the company posted nine job openings related to this initiative.

Earlier, Grayscale launched five new cryptocurrency funds. Before that, the firm filed applications to register six more trusts.

Subscribe to ForkLog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!