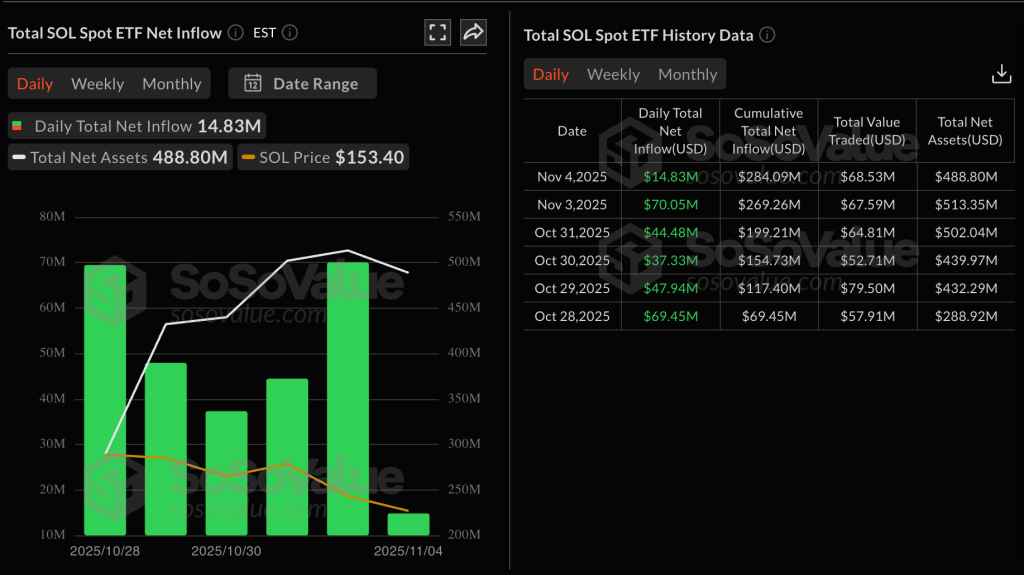

Solana ETFs Attract Over $280 Million in Six Days of Trading

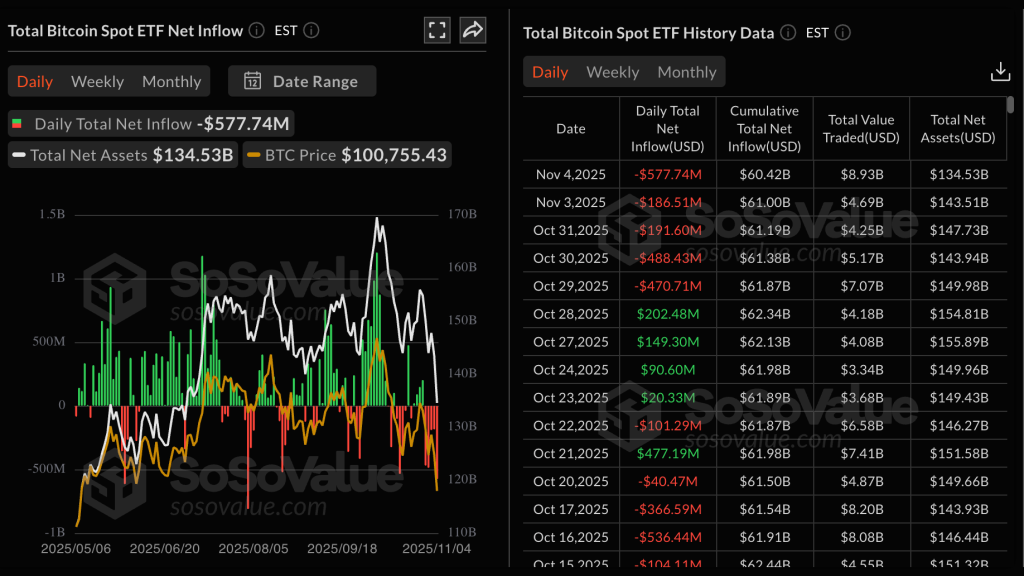

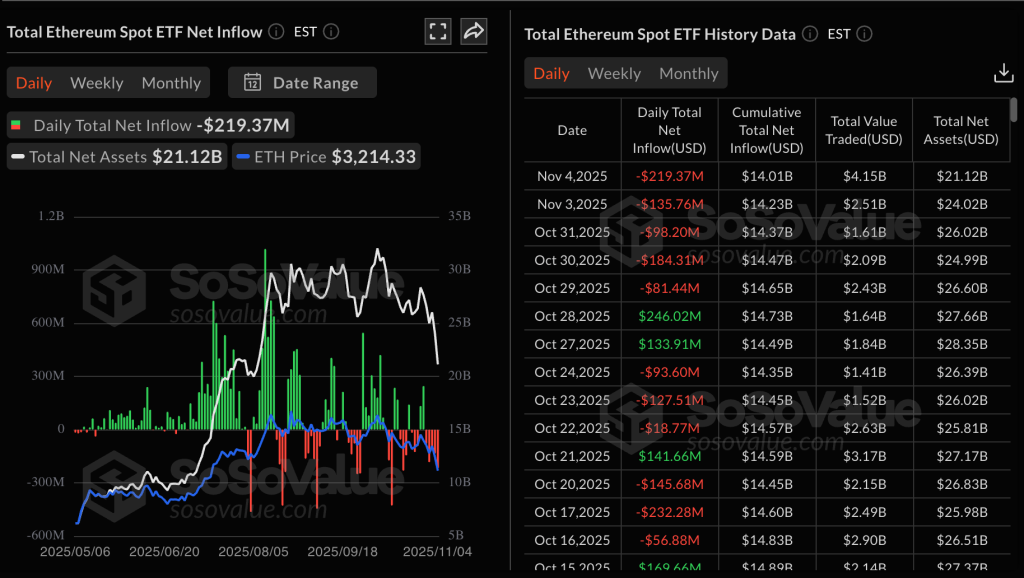

Bitcoin and Ethereum funds recorded outflows of $2.6 billion.

Since October 28, amid the decline in the crypto market, exchange-traded funds based on Solana have attracted $280 million. During the same period, a total of $2.6 billion was withdrawn from Bitcoin and Ethereum ETFs, according to SoSoValue.

In the segment of Solana-focused investment products, there are currently two players — BSOL from Bitwise and the converted GSOL from Grayscale. The majority of funds ($275 million) were secured by the former.

The total value of assets under management by these funds reached $488 million — 0.58% of the total cryptocurrency supply. The average daily trading volume was about $60 million.

In the last 24 hours, $577 million was withdrawn from Bitcoin ETFs — the highest since early August, when the figure exceeded $812 million. The main losses were incurred by FBTC from Fidelity, which lost $356 million.

In second place in terms of funds withdrawn was ARKB from Ark & 21Shares (-$128 million).

The negative trend continued for the fifth consecutive day.

Similarly, spot exchange-traded funds based on Ethereum lost $219 million in the last trading session. The main volume was attributed to ETHA from BlackRock (-$111 million) and ETH from Grayscale (-$68 million).

Reasons

Vincent Liu, Chief Investment Officer at Kronos Research, believes that the current trend reflects macroeconomic uncertainty rather than a decline in confidence in cryptocurrencies.

“The multi-day fund outflows indicate that financial institutions are reducing risks as leverage decreases and macro concerns grow. Until liquidity conditions stabilize, capital rotation will continue to support ETF outflows,” he stated in a comment to Cointelegraph.

According to the expert, the negative trend is driven by a general investor preference for safe-haven assets amid a strengthening dollar and tightening liquidity.

He explained the positive sentiment around Solana-based exchange-traded funds as a combination of fundamental advantages and a favorable market narrative. Investors are attracted by the yield on these ETFs, which include a staking function.

However, Liu cautioned that altcoin-focused products remain niche. The segment is primarily fueled by early adopters and speculators “chasing high yields.”

Solana has not shown a pronounced price movement in response to investor interest in exchange-traded funds based on the asset. Over the past week, the coin’s price has decreased by 2%.

At the time of writing, the altcoin is trading around $156.

Earlier, analysts at Hyblock compared Solana’s reaction to Bitcoin’s behavior following the launch of spot BTC ETFs in January 2024. They noted that the first cryptocurrency remained in a sideways trend but eventually broke out. A similar dynamic is possible for SOL.

Experts at Wintermute attributed the current downward trend in the crypto market to liquidity distribution.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!