Tristero Research Warns of Potential 2008-Like Crisis in RWA Sector

RWA sector's rapid growth may trigger a 2008-like crisis at blockchain speed.

The rapidly growing RWA sector is creating a “liquidity paradox” that could trigger a crisis akin to the 2008 mortgage collapse, but at “blockchain speed,” according to Tristero Research.

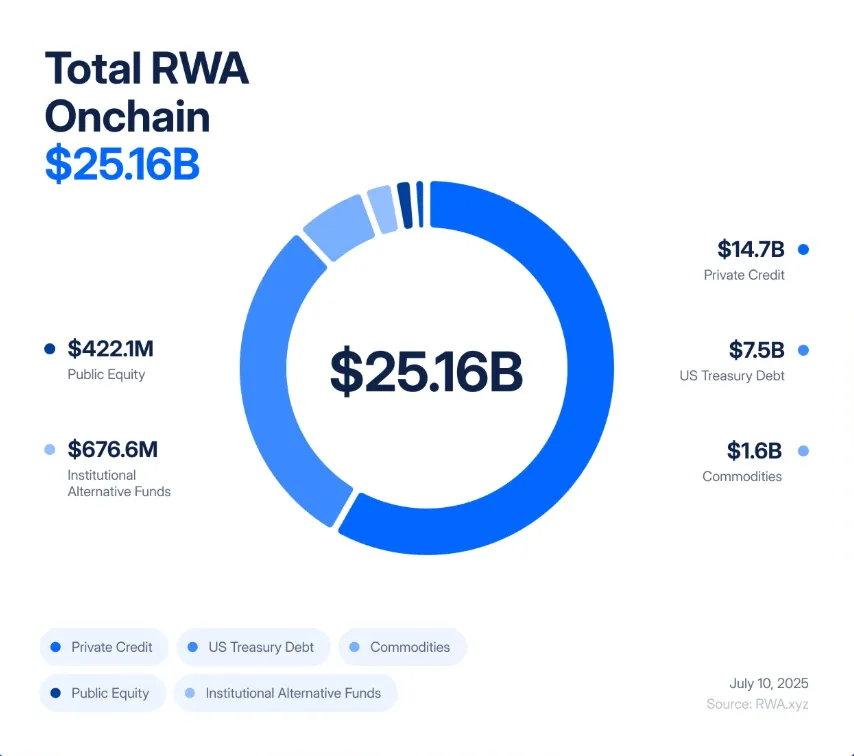

Analysts noted that the RWA market has expanded from $85 million to $25 billion over five years. Major players like BlackRock are already issuing tokenized treasury bonds, and analysts predict an influx of trillions of dollars into this sector.

The Illusion of Liquidity

The issue, experts noted, is that tokenization does not alter the nature of the underlying assets. An office building, a private loan, or a gold bar remain slow and illiquid, with legal processes for sale and transfer taking weeks or months.

Tokenization creates a “liquid shell.” A token can be sold instantly, used as collateral, or liquidated. This leads to a mismatch: slow real-world risks related to loans and valuations become high-frequency volatility risks on the blockchain.

Parallel to 2008

Experts drew a direct analogy to the 2008 financial crisis. Back then, Wall Street turned illiquid mortgage loans into seemingly reliable derivative instruments—CDOs and CDSs.

When borrowers began defaulting en masse, real mortgage losses accumulated over months. However, the related derivatives collapsed in mere days, triggering a chain reaction and global shock.

Analysts believe that RWA tokenization replicates this architecture, only faster. A crisis in DeFi protocols could spread not over months, but within minutes.

How the Collapse Could Occur

Tristero Research provided an example of a token tied to commercial real estate. As long as tenants pay and documents are in order, the asset appears stable. However, transferring rights to the property itself takes weeks.

On the blockchain, this same asset as a token trades around the clock. A rumor on social media or a delay in oracle data updates could instantly undermine confidence in the token.

Panic selling would ensue. DeFi protocols would register the price drop and trigger automatic liquidations of collateral backed by this token. This would create a feedback loop, turning a slow real estate issue into a full-blown on-chain crash.

The Next Stage: “RWA2“

Researchers are confident that the next step will be the creation of derivatives based on RWA tokens. Indices, synthetic assets, and structured products combining shares in various real assets will emerge.

This will introduce new risks. Instead of unscrupulous rating agencies, oracles will become the weak link, and instead of counterparty default, vulnerabilities in smart contracts will pose threats. A failure in one major protocol could collapse all derivative instruments built on its foundation.

Tristero Research emphasized that tokenization brings efficiency and transparency to the market but does not eliminate the risks of underlying assets. It merely accelerates the response to them.

Analysts believe the industry should not abandon tokenization but develop it with the “liquidity paradox” in mind. This requires more conservative collateral standards, reliable data update mechanisms, and built-in “circuit breakers” to prevent cascading liquidations.

In June, Moody’s experts stated that the growing use of tokenized U.S. treasury bonds with yield as collateral for margin trading opens “new channels of risk transmission” between markets.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!