USDC supply stabilises after Silicon Valley Bank collapse

Following a wave of redemptions of the stablecoin USDC, tied to the collapse of Silicon Valley Bank (SVB) and the loss of parity with the dollar, the coin’s supply slowed its decline. The Block reports.

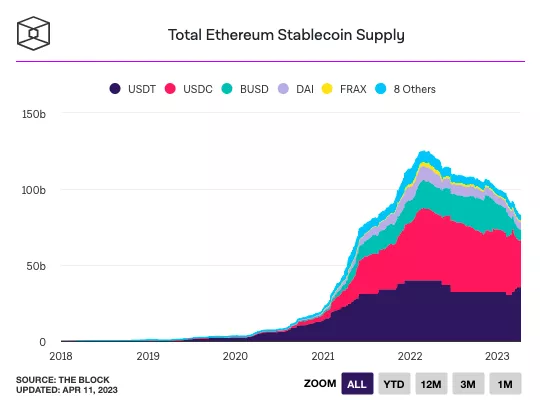

The total amount of USDC in the Ethereum network stands at just under $31 billion, down $11 billion from the start of the year.

On March 11, the stablecoin lost its dollar peg after reports that Circle, the issuer, held in the failed SVB portion of the asset’s reserve of $3.3 billion. Because of the depegging, algorithmic stablecoins DAI and FRAX also lost their dollar peg.

Indicators for other Ethereum-based stablecoins, including Binance USD (BUSD) and Gemini Dollar (GUSD), also declined.

The supply of BUSD fell from $16.5 billion to $7 billion, and GUSD from $575 million to $391 million.

Likely, the weakening of Binance’s stablecoin positions is tied to regulatory problems. At the end of March, CFTC accused the exchange of “sham” compliance with U.S. rules on derivatives trading.

There are also concerns about the state of the Gemini crypto exchange run by the Winklevoss twins. In April, Bloomberg reporters said the brothers provided a $100 million loan to their trading platform.

Tether (USDT), by contrast, is showing growth. ERC-20 USDT accounts for 43% of all stablecoins on Ethereum. At the start of the year this figure stood at 32%; over the three months the supply of the stablecoin rose from $32.3 billion to $35.3 billion.

Against the backdrop of a temporary USDC depeg, the market capitalisation of USDT rose to $74.7 billion, nearly twice the value of Circle’s stablecoin.

According to a recent statement by Tether’s CTO Paolo Ardoino, for the first quarter the company expects to report a net profit of $700 million, which would lift USDT’s excess reserves to $1.66 billion.

In March, Circle announced plans to launch USDC in the ecosystem Cosmos.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!