Week in Review: Grayscale wins court case against the SEC, but Bitcoin falls below $26,000

Bitcoin initially rose, then crashed; Grayscale won its case against the SEC; the regulator delayed a decision on Bitcoin ETFs; cryptocurrency exchanges removed sanctioned Russian banks from their P2P platforms; and other developments of the waning week.

Bitcoin price fell below $26,000

On Tuesday, August 29, the price of the first cryptocurrency surpassed $28,000 after the US court granted Grayscale Investments' motion in the case against SEC.

In the early hours of Friday, September 1, Bitcoin fell below $26,000. Ahead of that, the SEC postponed decisions on spot Bitcoin-ETF applications.

As of writing, digital gold trades below the $26,000 level.

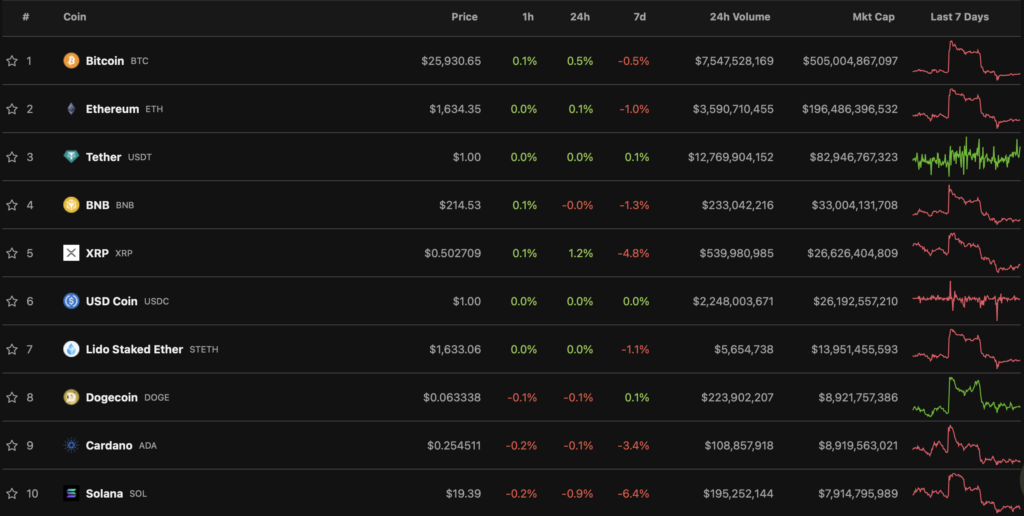

Most top-10 assets by market cap ended the week in the red. Solana (-6.4%) and XRP (-4.8%) posted the largest declines.

The combined market cap of the crypto market sits below $1.1 trillion. Bitcoin dominance index stands at 49.3%.

Grayscale wins court case against the SEC. Regulator delays decision on Bitcoin ETFs

In June 2022, asset manager Grayscale filed a lawsuit against the SEC for denying the conversion of GBTC into a Bitcoin ETF. The conversion application was submitted in October 2021.

In August 2023, the appellate court ordered the Commission to reconsider its decision. After that, U.S. Representative Warren Davidson again urged Gary Gensler to step down as head of the SEC.

On August 31 the regulator delayed decisions on spot Bitcoin-ETF applications from BlackRock, Fidelity, Bitwise, VanEck, WisdomTree, Invesco and Valkyrie at least until mid-October.

Overall, the agency has 240 days from the start of review.

Bloomberg analysts James Seyffart and Eric Balchunas raised the odds of a spot Bitcoin ETF this year to 75%. Former SEC head Jay Clayton called it inevitable that a positive decision would come for the instrument.

What to discuss with friends?

- The blogger revealed a seed phrase on YouTube and lost $60,000.

- The crypto-friendly mayor of Miami declined to run for president.

- Stronghold requested permission to mine on burning tires.

- Ronaldinho denied involvement in a $61 million crypto scam.

OKX, Bybit and KuCoin removed sanctioned Russian banks from P2P platforms

Russian users of OKX’s P2P service noted that banks Sber, Alfa and Tinkoff became unavailable as payment methods.

Bybit users also reported the disappearance of Sber and Tinkoff. Although these banks remain in the dropdown list of payment methods, trades via them are not executed.

KuCoin banned operations with Sber and Tinkoff, as noted in a letter. Buying or selling cryptocurrencies is possible only via bank transfer and through payment services.

Earlier, Binance banned Russian citizens from conducting operations through its P2P platform with any currencies other than the ruble.

Binance to discontinue support for BUSD in 2024

The cryptocurrency exchange Binance said it intends to discontinue support for its own stablecoin BUSD in 2024.

In February, NYDFS initiated an investigation into Paxos, the issuer of the stablecoins. The regulator ordered the company to discontinue issuing BUSD. The firm also halted its cooperation with Binance.

The company stopped issuing new stablecoins in line with regulator directives. Redemption and conversion operations are supported at least until February 2024.

Also on ForkLog:

- Bitcoin trading volume fell to five-year lows.

- OpenAI launched an improved business version of ChatGPT.

- In Russia, insurance was paid for with digital rubles for the first time.

- Robinhood will buy back a stake in Sam Bankman-Fried for $605 million.

Pepe developer accuses former team members of stealing $15 million

The sole remaining Pepe (PEPE) developer said that behind the theft of 16 trillion coins (~$15 million) are three former members of the project team.

On August 25, on-chain researchers noted that the multisig wallet PEPE reduced the number of required confirmations from five to two and moved part of the assets to decentralized exchanges OKX, Binance, KuCoin and Bybit.

«Since the creation of PEPE, it has, unfortunately, suffered from internal factions, with some team members acting as saboteurs driven by egos and greed. Conflicts arose frequently, and most involved in creating the coin began distancing themselves a week after launch», — the developer said.

A project spokesperson apologised for the incident and noted that now only he controls the token’s smart contracts. He said that in the coming months PEPE will be fully decentralised.

The stolen coins account for about 4% of the total issuance, and the multisig wallet holds about 10 trillion PEPE. These tokens will be transferred to a new address, where they will be “safely stored until they are needed for use or burned,” the programmer explained.

BlackRock has invested over $400 million in mining companies

BlackRock holds shares in four crypto-mining companies totalling $411 million.

According to Finbold, on July 30 the firm bought on the dip:

- Riot Blockchain (RIOT) — 10.7 million shares (6.14%) for $199.08 million;

- Marathon Digital (MARA) — 10.9 million shares (6.44%) for $190 million;

- Cipher Mining (CIFR) — 2.2 million shares (0.88%) for $8.36 million;

- TeraWulf (WULF) — 4.8 million shares (2.28%) for $14.10 million.

The total amount of the venture firm's investments represents 0.35% of the $117.6 billion it owns.

Moreover, BlackRock's current stake makes it one of the largest Bitcoin Mining Council members by volume — the lobbying group for the Bitcoin mining industry in the United States.

What else to read?

This week ForkLog spoke with a former employee of scam companies, learned about the technology for launching a crypto-processing service in Europe, and explained the essence of neuro-art.

In a traditional digest, we gathered the week's main cybersecurity events.

The cryptocurrency industry is attracting more institutional players. This is evident in both new investments in infrastructure and the growing attention that companies give to Bitcoin as an asset class. The most important events of recent weeks are in ForkLog's overview.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!