October 2020 in Numbers: Bitcoin, Ethereum, DeFi, the CBDC Race

Key

- Bitcoin closed the best month since the start of 2018, updating a two-year price high at $14,100.

- Activity on the regulated CME exchange and inflows into Grayscale funds signal institutional interest in the first cryptocurrency.

- DeFi token prices have fallen significantly.

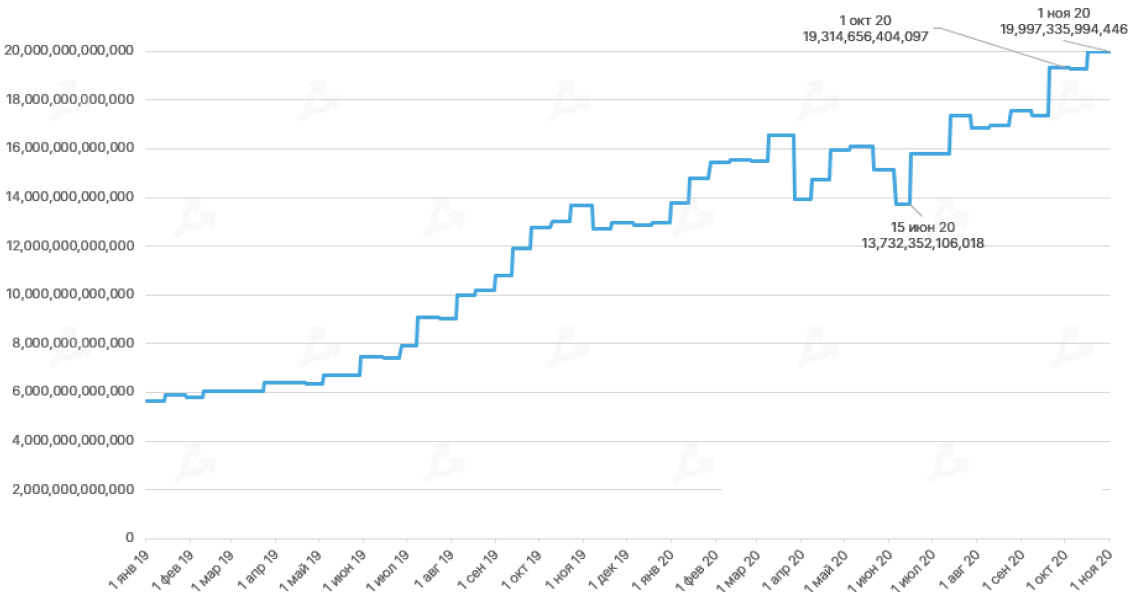

- The market capitalization of Bitcoin tokens on the Ethereum blockchain is rising rapidly.

- Trading volume on decentralized exchanges declined, but the overall picture points to the popularity of DEXs among users.

- The rally spurred a spike in transactions in the stablecoin USDT. USDC capitalization approached $3 billion.

- More central banks have announced plans to study and develop a digital currency (CBDC). Among them is the Bank of Russia.

- Jack Dorsey’s Square invested 1% of its savings in Bitcoin, and PayPal added crypto support.

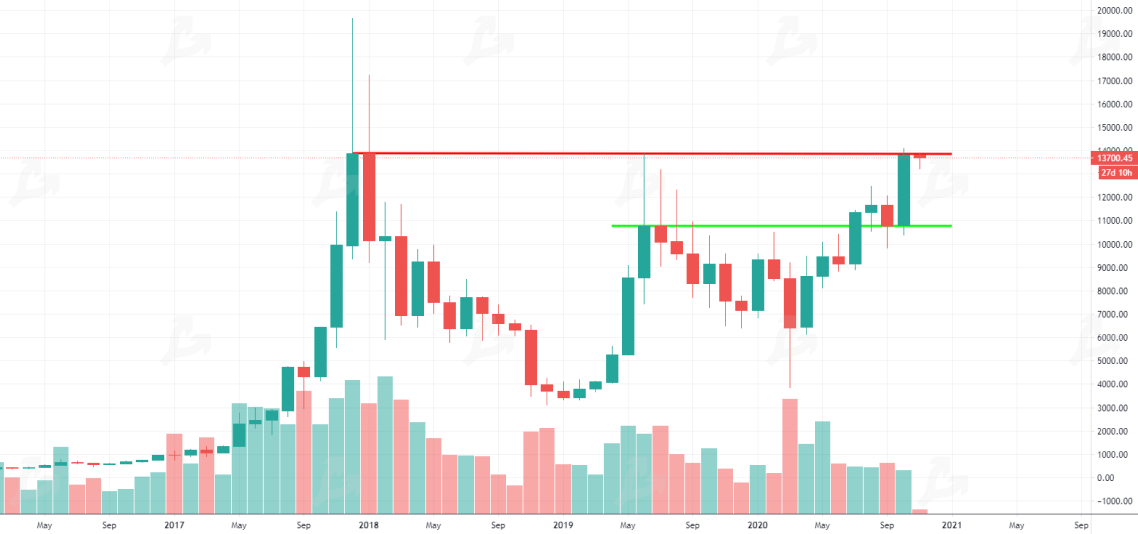

Bitcoin and Ethereum price

Monthly BTC/USD chart on Bitstamp. Data: TradingView.

Monthly ETH/USD chart on Bitstamp. Data: TradingView.

- During the month Bitcoin rose 28%. The first cryptocurrency updated its annual high, and then a two-year high, closing the best month since 2017–2018. The price remained above $10,000 for more than three months (96 days as of November 1). Since the third halving, Bitcoin has risen by 60%.

- New money is entering the market, as evidenced by record Bitcoin addresses and market capitalization above $400 billion for the first time since 2018. Fundamental factors indicate further growth, though October’s trading volume was relatively small.

- Ethereum held the $350 level, but price was nowhere near the year’s high. Fundamentally, the outlook looks optimistic for continued growth — hash rate, the value of assets locked in the DeFi sector (TVL), and addresses with 32 ETH or more are rising.

- In Russia, the price of 1 BTC exceeded 1 million rubles. Bitcoin also hit all-time highs in pairs with national currencies Turkey, Argentina, Brazil, Sudan, Angola, Venezuela and Zambia.

Market sentiment and correlations

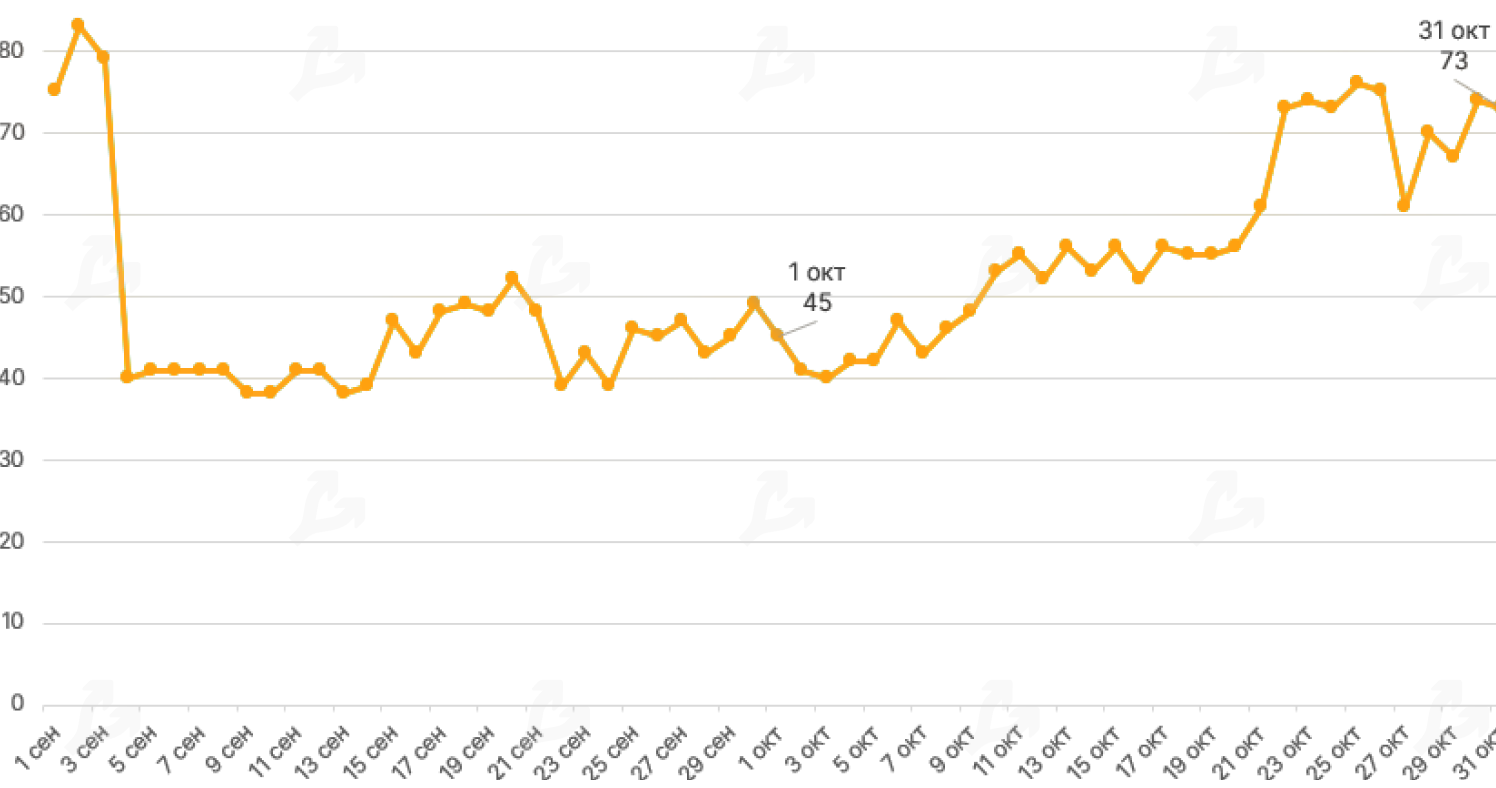

The cryptocurrency “fear and greed index” was steadily rising, signaling optimism in the market and higher volatility. The average for October was 57.1 (September 46.9).

Dynamics of “Fear and Greed Index” in October 2020. Data: alternative.me.

Data as of 1.11.2020.

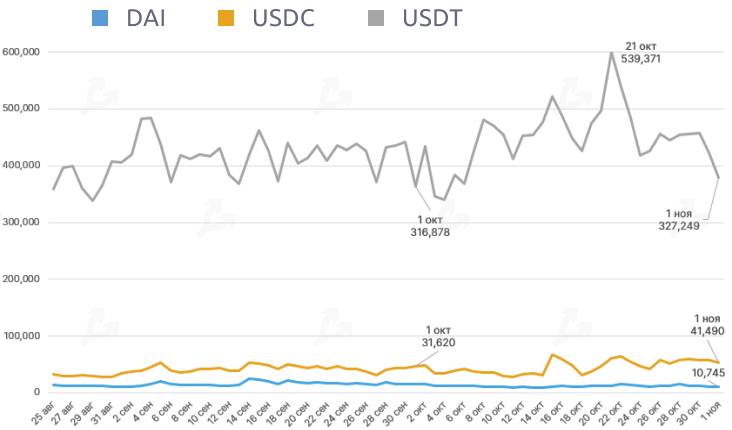

Trading volume

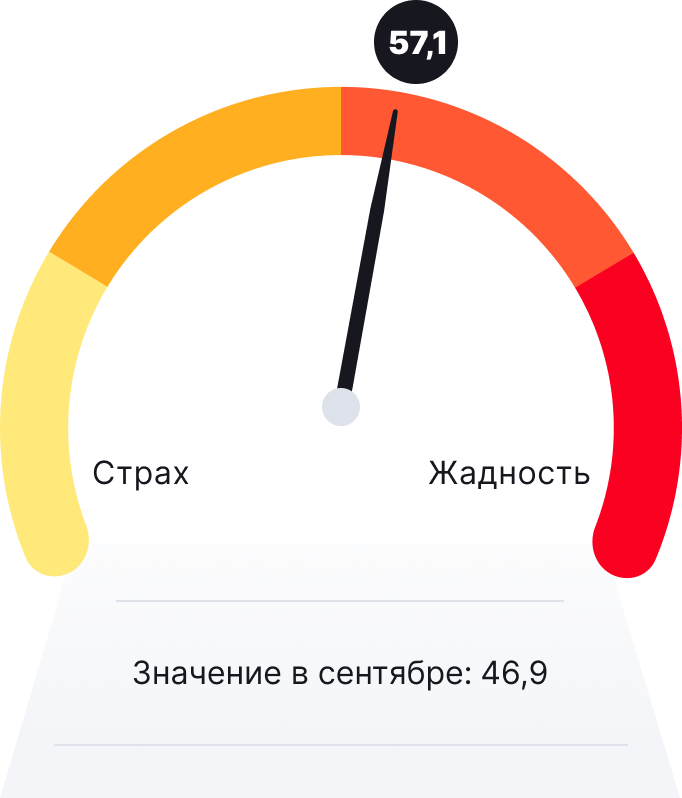

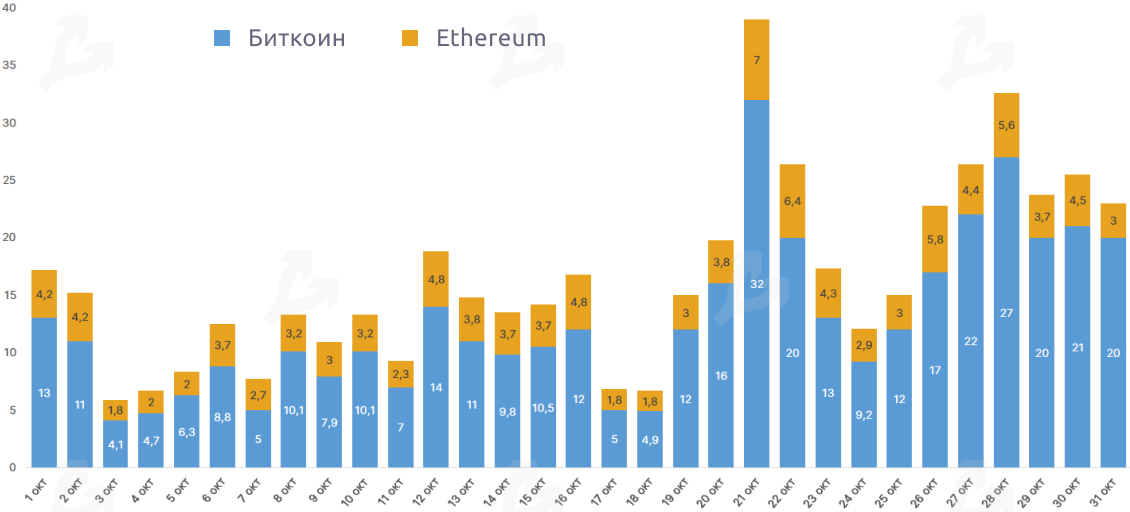

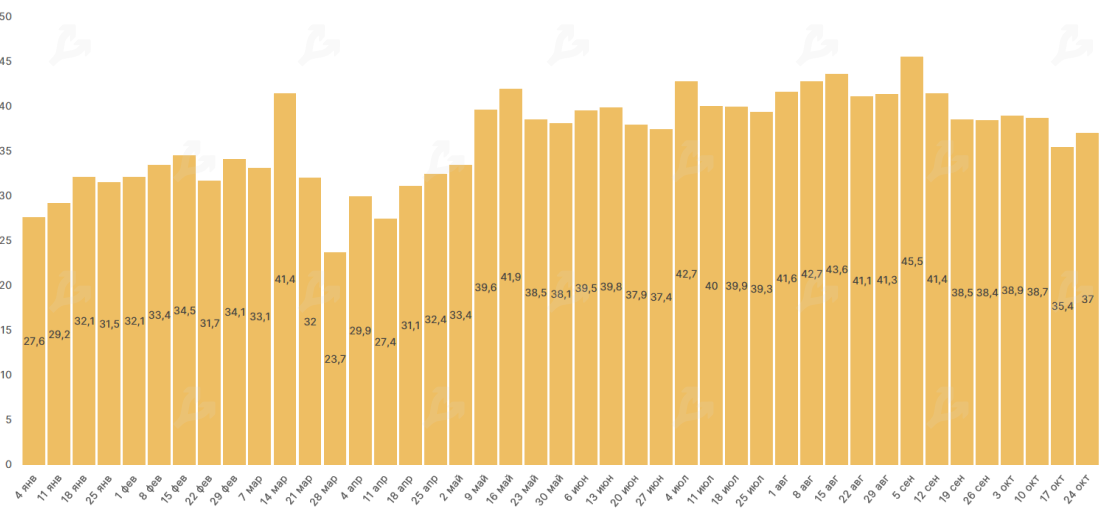

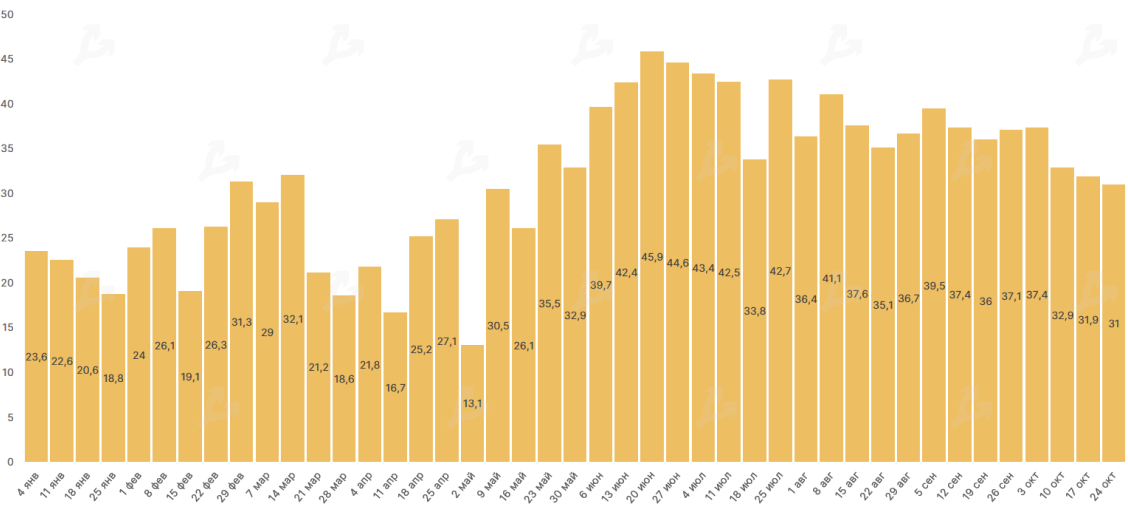

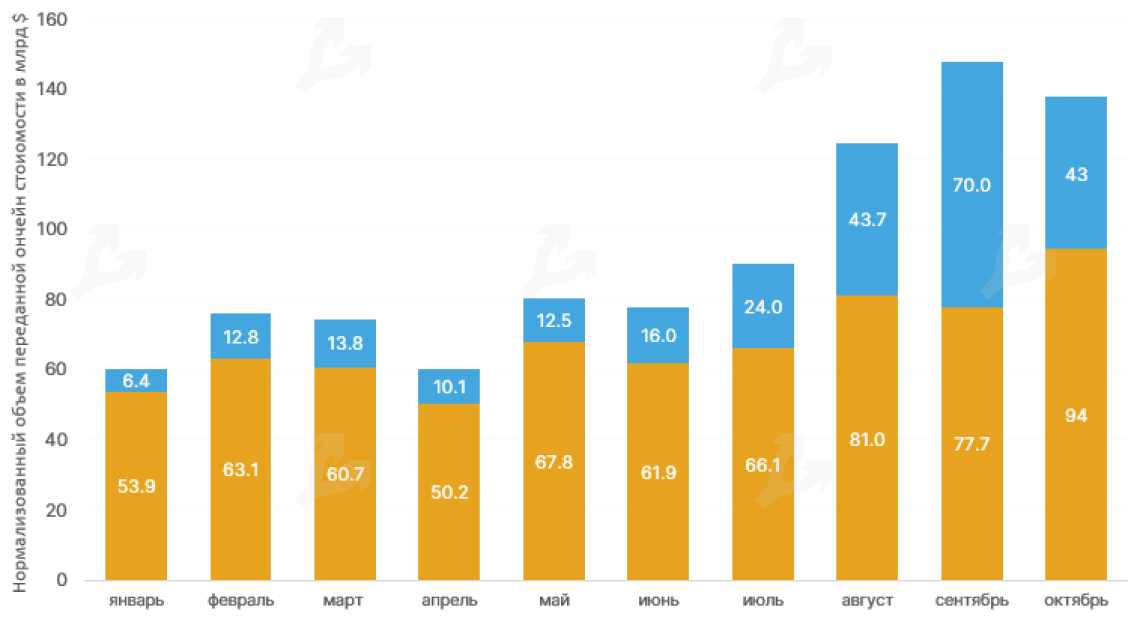

Trading volume (spot), USD bln. Data: CryptoCompare.

Despite Bitcoin’s rise, trading volume on cryptocurrency exchanges in October fell by 42%. The aggregated figure across leading platforms stood at $90.4 billion, down from $156 billion in September.

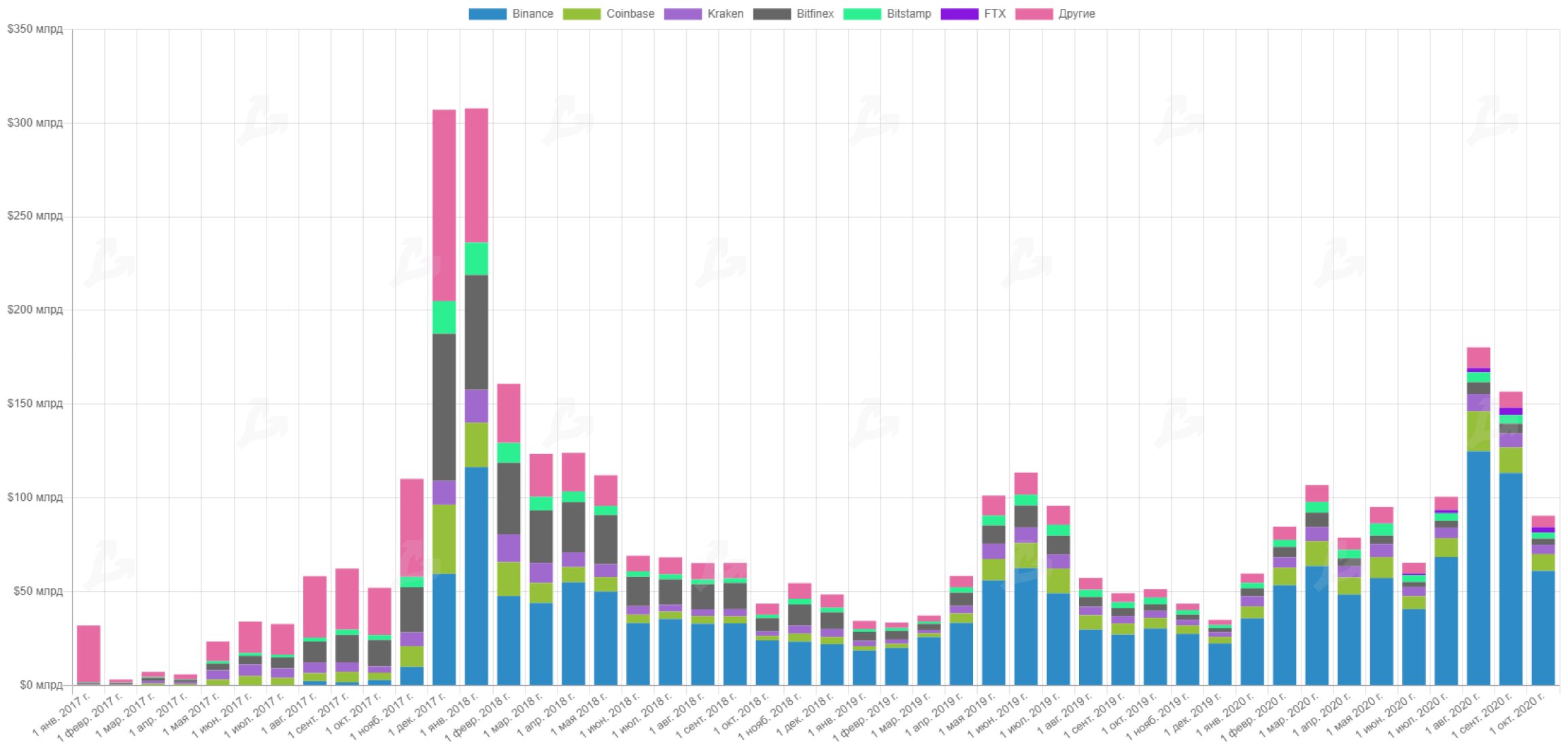

Trading volume of Bitcoin and Ethereum futures. Data: skew.

Trading volume of Bitcoin and Ethereum options. Data: skew

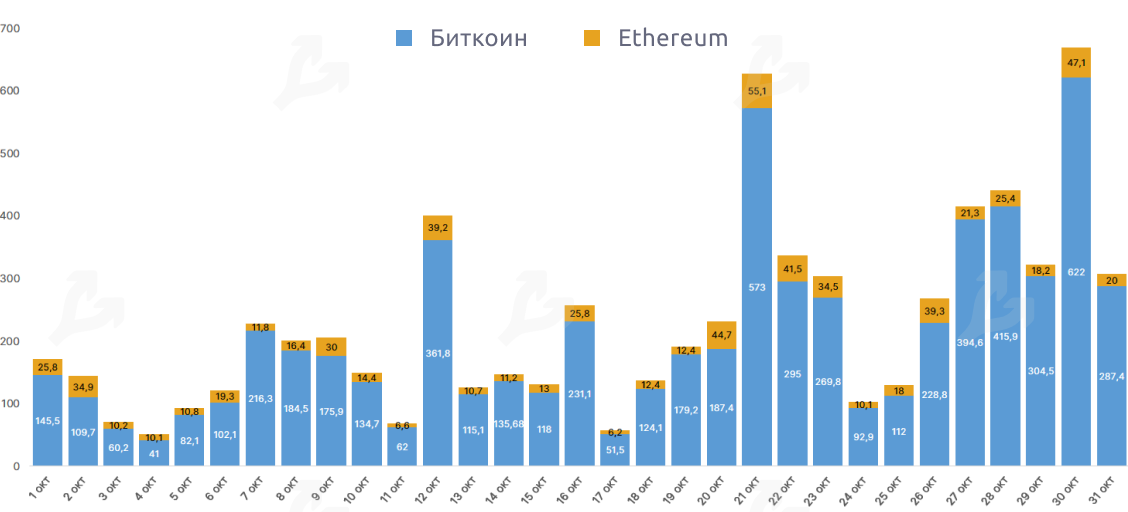

Stablecoins

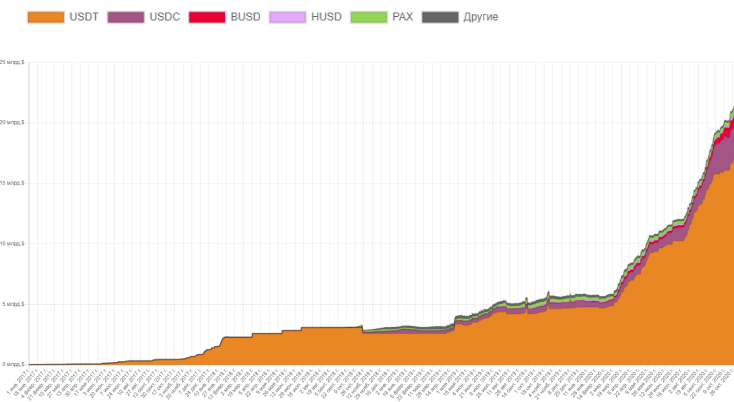

Market capitalization of stablecoins. Data: Messari.

Top-5 stablecoins by market cap, millions $. Data: Messari.

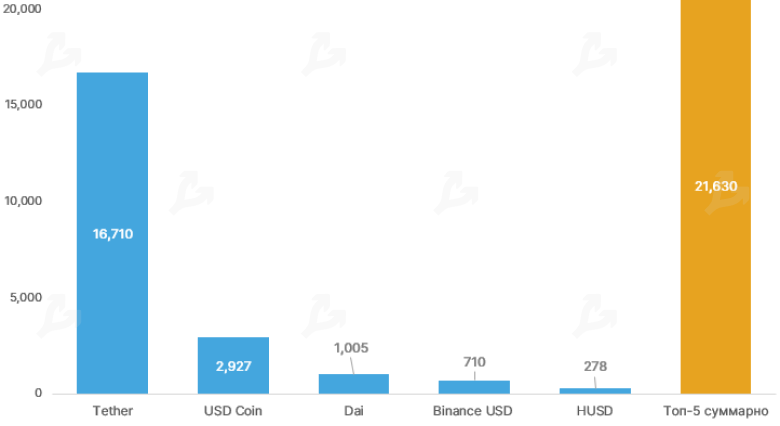

Number of stablecoin transactions. Data: Messari, Coin Metrics.

- Capitalization of stablecoins reached $22.4 billion. In October Tether issued an additional $600 million USDT. USDC capitalization is approaching $3 billion, and the DAI metric surpassed $1 billion. Binance’s BUSD is gaining popularity — its capitalization grew 42% in the month to $710 million. Tether’s share in the segment fell from 77.9% to 74.5%.

- In the first two dec-ades of October, amid Bitcoin’s rise above $13,000, there was a significant rise in USDT transactions. After Oct 21 on-chain activity normalized. The number of USDC transactions in the month rose 31%.

P2P segment

1 Volume on LocalBitcoins P2P platform in 2020, mln $. Data: coin.dance.

Volume of trades on the Paxful P2P platform in 2020, mln $. Data: coin.dance.

Mining, hash rate, miners’ revenue

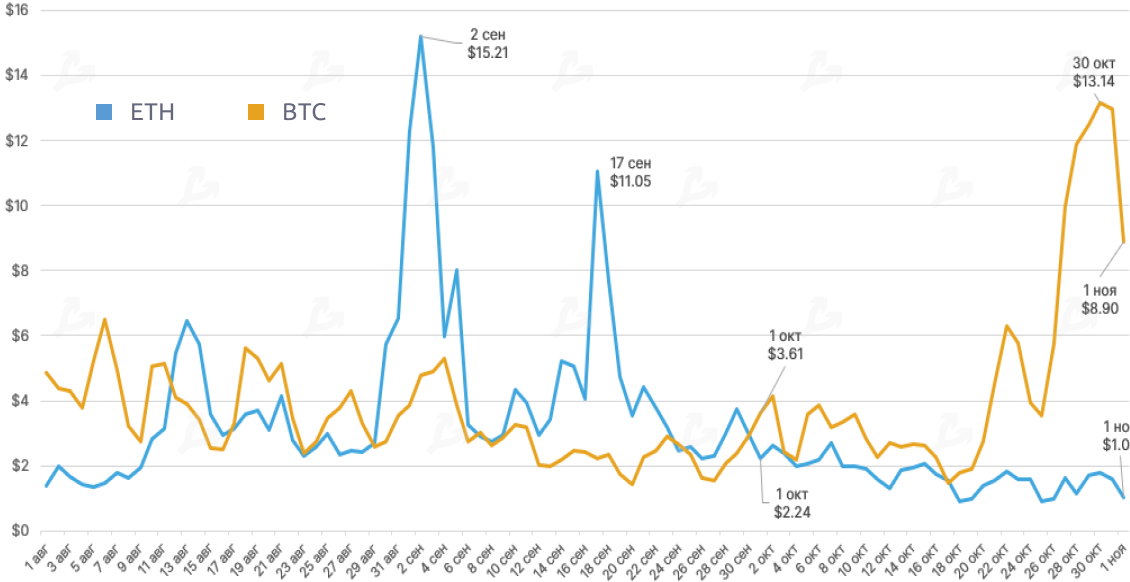

Average Bitcoin- and Ethereum-transaction fees (mol $). Data: Blockchair.

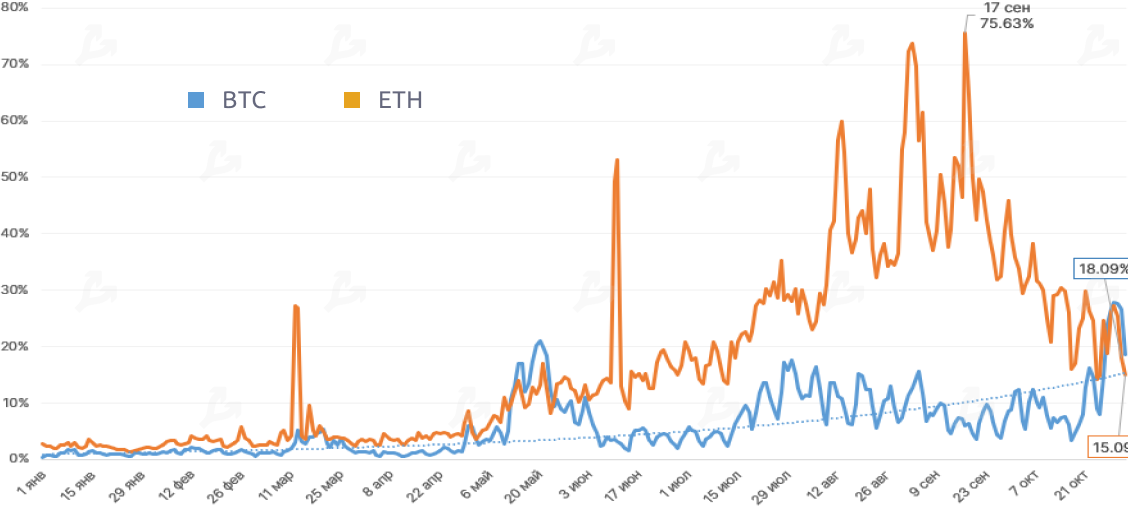

Dynamics of the share of fees in Bitcoin- and Ethereum-miners’ revenues. Data: Coin Metrics.

In October, Bitcoin network fees rose sharply — the average crossed $13 by October 30. The last time such levels were seen was January 2018. Over the same period, Ethereum’s average fee declined by more than half. This is likely linked to cooling DeFi activity and lower transaction demand for USDT.

The trend toward lower fees in Ethereum miner revenues has been evident since mid-September. In October, Bitcoin miners saw a reversal in this trend.

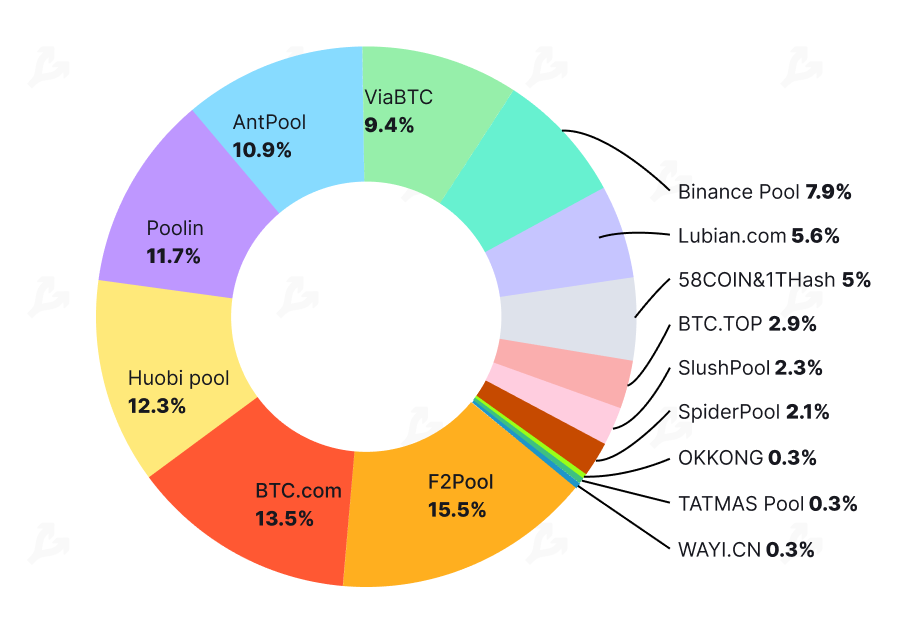

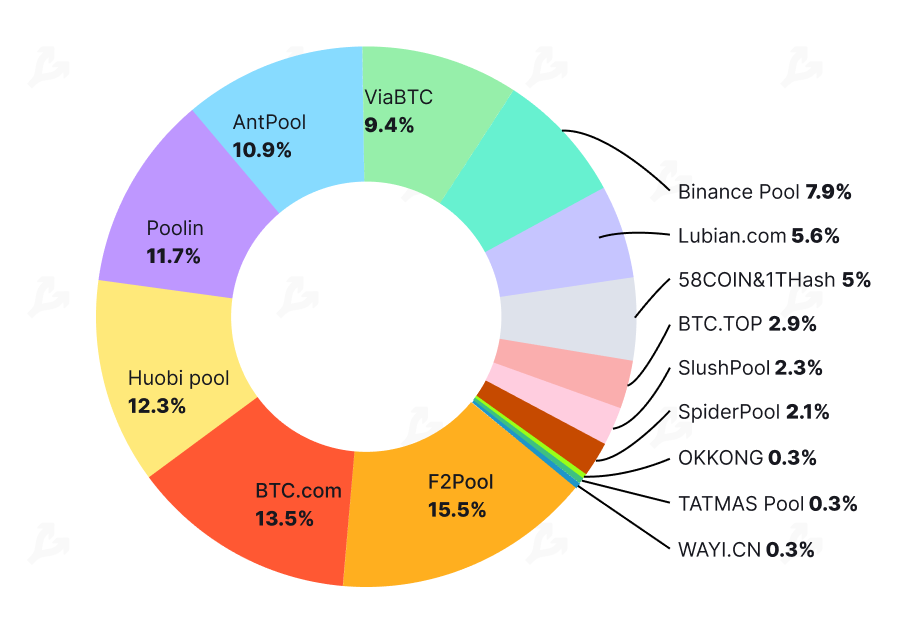

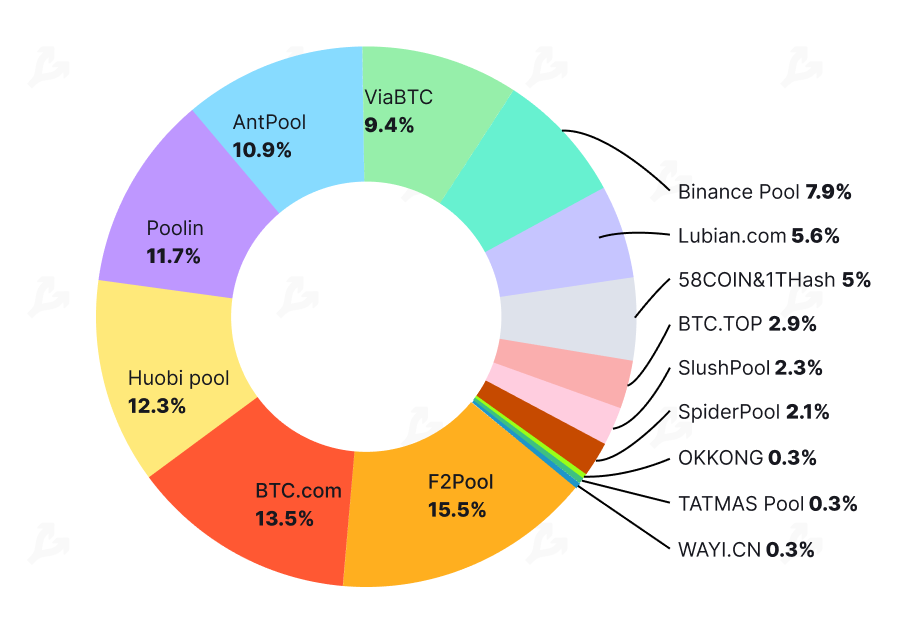

Share of the largest pools in Bitcoin hash rate. Data: BTC.com as of 1.11.2020.

Ethereum miners’ revenues and their structure (mln $). Data: Coin Metrics.

In October, Bitcoin miners’ total revenues from transaction fees rose 63%. Ethereum miners’ fee-based revenues, conversely, fell 66%. Bitcoin miners’ total revenue in October was $352.7 million — up 8% from September. Ethereum miners earned $214.3 million in October — down 33% from the previous month.

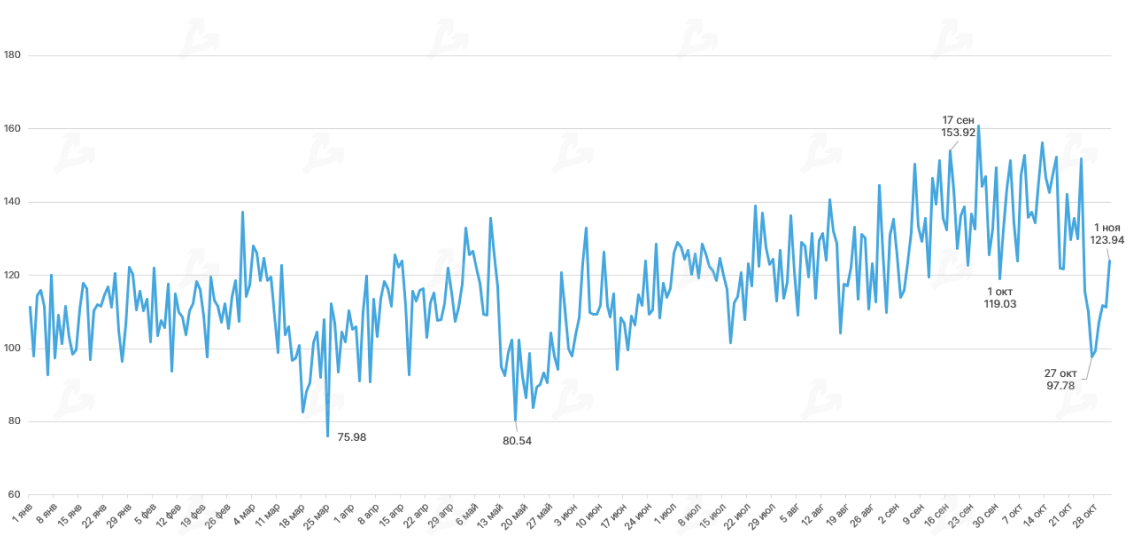

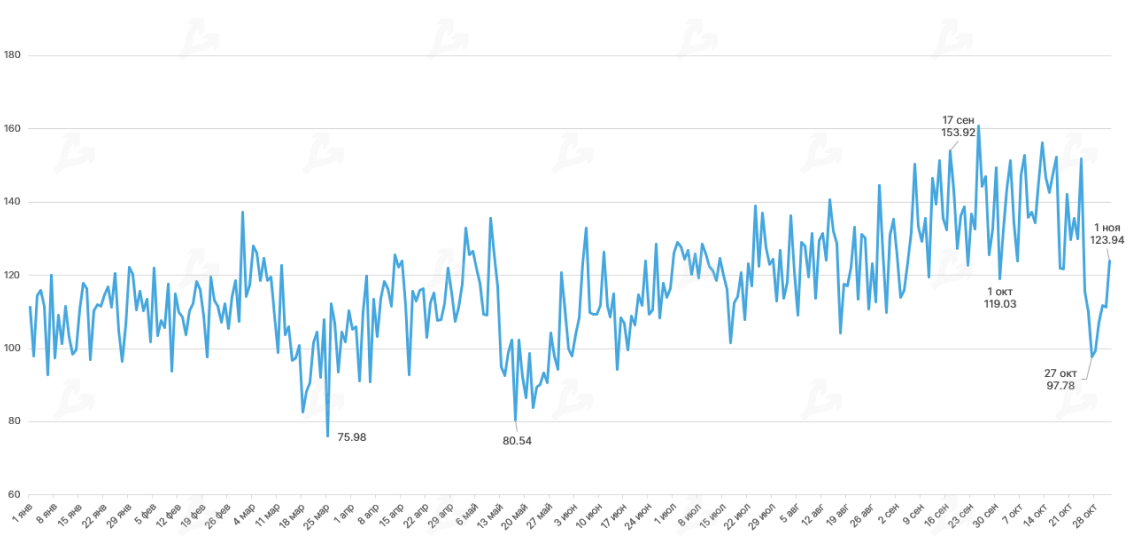

Hashrate dynamics of Bitcoin, Eh/s. Data: Glassnode.

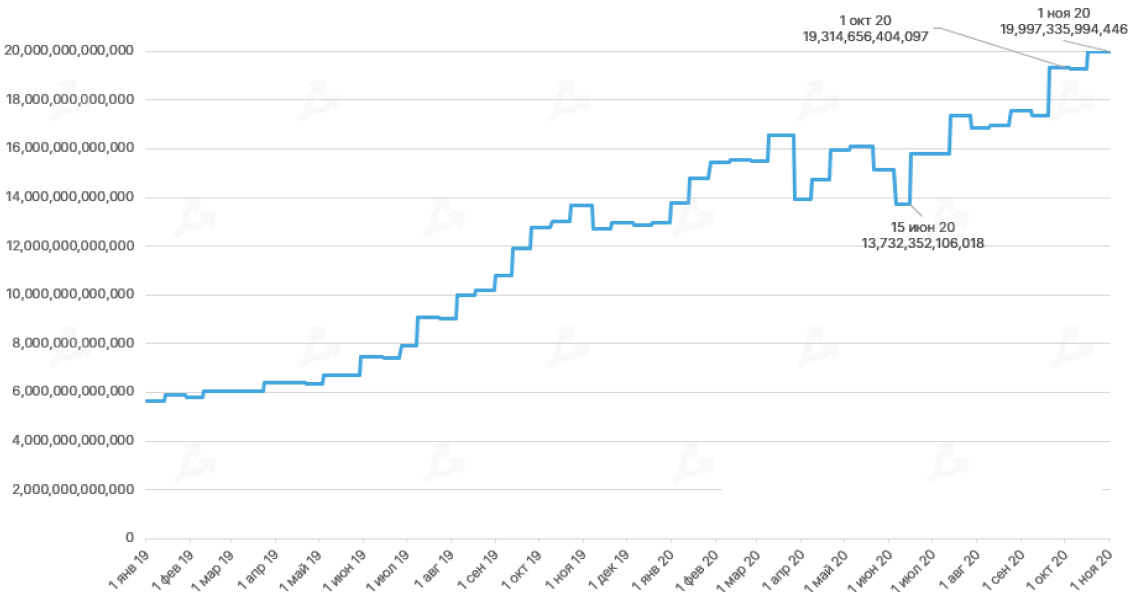

Mining difficulty for Bitcoin. Data: Blockchair.

At the end of October, Bitcoin’s hash rate fell about a quarter amid the end of the drought season in Sichuan, but it soon recovered. Monthly hash rate rose by 4.13%. Bitcoin’s mining difficulty rose by 3.53% during October.

Share of the largest pools in Bitcoin hash rate. Data: BTC.com as of 1.11.2020.

Bitcoin miners’ revenues and their structure (mln $). Data: Coin Metrics.

Revenue of Bitcoin miners from transaction fees rose 63% in October. Ethereum miners’ fee revenue declined 66%. Bitcoin miners’ total revenue in October was $352.7 million, up 8% from September. Ethereum miners earned $214.3 million in October, down 33% from a month earlier.

Bitcoin hashrate dynamics, Eh/s. Data: Glassnode.

Mining difficulty of Bitcoin. Data: Blockchair.

By the end of October, Bitcoin’s hashrate dipped about a quarter amid the Sichuan drought season’s end, but quickly recovered. The month’s hashrate growth stood at 4.13%. Bitcoin mining difficulty rose by 3.53% in October.

Share of the largest pools in Bitcoin hash rate. Data: BTC.com as of 1.11.2020.

Bitcoin miners’ revenues and their structure (mln $). Data: Coin Metrics.

In October, revenues of Bitcoin miners from transaction fees rose 63%. Ethereum miners’ fee revenues, on the other hand, fell 66%. Bitcoin miners’ total revenue in October amounted to $352.7 million — up 8% from September. Ethereum miners earned $214.3 million in October — 33% less than a month earlier.

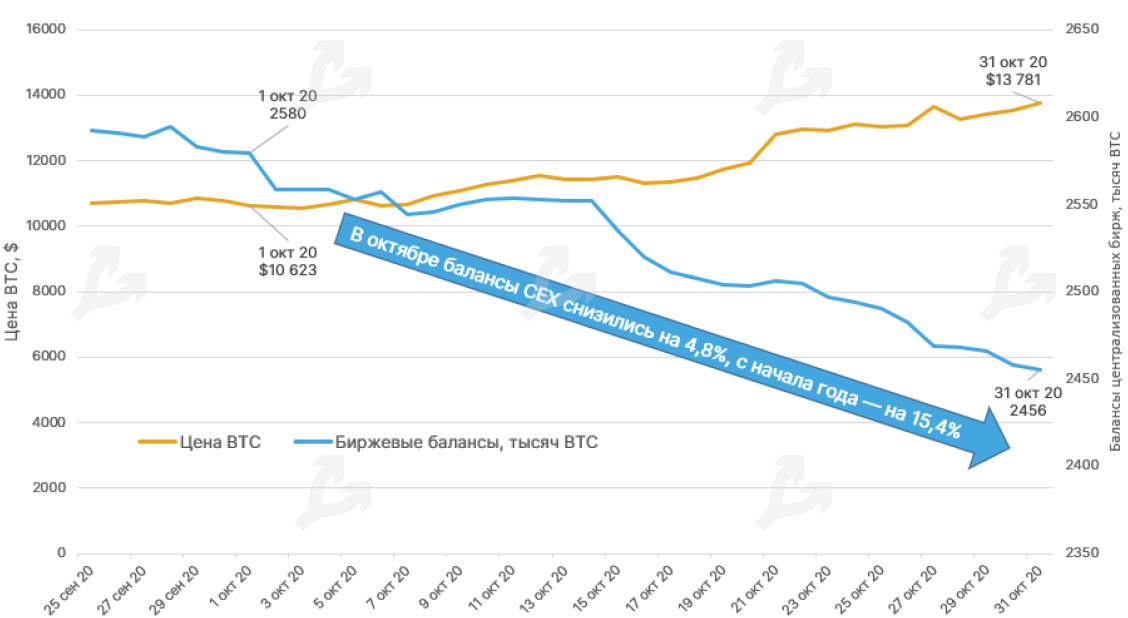

Bitcoin price and the dynamics of centralized exchange balances, thousands BTC. Data: Yahoo Finance, Glassnode.

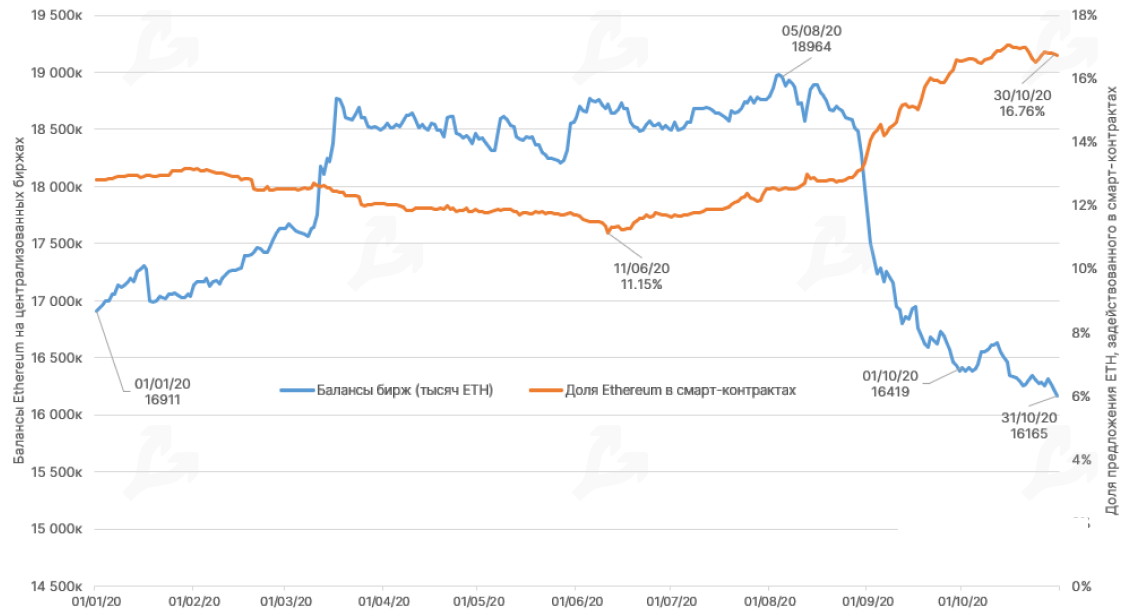

Ethereum: exchange balances and share of supply ETH deployed in smart contracts. Data: Glassnode.

- There was a noticeable rise in the number of addresses with balance over 1000 BTC: year-to-date up 4.7%, October up 1%. This could signal interest from large players adopting Buy&Hold strategies.

- From the beginning of the year, Ethereum addresses with ≥ 32 ETH rose 14%, October +1.77%. This indicates market participants’ interest in staking in the ETH2 ecosystem, where Proof-of-Stake will be used.

Etheruem: exchange balances and share of ETH supply deployed in smart contracts. Data: Glassnode.

On-chain activity in Bitcoin and Ethereum ecosystems. Data: Coin Metrics.

- In October, there continued outflows of Bitcoin from centralized exchanges. The concentration of ETH on DeFi smart contracts eased slightly, where roughly 17% of the asset’s supply is deployed.

- On-chain activity in the Bitcoin ecosystem rose significantly in terms of value moved on-chain, while Ethereum activity declined (excluding ERC standards tokens). This affected blockchain congestion and transaction fees.

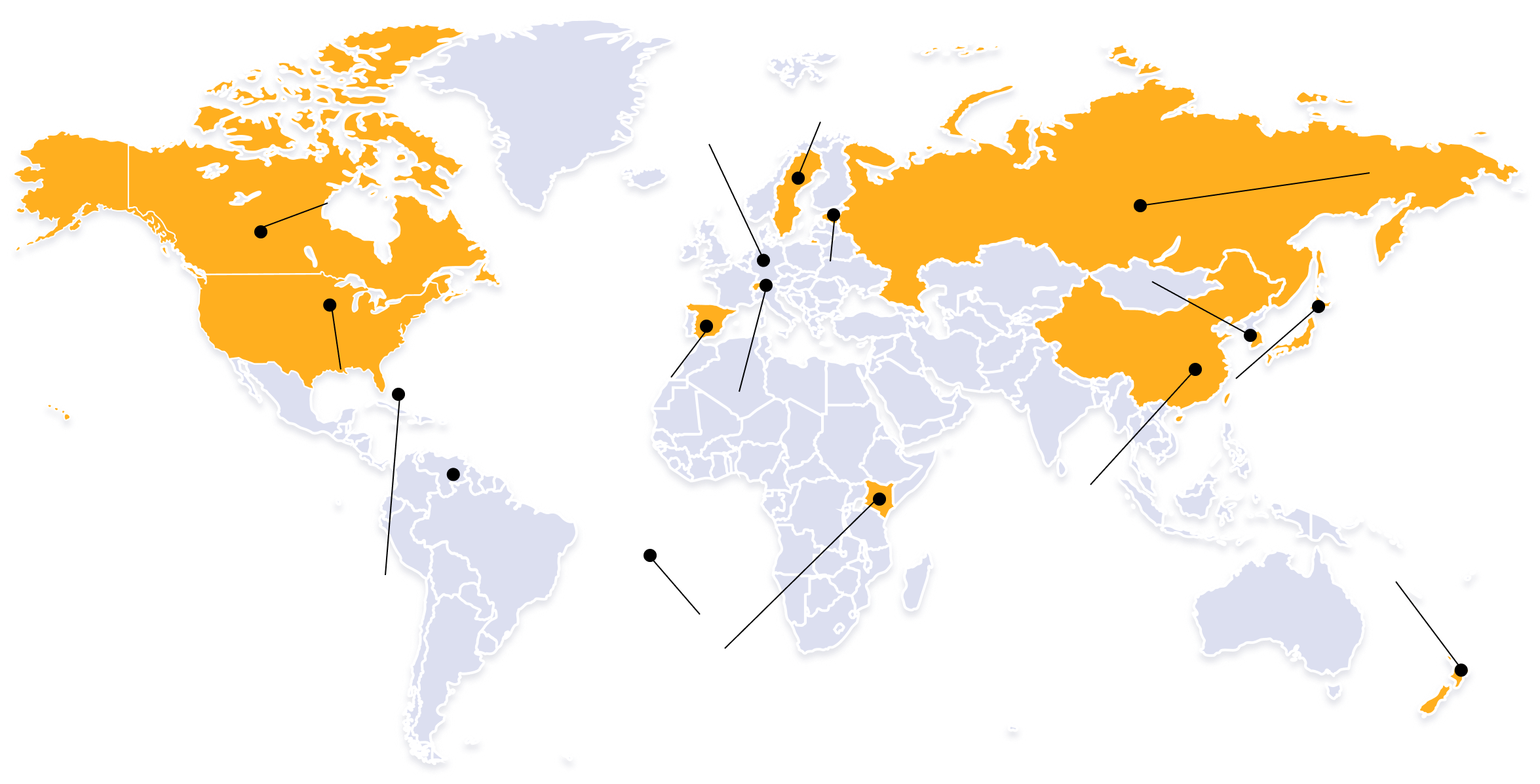

CBDC race around the world

CBDC race around the world

China leads the CBDC race

1The PBOC’s first report in early October reported processing 3.13 million transactions for 1.1 billion yuan (~$162 million) in digital yuan (DCEP). By month’s end it had processed more than 4 million transactions worth over 2 billion yuan (~$299 million). This remains a test phase.

2On 8 October, Shenzhen authorities announced the first distribution of digital currency among 50,000 residents of the Luohu district, which attracted almost 2 million people. 50,000 bounty participants received 200 yuan each (~$29.5), to be spent from 12 to 18 October in 3389 points of sale.

3As part of the pilot project, support for the digital yuan was implemented at 11 gas stations in Shenzhen.

447,573 of the 50,000 lottery winners (95%) spent the funds, settling 62,788 transactions for a total of 8.8 million yuan (~$1.3 million).

5In October there were reports of readiness to test offline payments and limited anonymity of transactions in the digital yuan, where records do not reflect a merchant. By month’s end Huawei announced support for DCEP in the Mate 40’s built-in hardware wallet, enabling offline payments.

6The PBOC announced the appearance of fake wallets for the digital yuan and made changes to legislation aimed at fighting the release of tokens based on DCEP.

Key regional events

- Russian Prime Minister Mikhail Mishustin believes cryptocurrencies and stablecoins threaten the stability of the existing financial system. The head of the State Duma committee on financial markets Anatoly Aksakov stated that the authorities do not oppose blockchain, but have not seen a future in Bitcoin.

- The Bank of Russia proposed restricting the purchase of digital assets for non-qualified investors.

- From 2021, officials in Russia will declare savings and crypto-derived income.

- Cryptocurrencies entered the top 5 popular tools among Russian investors, surpassing gold.

- Authorities in Buriyatia approved the construction of a mining center.

- At a closed Norilsk plant of North Nickel a mining center was opened on site.

- The Committee of the Verkhovna Rada of Ukraine supported the draft law “On Virtual Assets.”

- Bitfury Holding BV and state enterprise Energoatom signed a memorandum on building data centers on Ukrainian nuclear power plant sites. The first one will appear in the Rivne region at the local nuclear power plant.

- Experts criticized the proposed amendments to legislation in Ukraine aimed at large miners.

- Authorities in Kyrgyzstan discussed blockchain introduction in the voting system.

Key regulatory events

- Regulator UK banned retail investors from trading crypto derivatives.

- The Swiss Finance Ministry began implementing a legal framework for regulating blockchain and crypto industry at the state level in August 2021.

- Authorities in Spain will require investors to disclose crypto assets.

- FSB G20 published final recommendations on regulation, supervision and control of stablecoins.

- New Zealand authorities obliged crypto firms to report customer assets.

- In the USA authorities indicated risks surrounding anonymous crypto assets.

- The Financial Stability Board (FSB) published final recommendations on regulation, supervision and control over stablecoins.

- The New Zealand authorities obliged crypto firms to report customer assets.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!

Related

We use cookies to improve the quality of our service.

By using this website, you agree to the Privacy policy.