OKEx problems, Filecoin launch, and other events of the week

Wrapping up the week in the cryptocurrency industry, we note the sudden withdrawal stoppage on the OKEx exchange, the launch of Filecoin’s mainnet, talk of a potential digital ruble, and other key developments.

Bitcoin price

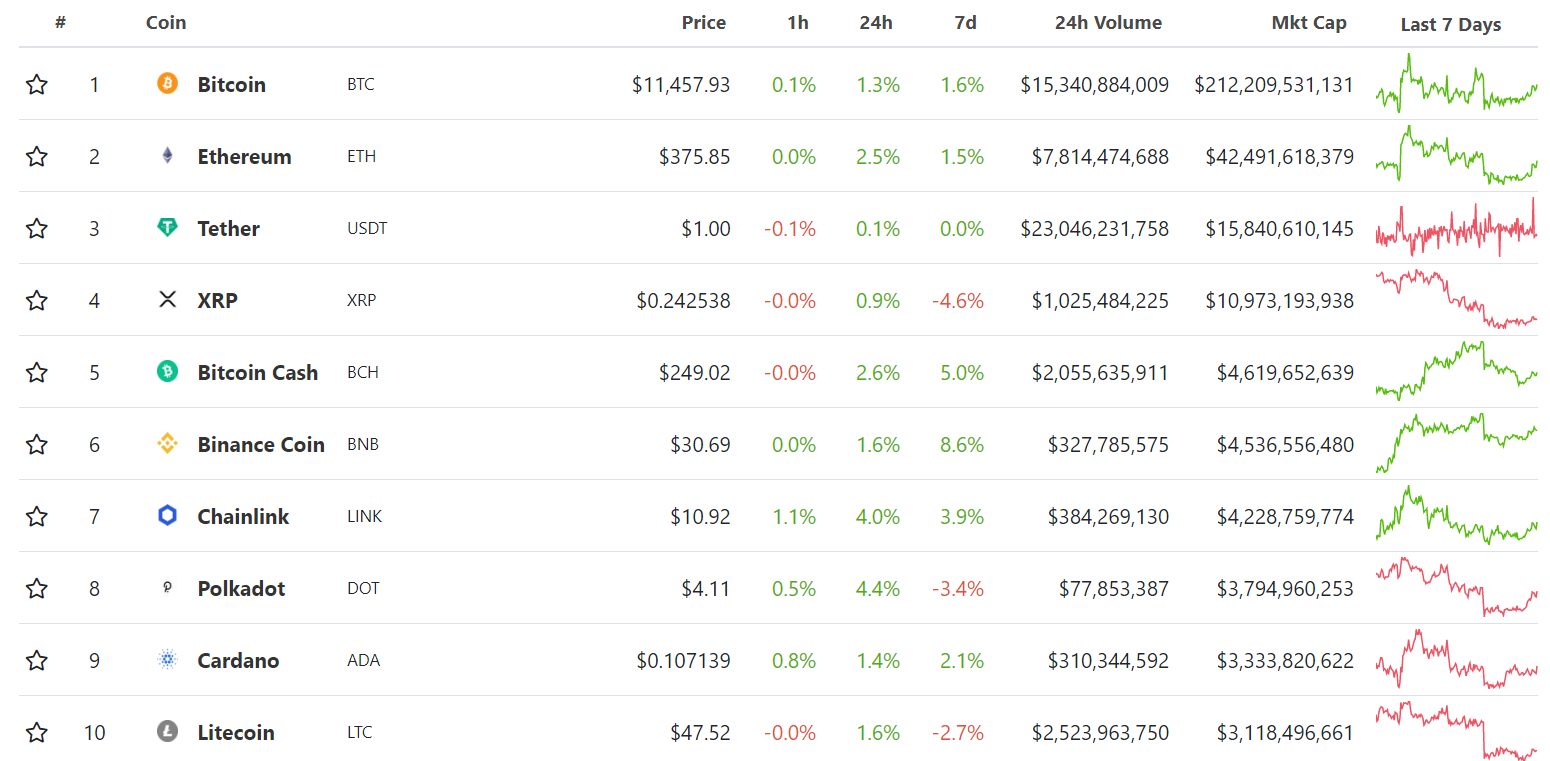

Over the past seven days, the price of the first cryptocurrency hardly changed, rising by 0.3%, even as bulls twice attempted to push above the $11,800 mark. In the first instance early in the week, the attempt nearly materialised as Bitcoin neared $11,750. On Thursday, 15 October, quotes rose to around $11,650.

At the time of writing, the cryptocurrency traded around $11,475 — virtually unchanged from a week earlier. The market capitalisation stood at $212 billion (58.1% of the total market).

Source: BTC/USD hourly chart from Bitstamp on TradingView.

Ethereum, the second-largest by market capitalisation, was trading around $376, also posting a minimal rise of 0.2%.

Among the top ten, the biggest weekly gain belonged to Binance Coin (+7.5% to $30.6), while Bitcoin Cash rose 3.5% to $249.

Source: Coingecko.

OKEx suspended withdrawals

On Friday, 16 October, the cryptocurrency exchange OKEx announced a suspension of withdrawals. It had been initially reported that one of the private-key holders was “cooperating with law enforcement” and could not be reached. OKEx CEO Jay Hao stressed that the investigation concerns the private key holder’s personal issues and is not related to the exchange.

Later, Chinese outlet Caixin reported that Star Xu, founder of OKEx and OKCoin, who in 2018 was named in an investigation into cryptocurrency fraud, had been detained a week earlier.

Other conflicting reports in local media followed. In an interview with ForkLog, an OKEx spokesperson said that Star Xu is in the Beijing office.

“He is not a key holder and cannot verify transactions. The police asked him to comment on the situation with the key holder, with which they have questions. We expect that after his talk with the police withdrawals will be restored”.

Additionally, OKEx representatives said that claims of large Bitcoin transfers from exchange-owned wallets after the withdrawal suspension are not accurate. Earlier, Whale Alert reported movements of 5,000 BTC and 3,500 BTC from OKEx to Binance addresses. It was also alleged that an unknown user transferred 1,995 BTC from Huobi to OKEx.

Representatives stressed that other functions were operating normally, and customer funds remained safe. The exchange did not specify when withdrawals would resume.

Another lawsuit has been filed against BitMEX

A Moscow resident, Dmitry Dolgov, has filed a lawsuit against HDR Global Trading Limited, the owners of the BitMEX exchange, Arthur Hayes, Ben Delo, Samuel Reed and others. The plaintiff alleges the trading platform laundered money and manipulated the market.

According to the 188-page filing, the exchange allegedly flouted Know Your Customer (KYC) policies and anti-money-laundering (AML) requirements, taking funds “from anyone, with no questions asked”.

Dolgov said BitMEX “directly” engaged in market manipulation and money laundering, causing him “substantial harm”.

Earlier, on October 1, the U.S. Commodity Futures Trading Commission filed a lawsuit against BitMEX and its owners, accusing them of operating an unregistered trading platform and violating CFTC rules regarding KYC/AML procedures.

Separately, the U.S. Department of Justice charged the exchange’s leadership with violations of the Bank Secrecy Act.

Meanwhile, SEC Commissioner Hester Peirce questioned whether regulators would stop at BitMEX. She said they sent a loud and clear message about enforcing requirements for user identification and anti-money-laundering. Peirce warned not to rely on their loyalty, as even traditional financial firms face problems.

Filecoin mainnet launch took place

On Thursday, 15 October, at block 148,888, the long-delayed launch of the Filecoin decentralised storage network’s mainnet took place.

The platform’s native token (FIL) trades on several major exchanges, including Binance, Huobi, Gemini, Kraken, Bitfinex, Kraken, Poloniex and Gate.io. Since launch its price briefly surged to as high as $150 on some exchanges, but has since trended lower. At the time of writing the coin was around $35, ranking 33rd by market capitalisation at $580 million.

Hourly chart of FIL/USD from TradingView.

CEO Justin Sun stated that after the mainnet launch the Filecoin team sent 1.5 million FIL to exchanges, whereas only 500,000 tokens were slated for unlocking in the initial phase. He argues that this not only crashed the token’s price but also breached investor agreements.

Filecoin development has been ongoing since 2014. In 2017 the project’s sponsor Protocol Labs conducted a fully regulated ICO, raising $257 million. Participation in the campaign was possible only for verified investment firms, banks, and wealthy private individuals in full compliance with U.S. Securities and Exchange Commission rules. During the crowd sale 1 FIL was priced at $0.75, with token distribution to investors taking place over three years.

Bitcoin Schnorr signatures and Taproot included

On Thursday, 15 October, Bitcoin Core developers added three proposals to the first cryptocurrency’s codebase aimed at boosting privacy and scalability. These include BIP-340, BIP-341 and BIP-342 — Schnorr signatures, as well as Taproot and Tapscript.

The request to include the updates was filed earlier this year by Pieter Wuille. The code for only one Taproot proposal was reviewed by more than 150 developers. The timing of the soft fork will be decided later. Depending on the activation mechanism, it may take some time — perhaps a year — before the upgrade takes effect.

Schnorr/Taproot, as with the Segregated Witness soft fork previously, will be among the most significant updates in Bitcoin’s history. In addition to boosting scalability and privacy, they are also aimed at overall improvement of network functionality and coin fungibility.

Schnorr signatures are a digital-signature scheme that can enhance Bitcoin’s privacy and scalability. They will replace the current multi-signature scheme.

Taproot expands the functionality of signatures, introducing a new version of the transaction output and a new way of defining spending conditions, which could be particularly useful for large players such as exchanges. Under certain conditions, Taproot also provides an option to recover lost coins.

Monero network received a new major upgrade

On Saturday, 17 October, Monero developers activated a new major upgrade. It is named Oxygen Orion and released as version 0.17.

The key upgrade is CLSAG, the enhanced version of MLSAG — Monero’s ring-signature scheme. With its activation, transaction sizes fell by 25% and confirmation speeds rose by 10% while maintaining the same level of anonymity.

Additionally, the new release improved network security, including the Dandelion++ technology aimed at concealing the sender’s IP address.

Technically, every new Monero codebase upgrade is a hard fork. Consequently, participants—from ordinary users to exchanges—must update their software to the latest version.

Aave raised $25 million in investments

On Monday, 12 October, the lending protocol Aave announced it had secured $25 million in investments from Blockchain Capital, Standard Crypto, Blockchain.com and several other firms.

“Aave has received funds from strategic investors to bring DeFi closer to institutional use cases and to expand the team to support growth in Asian markets,” said the company head Stani Kulechov.

He added that new investors would participate in staking and governance of the protocol.

In September Aave launched a governance system via community voting. The first proposed improvement to the protocol was the shift to a new governance token—LEND was replaced by AAVE.

As he explained, after migrating from LEND to AAVE, anyone can create new functionality in the protocol together with the Aave team. He said this is effectively decentralising development and governance.

The NEAR Protocol mainnet launch

This week, NEAR Protocol validators voted to launch the mainnet. The aim of the vote was to lift the ban on token transfers and to activate inflation. The inflation mechanism will come into effect after the next upgrade, and transactions are already possible.

The protocol runs on its own Proof-of-Stake algorithm and seeks to address scaling to support resource-intensive decentralized apps (dapps).

In May, the NEAR team raised $21.6 million from major venture firms, including Andreessen Horowitz.

Bank of Russia contemplates digital ruble

The Russian central bank has contemplated the possibility of creating a digital ruble. This week the regulator released a report on its feasibility and plans to gather feedback on the matter by year-end.

According to the document, the central bank digital currency (CBDC) is being considered as a third form of the ruble alongside cash and cashless rubles.

“All three forms will be equally valid — just as 1 ruble in cash is equivalent to 1 ruble in non-cash form, a digital ruble will always be equivalent to either of them. At the same time, holders will be able to freely transfer rubles between forms,” the report says.

The central bank said that, like cash and non-cash rubles, the digital ruble would perform all three functions of money — a means of payment, a unit of account and a store of value.

The digital currency would take the form of a unique digital code stored in a dedicated electronic wallet. It is envisaged that the digital ruble could be used offline — without access to mobile connectivity or the Internet.

If the project is approved, the Central Bank of Russia would conduct a pilot of its use among a limited group of users.

For a detailed analysis of how the Bank sees the digital ruble, read ForkLog’s special feature:

Accessibility and traceability: how the Bank of Russia sees the digital ruble

Other ForkLog exclusives

- DEX without a native token — a relic of the past or a viable direction?

- How the pandemic is killing freedom on the internet: Freedom House report

And on ForkLog Live there is an educational video about the decentralised exchange Uniswap:

Also we wrote:

- In the third quarter, Grayscale’s cryptocurrency funds attracted a record $1.05 billion

- More than 10% of Bitcoin’s supply is stored on five centralised exchanges

- The Mt. Gox creditor repayment plan filing deadline moved to December 15

- The Uniswap community sees risks of centralisation in the new governance scheme

- Researchers identified the main trends in the blockchain industry

Bonus: ForkLog released a limited-edition merch drop

This week ForkLog launched a pilot merch line, which you can buy on Instagram. We started with a classic line of HODL hoodies and T‑shirts, which will appeal to followers of the first cryptocurrency, and a more provocative Crypto Porn design.

Subscribe to ForkLog news on Telegram: ForkLog FEED — the full feed, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!