Open interest in Bitcoin options hits $8.8 billion

Open interest in Bitcoin options reached $8.8 billion ahead of the expiry of 45% of contracts.

Against the backdrop of the asset’s two-month rally, open interest rose 118% to $8.4 billion. The total value of options expiring in 11 days stands at a record $3.8 billion.

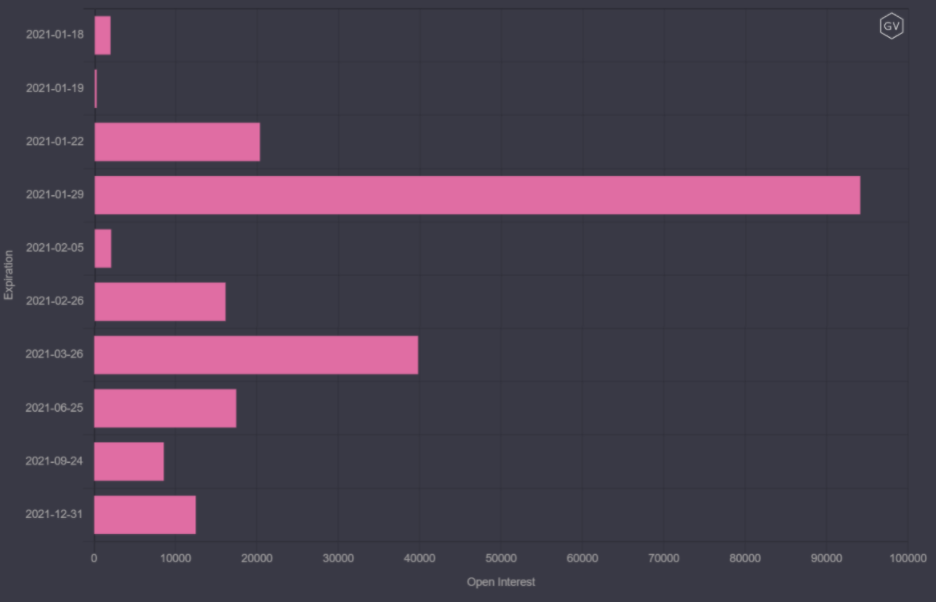

Deribit accounts for 85% of contracts. On January 29, 45% of Bitcoin options on the platform expire, with obligations settled for 94,060 BTC.

Open interest in Bitcoin options on Deribit with different expiry dates. Data: genesisvolatility.io.

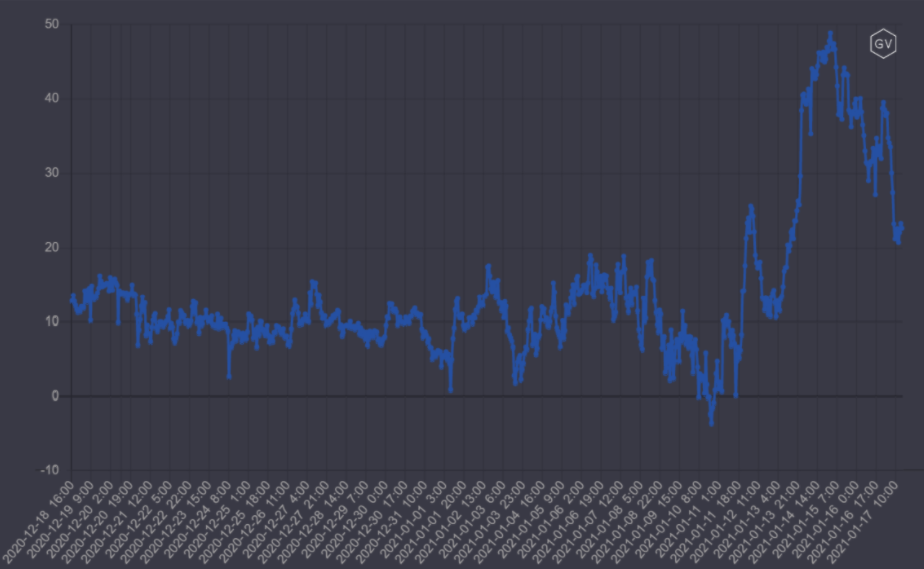

[simple_tooltip content=’Shows the ratio of call and put options. A positive value indicates expectations of growth, negative — decline.’]Delta[/simple_tooltip] on the Deribit platform indicates that the last time bearish sentiment dominated the market was January 10, when Bitcoin’s price fell 15%.

Delta for Bitcoin options on Deribit. Data: genesisvolatility.io.

Since January 12, market sentiment has been upbeat, with the gauge rising above the 20 mark.

For an explanation of options and how they work, see our explainer.

As reported on December 21, the CME Bitcoin futures open interest reached a new high of $1.47 billion.

Follow ForkLog on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!