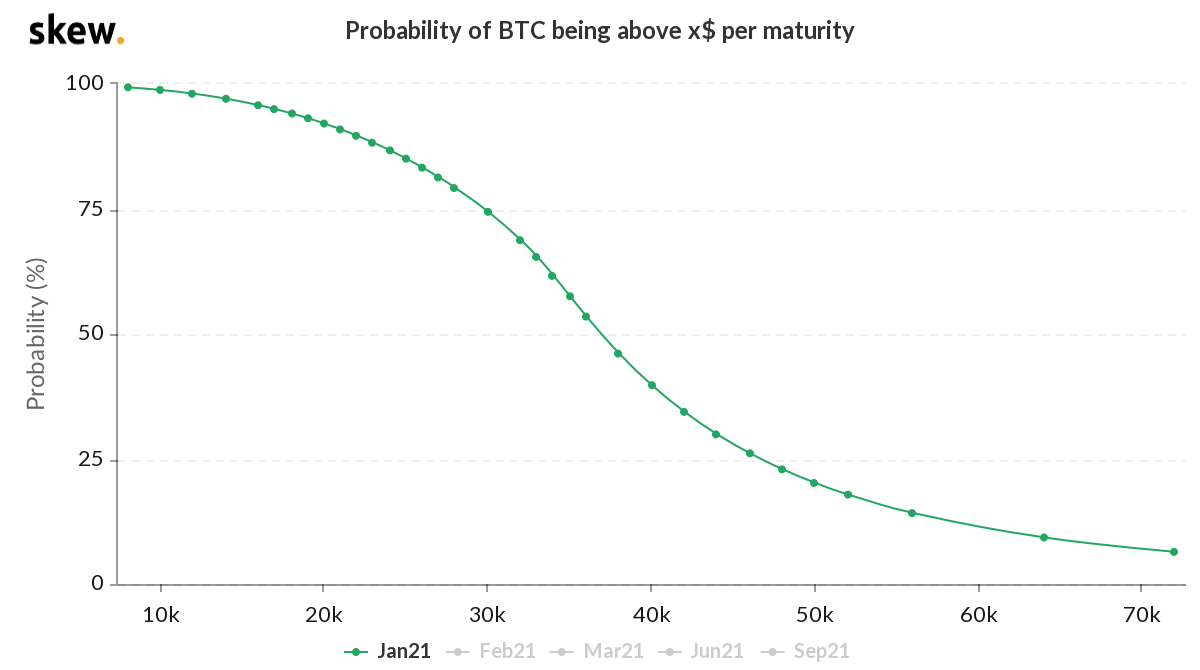

Options market eyes Bitcoin at $50,000

The options market, pricing in a 20% probability, sees Bitcoin rising to $50,000 by January 29. Data from the analytics service Skew show this.

Such a scenario is not excluded in the context of the cryptocurrency’s early-year dynamics. After a 20% correction from January 8–11, with the price of the first cryptocurrency slipping below $31,000, it subsequently returned to levels just below $40,000.

The indicator is calculated using the Black–Scholes formula based on the prices of call options, strike prices, the price of the underlying asset, the risk-free rate, and time to expiration.

Data: Skew.

Deribit, an exchange focused on options, raised the strike price for Bitcoin-based contracts expiring at year-end to $400,000.

We’ve added the $BTC 400K strike in the Dec21 expiry! 🚀

Send tweet!

— Deribit (@DeribitExchange) January 14, 2021

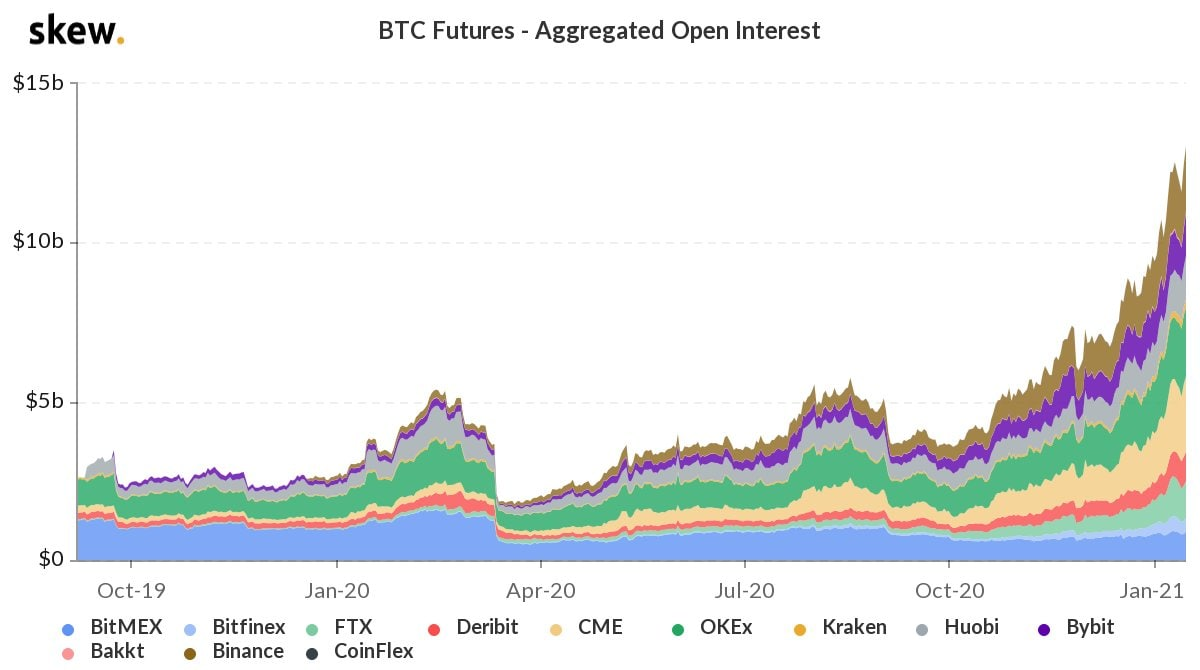

Open interest on the Bitcoin futures market rose again to near-record levels, around $13 billion.

Data: Skew.

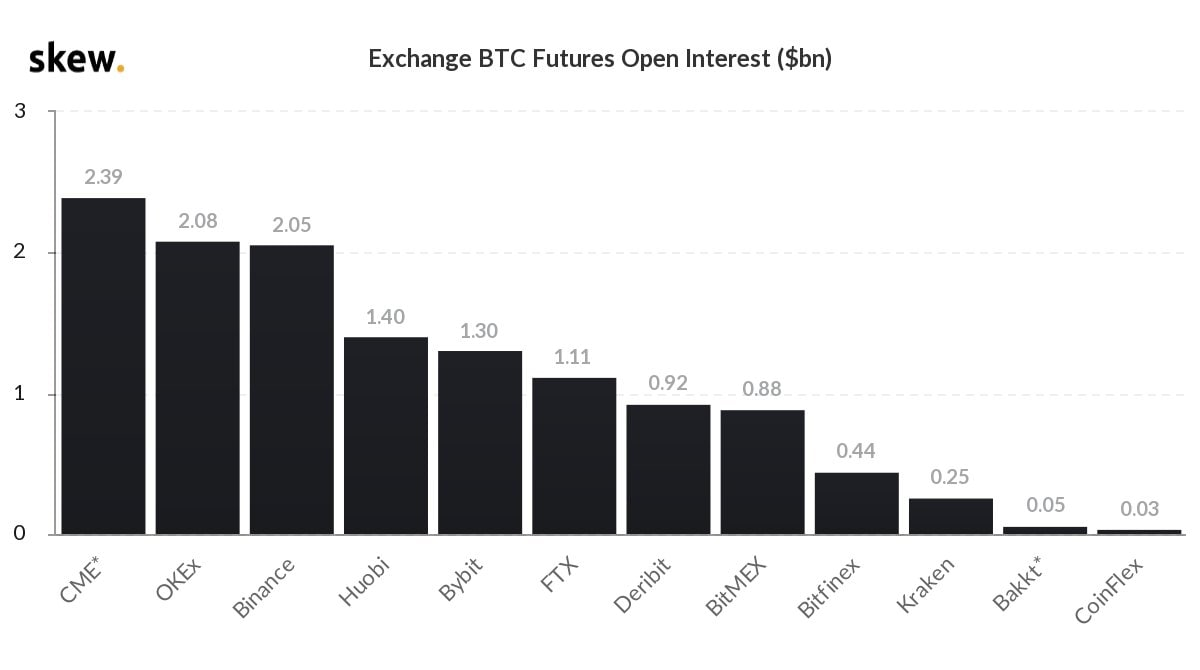

The CME, oriented toward large investors, accounted for the largest share of open interest, at $2.39 billion.

Data: Skew.

In Q4, Grayscale’s crypto funds attracted a record $3.26 billion.

On January 12, Grayscale Investments reopened accepting deposits into several crypto funds after a suspension in late 2020.

Follow ForkLog’s news on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!