Presto Warns of Corporate Crypto Bubble Risks

The rise in corporate cryptocurrency reserves marks a new era in the financial sector, akin to the advent of leverage and ETFs, yet it conceals risks. This is highlighted in a report by Presto’s Head of Research, Peter Chang.

“Some crypto treasury companies (CTC) will not become diamond-grade, but this does not necessarily mean the market has become riskier. Managing this risk entirely depends on each CTC’s ability to foresee cash flow needs and structure capital to sustain and grow crypto assets. The market will reward successful ones with higher NAV multiples and penalize those who fail,” the analyst stated.

The term CTC refers to public organizations that prioritize accumulating cryptocurrencies as the main driver of shareholder value, financed through public capital markets. It excludes companies whose primary value stems from regular operations with partial crypto treasury assets (such as Tesla, Coinbase, or miners).

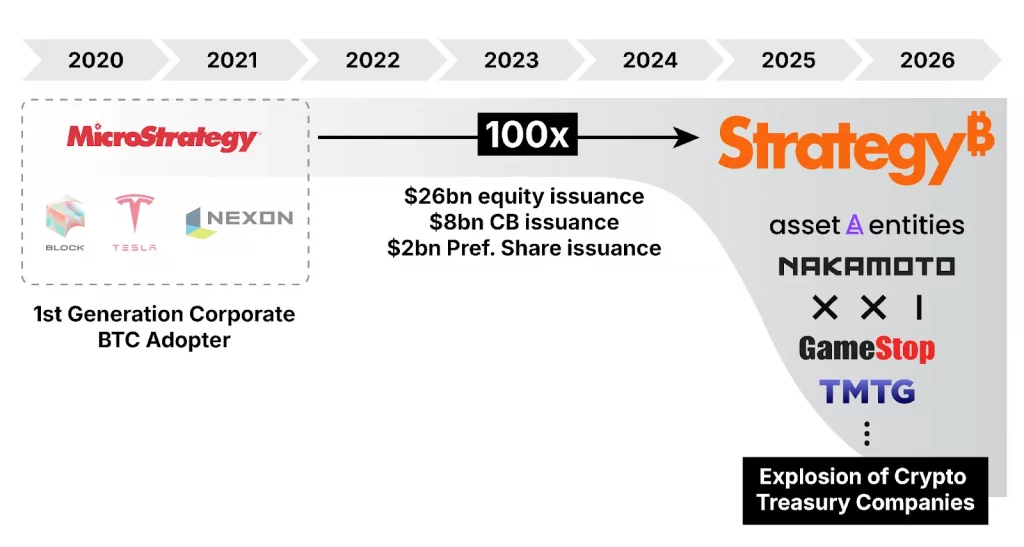

Inspired by the Strategy treasury model, this trend has gained momentum, particularly in the United States, which benefits from deep capital markets and seasoned institutional investors, Chang noted. Such organizations are typically structured as former operational firms, SPAC, or shell companies repurposed for cryptocurrency accumulation.

The rapid growth of CTCs has raised concerns that leveraged positions could trigger a new wave of forced liquidations if the crypto market enters a bearish phase.

Chang identified two primary risks: collateral liquidation and “activist attack”—a hostile takeover aimed at profiting from NAV shortages. However, these concerns are more limited than those that fueled past cycle shifts like the Terra collapse.

“While an overly stretched premium might indicate a bubble, limited historical data for most crypto treasury companies makes it difficult to determine what level of premium qualifies as excessive. The recurring nature of accumulation implies that some premium is justified. Moreover, unlike closed-end funds, CTCs can use capital markets to increase their crypto assets per share through innovative financing,” Chang clarified.

According to the researcher, managing cryptocurrency strategies is a complex task. Therefore, some new and inexperienced participants may face difficulties during downturns. Ultimately, the key risk is not the market itself, but how well each player plans for unpredictable funding needs, Chang concluded.

Earlier, Coinbase identified the growing popularity of corporate bitcoin reserves as both a major trend and a risk for the crypto market.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!