Record Outflows from Spot Bitcoin ETFs

On January 24, outflows from the Grayscale Bitcoin Trust ETF (GBTC) reached $429.3 million, surpassing the combined inflows into other spot bitcoin ETFs ($204.7 million). These calculations were provided by Bloomberg analyst James Seyffart.

Day 9 — More $GBTC outflows, -$429 million. Still waiting on BlackRock data. pic.twitter.com/S2mjoEvg5o

— James Seyffart (@JSeyff) January 25, 2024

As a result, the net outflow from the sector over the past day amounted to $224.6 million. The provided data does not include figures from IShares Bitcoin Trust (IBIT).

According to BitMEX Research, on January 24, investors directed $66.2 million into the mentioned product. Consequently, the net outflow for the sector was reduced to $158.4 million.

Bitcoin Spot ETF Flow — Day 9 — UPDATE

Data out for all providers

$158m net outflow for day 9 pic.twitter.com/5UZmgoyK28

— BitMEX Research (@BitMEXResearch) January 25, 2024

The negative trend continued for the third consecutive day. Over nine days, the figure remains positive at $824.4 million. This was largely due to the excitement on the first day of trading ($655.2 million).

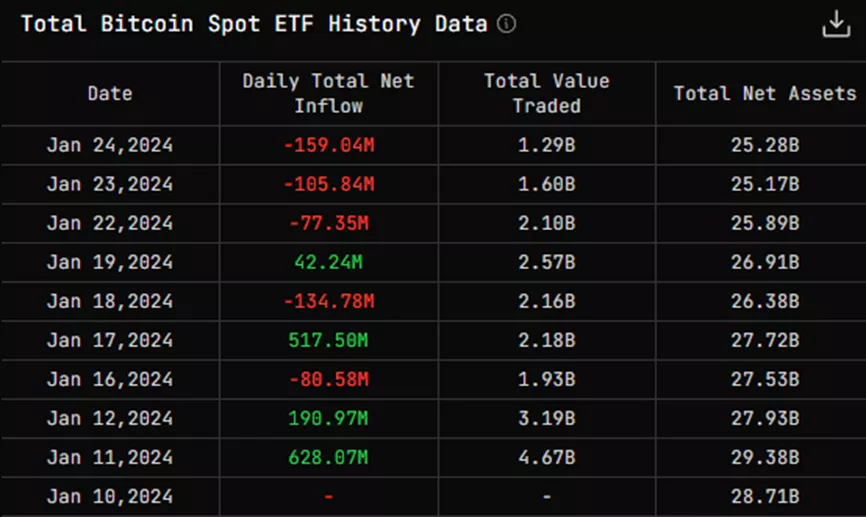

At sosovalue.xyz, the net outflow figures for January 24 were nearly identical to BitMEX ($159.04 million).

According to K33 Research, issuers’ addresses, excluding Grayscale, now hold 126,155 BTC.

Jan 25 (cont)

The new ETFs now hold 126,000 BTC.

IBIT has become the 2nd largest BTC investment vehicle worldwide — still dwarfed by GBTC. All top 4 BTC ETFs are now U.S. domiciled.

Impressed (surprised) by BITO maintaining its BUM — exposure still above any pre-2024 level. pic.twitter.com/FGAkcXmOue

— Vetle Lunde (@VetleLunde) January 25, 2024

IBIT holds the second position with 45,670 BTC, following GBTC (509,955 BTC).

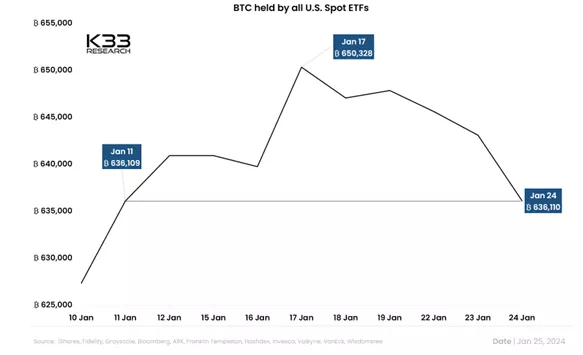

Across all U.S.-registered spot products, including GBTC, the total bitcoin position has dropped to 636,100 BTC.

At Bitcoin Treasuries, the figure was slightly higher at 654,138 BTC.

Combined with bitcoin ETP from other countries, issuers hold 832,432 BTC, equivalent to 3.96% of the current issuance of the leading cryptocurrency.

In this regard, asset management companies have surpassed mining firms, sovereign funds, and both public and private companies.

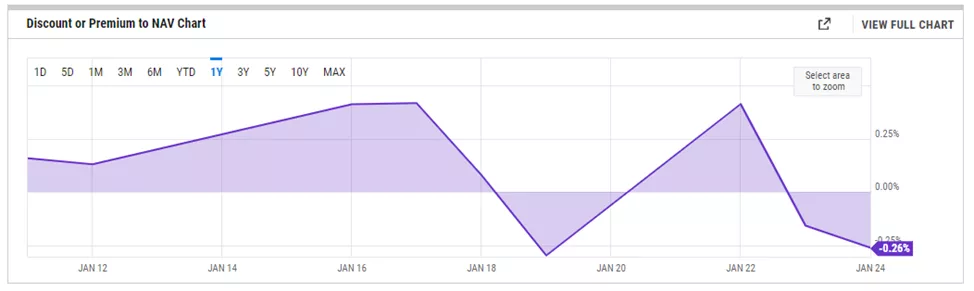

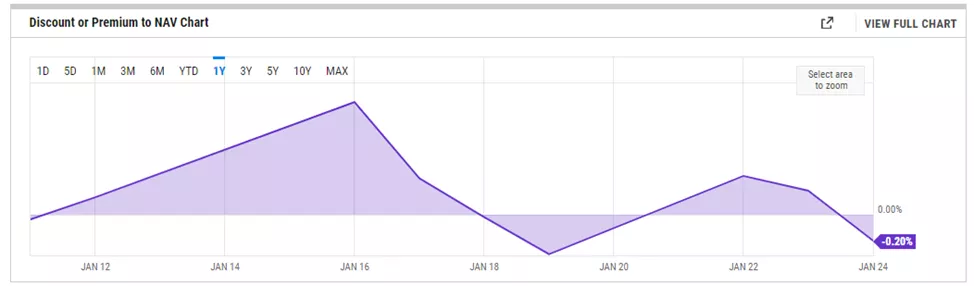

The recent downturn in the cryptocurrency market has led to a discount for IBIT and FBTC relative to NAV of 0.26% and 0.2% respectively.

CEO of Galaxy Digital, Mike Novogratz, has downplayed the impact of GBTC sales on the prospects of digital gold.

Previously, several experts noted the price dependency on the wave of position liquidations in the Grayscale exchange-traded fund.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!