Rival Bitcoin ETFs Attract Over 100,000 BTC

- Nine “new” spot Bitcoin ETFs have attracted 109,221 BTC.

- Due to GBTC sales, net outflows from instruments on January 22 reached 4,537 BTC ($179.6 million).

- Traders do not rule out a decline in Bitcoin to $36,000.

The volume of coins held by spot Bitcoin ETFs, excluding the Grayscale Bitcoin Trust (GBTC), has reached 109,221 BTC (~$4.26 billion), according to K33 Research.

January 23

The new ETFs took seven trading days to amass BTC holdings of more than 100,000 BTC.

BlackRock needed 7 trading days to become the third-largest BTC investment vehicle globally — set to become the second-largest after today.

Fidelity has also entered the top 4. pic.twitter.com/NUvkQQcHbt

— Vetle Lunde (@VetleLunde) January 23, 2024

The selection includes products from:

- BlackRock (IBIT);

- Fidelity (FBTC);

- Bitwise (BITB);

- Ark 21Shares (ARKB);

- Invesco (BTCO);

- VanEck (HODL);

- Valkyrie (BRRR);

- Franklin Templeton (EZBC);

- WisdomTree (BTCW).

Among the new products, IBIT stands out with 40,213 BTC, FBTC with 34,152 BTC, BITB with 8,800 BTC, ARKB with 7,566 BTC, and BTCO with 4,642 BTC.

Experts at Arkham Intelligence identified the ETF addresses from BlackRock, Fidelity Investments, Bitwise, and Franklin Templeton.

IBIT iShares Bitcoin Trust

Holdings: 28.62K BTC

Value: $1.16B

Entity Link:https://t.co/e64glDMXxXFBTC Fidelity Wise Origin Bitcoin Fund

Holdings: 29.91K BTC

Value: $1.21B

Entity Link:https://t.co/gxugCID2whBITB Bitwise Bitcoin ETF

Holdings: 10.15K BTC

Value: $422.68M

Entity…— Arkham (@ArkhamIntel) January 22, 2024

According to their estimates, IBIT holds 33,431 BTC, FBTC 29,907 BTC, BITB 10,152 BTC, and EZBC 1,660 BTC valued at $46.1 million.

K33 Research estimated GBTC’s Bitcoin reserves at 564,933 BTC. After converting the product to an ETF, its AUM fell by 54,287 BTC.

CoinGlass provides different data — 552,680 BTC. According to the aggregator, the figure dropped by more than 10% from 619,220. The reduction of 66,450 BTC is equivalent to 60% of the coins held by the “new” spot Bitcoin ETFs.

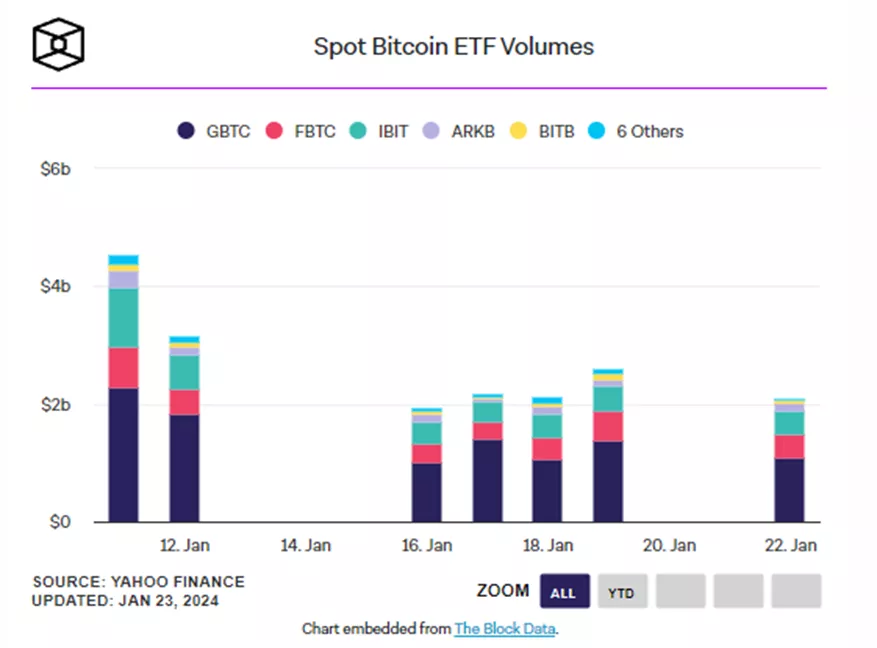

According to The Block, on the seventh trading day, product turnover amounted to $2.1 billion. More than half ($1.1 billion) was attributed to GBTC.

GBTC Outflows Surpass Demand

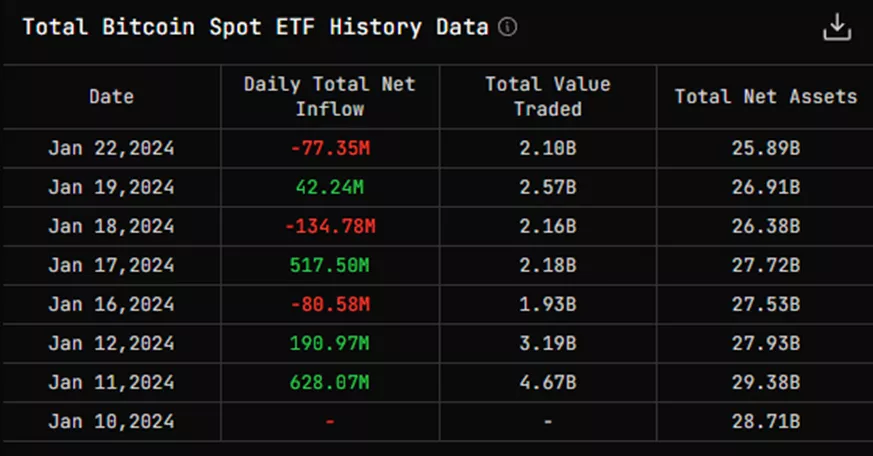

Bloomberg analyst James Seyffart estimated inflows into instruments on January 22 at $564.5 million. IBIT led with $272 million, followed by FBTC ($159 million), while the rest attracted less than $100 million combined.

Total inflows were lower than the $640.5 million outflow from GBTC. As a result, the spot Bitcoin ETF segment lost $76 million, which could have contributed to the asset’s price falling below $40,000.

Update: BlackRock’s numbers are in for the #Bitcoin ETF Cointucky derby. Third biggest inflow day for $IBIT yet at $272 million. Only -$76 million in net outflows for the day. https://t.co/ySE0edbz4c pic.twitter.com/RzgH6qn5Md

— James Seyffart (@JSeyff) January 23, 2024

“A bad day. Over $640 million was withdrawn today. The outflow is not slowing down, but increasing. This is the largest for GBTC [since ETF approval]. The total amount so far is $3.45 billion,” he calculated.

According to Lookonchain, the net outflow on January 22 was 4,537 BTC ($179.6 million). GBTC saw a withdrawal of 14,292 BTC ($565.84 million), which was only partially offset by inflows into nine “new” ETFs — 9,755 BTC ($386.24 million).

According to the latest data released on the website:#Grayscale decreased 14,292 $BTC($565.84M) yesterday.

8 ETFs added 9,755 $BTC($386.24M) yesterday, of which #Fidelity added 5,312 $BTC($210.33M). pic.twitter.com/CVBdH5iybB

— Lookonchain (@lookonchain) January 23, 2024

According to sosovalue.xyz, in value terms, the AUM of 10 spot Bitcoin ETFs decreased by $2.82 billion.

What to Expect from the Market?

In a comment for ForkLog, trader Vladimir Cohen noted the pressure from GBTC holders who, after more than two years, have seen their shares turn profitable. Their sales seem logical, he added.

The expert suggested that Bitcoin ETF issuers since 2022, even before the instrument’s launch, might have entered into forward contracts with miners for the supply of digital gold. This could have limited the scale of purchases after the SEC approved the product.

“This led to disappointment. Even long-term holders, observing such price dynamics, start to unload. There is an excess supply of Bitcoin [in the form of GBTC] and a lack of demand,” Cohen explained.

In his view, the situation could change with an influx of fresh liquidity and a risk-on mode in the market.

“Those who expected growth after the ETF approval have already bought. Interest rates remain high, yields on US Treasuries have returned above 4%, and funds will not buy BTC at nearly two-year highs under such conditions. They will enter the market only after a significant correction when the risk/reward ratio becomes more attractive,” the trader explained.

The expert anticipates Bitcoin moving into the $36,000-38,000 range and to lower levels in the absence of new demand.

“In a negative scenario, we face panic selling and a move into the $25,000-30,000 range, which preceded purchases on the ETF approval narrative. If Bitcoin trades in the $30,000-35,000 range until the halving, it will create a good base for continued growth,” Cohen concluded.

Experts at Bitfinex have pointed out the risks of Bitcoin falling further to $36,000.

Earlier, CoinDesk journalists reported on the sale of GBTC shares worth $908 million from the bankruptcy estate of FTX.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!