Standard Chartered: Ethereum Treasuries Offer More Attractive Alternative to ETFs

Public companies holding reserves in Ethereum are more appealing to investors than spot ETH-ETFs, according to Jeffrey Kendrick, head of digital assets at Standard Chartered, as reported by The Block.

He noted that the market net asset value (MNAV) multipliers of these firms—the ratio of market capitalization to the value of the cryptocurrency they hold—have stabilized above 1.

“I see no reason why NAV would fall below 1, because they [firms with Ethereum reserves] offer investors opportunities for regulatory arbitrage,” he stated.

Unlike ETFs, companies can earn staking rewards (~3% annually) and utilize DeFi tools, enhancing overall investment returns. As Ethereum reserves grow, the asset value per share proportionally increases, creating additional value for shareholders.

By investing in shares of such firms, stakeholders also gain indirect access to Ethereum without the restrictions imposed on exchange-traded funds.

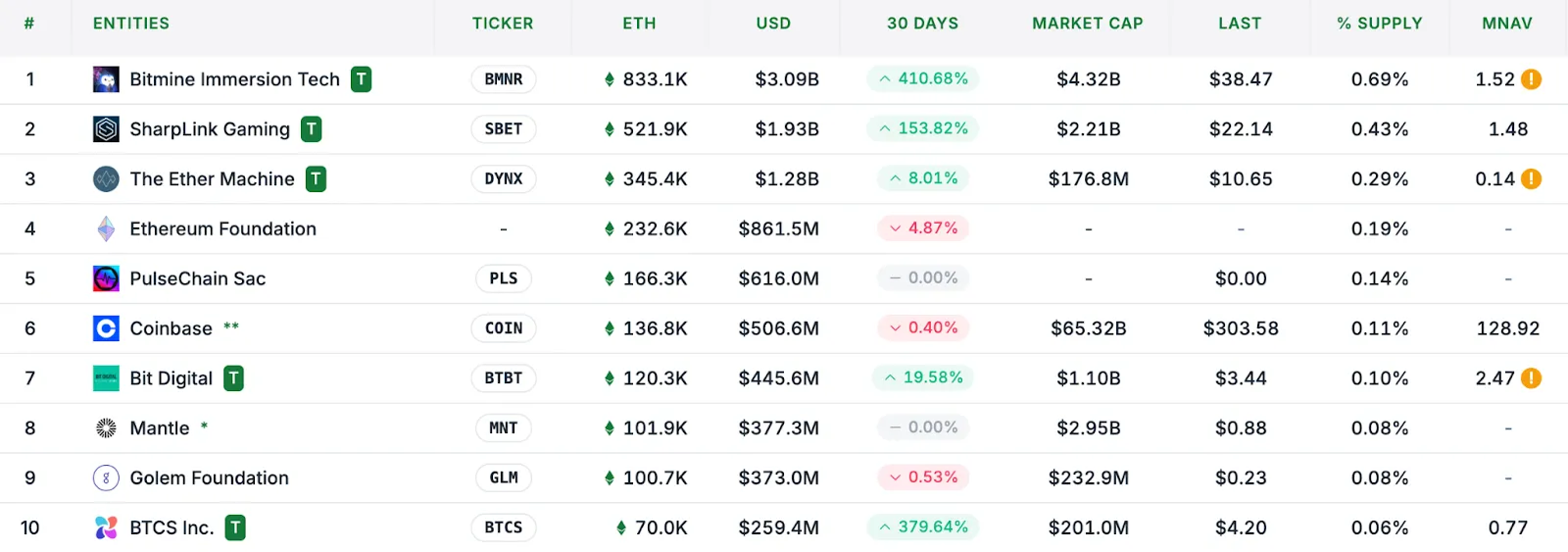

According to Strategic ETH Reserve, the largest holders at the time of writing include:

- BitMine — 833,000 ETH valued at over $3 billion;

- SharpLink Gaming — 521,000 ETH worth $1.9 billion;

- The Ether Machine — 345,000 ETH at $1.2 billion.

Since June, public companies have acquired 1.6% of the total Ethereum supply, matching the volume of ETF purchases over the same period. Kendrick predicted that these firms’ reserves could grow to 10%.

Over the past month, the price of the second-largest cryptocurrency by market capitalization has increased by more than 45%, according to CoinGecko. At the time of writing, the asset is trading at $3,700.

Back in early August, a technical analyst known as Edward predicted Ethereum’s rise to $16,000. Key factors included technical patterns, inflows into ETFs, and growing institutional demand.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!