This week’s wrap: Bitcoin and Ethereum fail to hold the year’s highs

Taking stock of the week just gone, we recall Bitcoin and Ethereum trading from their 2020 highs, the controversial listing of unlocked Polkadot tokens on Binance and Kraken, the first token-collateral loan in Russia, and other key events.

Bitcoin price

On Monday, August 17, Bitcoin breached the $12,000 level. During the day the price climbed above $12,450 (Bitstamp).

The move came as the amount of BTC stored on exchanges approached 24 November lows. On Monday the indicator fell to 2.61 million BTC.

Open interest in Bitcoin futures, by contrast hit an all-time high, reaching $5.8 billion.

The network’s all-time high of 129 EH/s was reached and the network’s hash rate, according to Blockchain.com. The Sichuan floods forced mining farms in the region to shut down equipment and evacuate staff. The computing power of leading Chinese pools fell by about 20%.

recent thunderstorm/flood in Shichun significantly tanked Bitcoin hashrate for ~20% of all Chinese pools this week

centralization risk of mining is not just coming from potential serizure but also natural disaster

colocation of rigs can be a collective single point of failure pic.twitter.com/DdN7xfioDy

— Dovey 以德服人 Wan (@DoveyWan) August 22, 2020

The cryptocurrency failed to hold a psychologically important level — by Tuesday the price had fallen below $12,000.

As predicted by Nikita Semov, founder of Crypto Mentors, the impulse proved short-lived. He noted that a genuine breakout above $12,000 could occur within the next two weeks.

The leading RoboForex analyst Dmitry Gurkovsky also believes that the downward movement presages a new attempt at a Bitcoin rally.

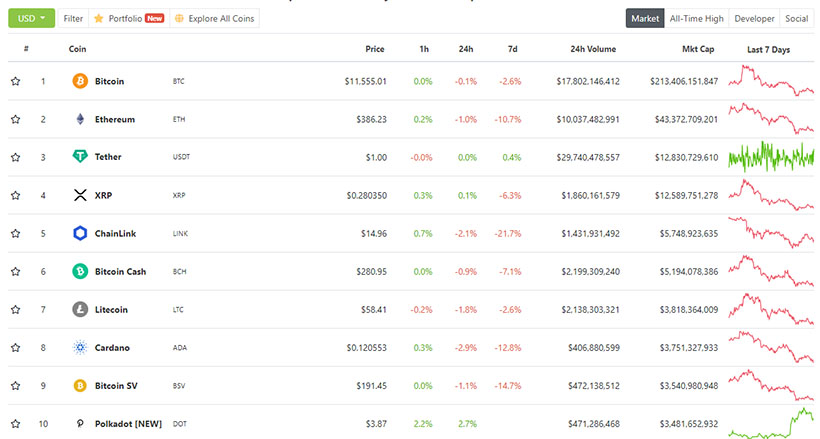

As of writing, the first cryptocurrency is trading at around $11 555 (Bitstamp), with a market capitalization of $372.3 billion and BTC dominance at 57.3% (CoinGecko)

Over the coming weekend, Ethereum price (ETH) fell below $400, although during the week it rose above $440 (Bitstamp).

Polkadot founder condemns Binance and Kraken for hasty DOT token listings

Gavin Wood called the exchanges ‘unscrupulous’ for listing DOT tokens immediately after their unlock. He is convinced that they exposed the community to risk.

Wood’s displeasure targeted Binance and Kraken. Both exchanges added DOT tokens to the listing two days before the August 21 redenomination.

At block number 1,248,328 on August 21st at 16:48 UTC, the DOT token underwent a redenomination from its original sale. ‘ ’ is now 100x smaller than ‘DOT (old)’. Therefore, your DOT balance is now 100x higher and the price per DOT is 100x lower. pic.twitter.com/OEvfj1Ddmu

— Polkadot (@Polkadot) August 21, 2020

The project’s leadership had warned that, due to the hurried listings on exchanges, DOT’s market value on such platforms could be 100 times lower than its true value.

According to a Polkadot representative, these concerns were borne out.

Analytical service CoinGecko added DOT to its ranking, where the cryptocurrency immediately found itself in the top 10 by market capitalization.

Binance Bitcoin exchange reveals P2P platform metrics for the first time

Total trading volume on Binance’s P2P platform for digital assets since launch in October 2019 stood at $2.5 billion, were announced by the exchange’s representatives.

In early 2020, the platform added support for the Russian ruble and Ukrainian hryvnia. In July the volume in Russian rubles amounted to $10 million. According to representatives, this figure shows monthly growth of 110%.

A similar dynamic is observed in Ukraine, although precise data are not yet available.

Binance supports P2P trading of Bitcoin, BNB, ETH, EOS and BUSD.

Developers confirm ETH 2.0 phase 0 launch this year amid testnet problems

The failure in the operation of the final Ethereum 2.0 testnet named Medalla will not affect the timing of the Phase 0 launch on the mainnet, assured Prysmatic Labs’ Raul Jordan.

Late last week, due to a failure in the Prysm client used by most validators, the test blockchain split into four chains.

On Monday, August 17, Prysmatic Labs developers resolved a critical bug in the Medalla client that had made normal network operation impossible.

Competitors, notably from Bitcoin SV, reacted on the CoinGeek blog to the testnet failure. They said that the August 14 events indicate Ethereum 2.0 is not ready for launch and could cause further delays. In their view, this could pose a serious challenge for developers amid issues on the current network.

Jordan noted that for the Ethereum team, the Medalla outage provided a good lesson “to prevent such a situation in the mainnet” and rejected the suggestion that the testnet had “died”.

«We consider that the expected Genesis block launch target in the mainnet, about 2-3 months after Medalla, remains an ideal guide. We will publish a public list of requirements for ETH2 to begin functioning. The Medalla incident will certainly add new items to the list concerning the stability and security of the client», — he clarified.

Ethereum co-founder Vitalik Buterin, in this context, acknowledged that ETH 2.0 has become a more serious challenge than the project team expected. But he has no doubts about the forthcoming transition to the second version of the protocol.

Vitalik Buterin disclosed the price at which he sold his Ethereum holdings

The Ethereum co-founder sold his ETH holdings when the cryptocurrency was around $700. He told this during a Twitter discussion.

The Bitcoin supporter under the pseudonym American.HODL suggested that all ETH holders also own BTC, but not the reverse.

The developer and Bitcoin maximalist under the handle WizardofAus.Hodl expressed confidence that Buterin sold his ETH at above $1000, after which he converted them into Bitcoin rather than rubles or dollars.

Buterin replied that he did indeed liquidate his cryptocurrency holdings for dollars, but at a market price around $700. Some ETH he donated to charity.

The Ethereum Foundation sold its coins at around $1200, directing the proceeds to developer payments and grants, he said.

Buterin noted that he has not bought Bitcoin since 2017, and uses dollars or local currency for settlements, depending on the country of residence.

First Bitcoin transaction using multisignature sent from the ISS

SpaceChain announced the successful execution of the first Bitcoin transaction using multisignature on hardware placed on the International Space Station (ISS).

The initiative to create a decentralized orbital cluster for fintech applications and commercial operations is implemented under the European Space Agency’s startup accelerator.

In 2019 SpaceChain received a €60,000 grant from ESA. The funds were directed to bringing a secure satellite blockchain network into orbit. The technology uses a three-signature system: two signatures are generated on Earth, the third — in orbit. For each transaction, at least two signatures are required.

In Russia, the first loan secured by tokens was issued

Russia’s Expobank for the first time in the history of the country issued a bank loan secured by tokens. The loan was extended to entrepreneur Mikhail Uspensky under an individual banking loan agreement.

During structuring, an escrow mechanism was used.

According to LFCS founder Yuri Brisov, who proposed the legal model for the deal, the hardest part was convincing bankers that tokens could be legally used in Russia.

The deal’s accompanying managing partner of the law firm EBR, Alexander Zhuravlev, noted that the tokens used as collateral clearly fall under the definition of “other property”.

In the near future it will be possible to apply special provisions of digital financial assets legislation, the lawyer reminded.

Head of the State Duma Committee on Financial Markets Anatoly Aksakov this week clarified that regulation of “digital instruments” will entail liability for non-performance of duties. He stressed that questions of issuing and circulating cryptocurrencies will be set out in a separate bill or adjusted by amendments to the law “On Digital Assets”

Ethereum Classic developers present plan to protect cryptocurrency from new attacks

After two successful 51% attacks on Ethereum Classic, which caused losses of about $7.3 million, developers have prepared a set of proposals aimed at protecting the network in the future.

The proposed changes include short- and long-term steps to reduce the risks of similar attacks and further development of the network.

The developers divided the proposed changes into five stages through January 2021. This time will be needed to coordinate changes with the community, develop them and implement them.

New version of the LND client increases the cap on funds transmitted in the Lightning Network

Lightning Labs have presented the beta version of the LND v0.11 client, which allows sending larger Bitcoin transactions on the second-layer Lightning Network.

The update supports so-called Wumbo channels. The name references a SpongeBob episode and means the word “big”.

For safety, LND caps throughput at 0.1677 BTC. With v0.11, LND users gained the ability to “handle larger transactions and larger volumes”.

This week ForkLog also wrote:

- US Army: around 6,000 hackers are targeting North Korea.

- Tether integrated into an Ethereum sidechain with “thousands” of TPS.

- China will test the digital yuan in major commercial operations.

What else to read?

This week ForkLog published a substantial material on the outcomes of a not-so-great second quarter of 2020 for the global economy.

For notable events and developments in the rapidly growing DeFi sector, see the traditional ForkLog overview.

Subscribe to Forklog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!