Tokenise and pledge

New opportunities in tokenised gold

On September 3, the World Gold Council (WGC) launched a pilot to tokenise the precious metal. The initiative aims to expand OTC trading in gold and its use as collateral in financial markets.

ForkLog examined the technical and legal aspects of a proposal that could upend a market with weekly turnover of about $1trn.

The virtual bar

“Wholesale Digital Gold ecosystem” can complement existing Loco London mechanisms. These include:

- physical delivery — ownership of specific gold bars stored in vaults with unique serial numbers, assay data and weight. The principal advantage is transparent title. Investors own the bars directly, insulating them from custodians’ credit risk. Drawbacks include a high entry cost (typically starting from a single 400 ounce bar), limited liquidity and fees;

- holding on unallocated metal accounts — an investor’s claim to a set quantity of gold held by a custodian. Offering greater flexibility and liquidity, this model enables trades down to a thousandth of an ounce. The big downside is the risk of loss: if the custodian goes bankrupt, investors’ claims to gold are pooled with those of other unsecured creditors.

The new digital unit PGI enables direct, fractional investment in physical gold while minimising the shortcomings of the current system. The instrument in effect allows banks and investors to trade fractional ownership rights in physical gold held in segregated accounts.

According to the WGC, the idea can be realised through:

- simplifying the transfer of title;

- fractional ownership of gold bars starting from 0.001 ounce;

- insolvency protection from the custodian;

- providing more flexible options for using the metal as collateral.

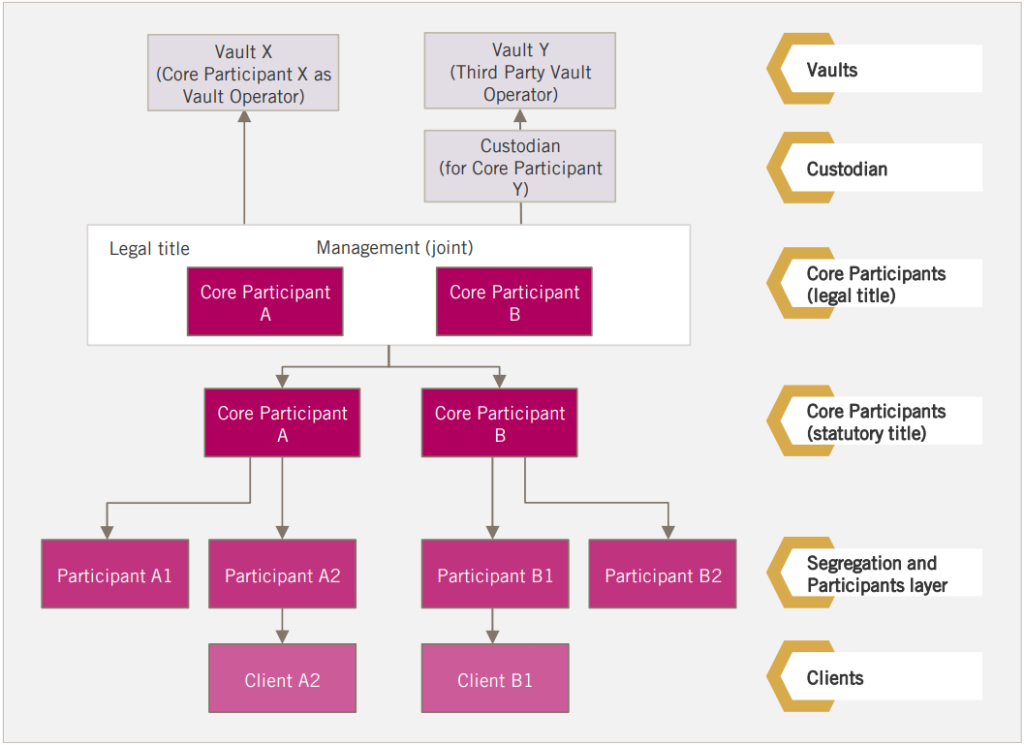

The white paper says the tokenised-gold ecosystem comprises three key layers:

- “vault — key participant”. Defines the procedure for transferring gold bars to a custodian;

- “key participant — subsequent asset splitting”. Creation of a legal co-ownership agreement and issuance of PGI;

- “splitting — client”. Reflects the principle of transferring PGI via intermediaries to a wider set of clients.

In the first phase, a small group of key participants (KPs) jointly owning bars issues PGI to evidence their beneficial interests in operators’ vaults.

Tokenised gold can then be transferred via entries in a digital register to a wider group of participants, who may hold it for clients.

By design, KPs would be responsible for safekeeping and joint management of the physical metal, including organising the loading and unloading of gold into the system. The algorithm tracks all changes and automatically rebalances assets.

The initial roadmap envisages several banks and financial institutions testing the technology, with launch slated for the first quarter of 2026. The WGC’s next step is scaling: onboarding clients, integrating with financial-market infrastructure, and active engagement with regulators and standard-setters. The organisation believes the first wave of participants can itself establish the foundation, governance and rules.

Adoption hurdles

WGC chief executive David Tait told the Financial Times that the new format would create an opportunity “for the first time to transfer gold digitally within the ecosystem as collateral”.

“We are trying to standardise this digital layer of gold so that the market can apply the same financial products that are already used in other sectors. My goal is for many asset managers around the world to start looking at gold differently,” the former banker added.

Representing gold miners’ interests, Tait argues the metal needs to be digitised to widen market reach, even though many investors value it precisely for its physical nature and strong defensive qualities.

Some experts reckon the project will face resistance, as key players in the gold market are conservative and cautious. Adrian Ash, research director at BullionVault, told the Financial Times he doubted Loco London would embrace the changes:

“Gold is already the best-performing asset. This looks like a solution in search of a problem.”

One of the main hurdles to the evolution of a gold surrogate lies in the legal realm. Existing financial-collateral privileges reflected in FCAR do not cover gold. That limits the automatic recognition of PGI as a simplified collateral asset. The white paper, prepared with law firm Linklaters and consultancy Hilltop Walk Consulting, sets out advocacy options and possible rule changes.

PGI are specifically structured to minimise regulatory costs and be potentially suitable under EMIR and the Dodd-Frank Act, but actual applicability depends on regulatory interpretation and, possibly, legal change.

A positive factor for adoption could be the rollout of the Gold Bar Integrity programme announced earlier this year — a migration of the physical-metal database to a blockchain. The initiative, launched by the LBMA together with the WGC, envisages tracking the full gold supply chain and creating digital bar passports.

Everything takes a golden form

The PGI concept sits at the intersection of three supertrends: the rising price of the “yellow metal”, the rapid expansion of the RWA market and the spread of cryptocurrencies.

Also on September 2, SmartGold, a provider of precious-metal-backed individual retirement accounts (IRAs), teamed up with tokenisation startup Chintai Nexus.

The collaboration allows US IRA holders to tokenise $1.6bn worth of gold and earn additional income in DeFi markets.

The continued decline of the US dollar index amid mounting macroeconomic uncertainty has prompted many governments to reconsider their attitude to reserves of the “yellow metal”. Central banks keep trimming the share of US Treasuries while increasing gold purchases.

The trend brings the digitalisation of the oldest reserve asset closer, especially amid talk of possible monetisation of the US Fed’s gold reserves, which also adds new use-cases for gold.

On September 9, the price of gold set another ATH, nearing $3,670 per ounce.

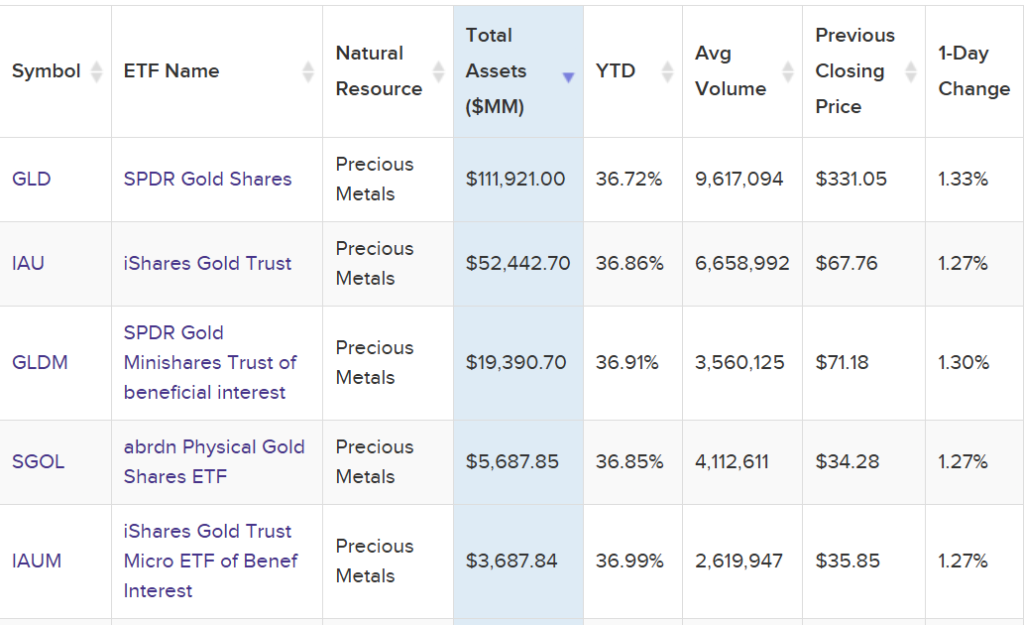

According to the WGC, inflows into gold ETFs are also at a peak; total market capitalisation in August surpassed $400bn. The leader remains SPDR Gold Shares with AUM of about $112bn.

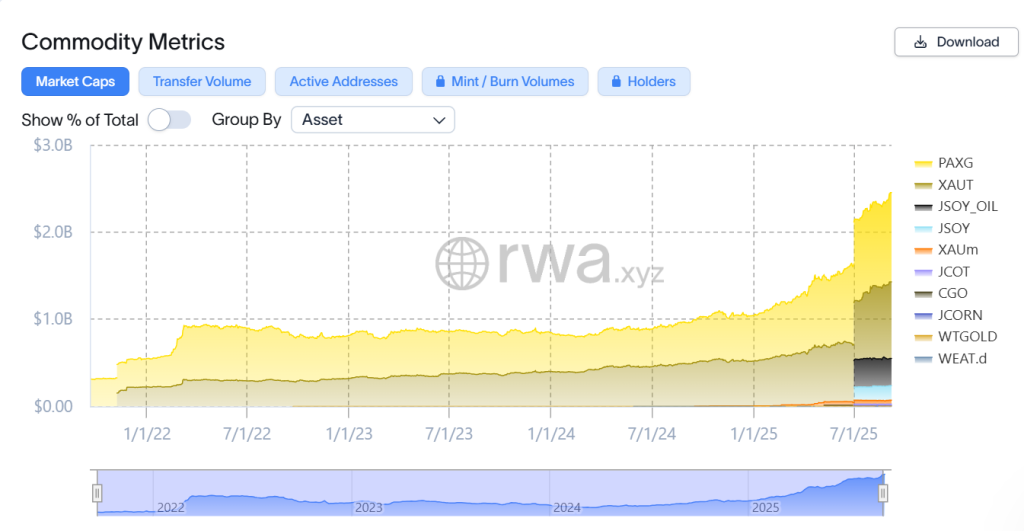

Tokenised gold stablecoins have not matched the popularity of traditional financial instruments. As the precious-metals market grows, the combined capitalisation of the two leaders — XAUT and PAXG — reached $2.4bn in September.

Despite the wide gap with ETFs, within the RWA sector gold stablecoins lead among tokenised commodities. At the time of writing they are being chased by “digitised” soybean oil on the Polygon blockchain, ticker JSOY_OIL, with a market capitalisation of $313m.

Enough gold dust to go around

Gold tokenisation is becoming routine even for public companies.

Matador Technologies, a bitcoin-focused company with an emphasis on tokenisation listed in Canada, the US and Germany, holds 77 BTC on its balance sheet. Ranking 101st among crypto companies, it ambitiously plans to own 1% of bitcoin’s supply.

In January, management announced a new direction — tokenising physical gold as inscriptions on the Bitcoin blockchain. The Ordinals collection, Grammies, lets buyers acquire unique digital artworks with the option to have them physically engraved on a gold bar.

Private company NatGold Digital goes further, arguing that gold mining is harmful and pointless, and proposes combining the strengths of blockchain and the noble metal. The startup issues NatGold tokens as proof of rights to gold that still lies underground.

On September 4, via a presale involving 7,052 users from 145 countries, 53,627 coins were sold for more than $103.5m.

PGI are, in essence, infrastructure that fuses precious metal with new technological solutions. The WGC white paper envisages a consortium blockchain, governed by key participants, to digitise and automate clearing between institutions. The target market is institutions with high demands for trust and efficiency, where PGI could in theory address clearing and collateral frictions among major Loco London institutions.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!