Trader outlines Bitcoin’s next price moves

Nikita Semov, a practicing trader and founder of the project Crypto Mentors, explains the current market situation.

Weekly Auction

First, the point to notice is that the bar from the past week managed to close above new all-time high. On the one hand, this signals buyer dominance. On the other, evaluating the breakout against previous updates [simple_tooltip content=’исторический максимум цены’]ATH[/simple_tooltip], we see hidden weakness among buyers. At present they are not able to push the price higher.

There are no signs of a significant dump with sellers pushing through buyers. A solid absorption of buying pressure earlier is a demonstration of strength. Given the overall long-bias dynamics, there is no reason to panic yet.

From the perspective of horizontal volume distribution there is a positive movement in the POC heading upward. Beneath us lies the buyers’ volume density, expressed by a balanced structure.

The most troubling scenario would be a return to the $43 000-$52 000 area. However, we do not consider long shorts until the $47 800 level is breached.

From the weekly picture we expect a decline with a potential move into a sideways market. There are no signs of a global market reversal yet.

Daily Auction

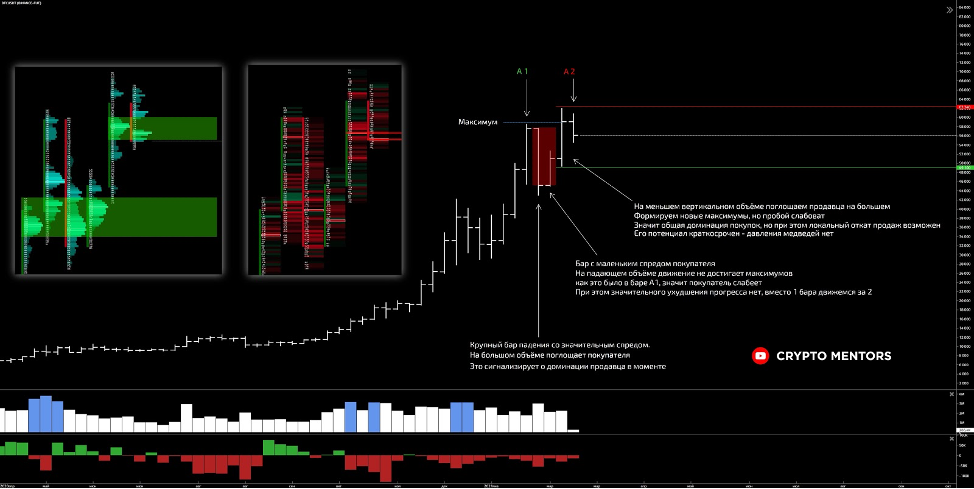

The price has returned to the sideways range, effectively a false breakout of the previous swing high.

Looking at the dynamics of buying and selling through the lens of Price Action, it becomes evident that in the AB and CD waves the bulls spent the same amount of time to cover comparable distances. This suggests that bullish momentum remains intact.

Sellers need less time to cover the same distance, but every attempt to press lower is quickly bought back.

Analyzing the bar from the last week, in the mid term selling appears somewhat weak (note the bar circled in blue).

Local Perspective

Locally there is a developing selling dynamic, supported by volumes. We are already beneath the largest March volumes and several key nodes where buyers could not hold the price.

There is currently a retest of the volume level $56 300. This event could act as a trigger to break through the boundary $55 150 and move toward $49 000.

Thus, the most priority scenario is a deeper correction. The revival of the bullish momentum could occur either if prices hold above $57 000, or at the $49 000 level.

An intermediate range of $50 500-$51 000 can also be considered, but the likelihood of a reversal from these levels is low.

Subscribe to ForkLog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!