Week in review: Bali authorities announce crackdown on cryptocurrencies in tourism sector; bitcoin miners’ May revenue tops $900m

Balinese authorities have decided to crack down on cryptocurrencies in the tourism sector, journalists revealed details of the Bitfinex hack report, bitcoin miners’ May revenue surpassed $900 million and other events of the week.

U.S. debt ceiling deal sparked bitcoin volatility

On May 28, U.S. House Speaker Kevin McCarthy announced an in-principle agreement with the White House on the debt ceiling. In this context, BTC rose above $28 400, but could not sustain the level and retraced.

By the end of the week, it emerged that the debt-ceiling bill had cleared the House and gained Senate approval. On June 3, President Joe Biden signed the measure. Bitcoin rose to above $27 100.

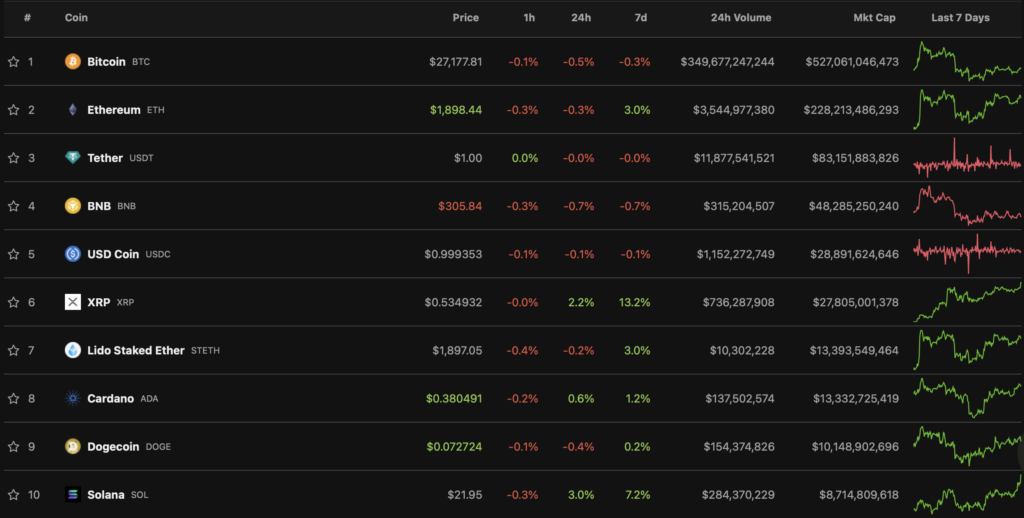

Most top-10 by market cap finished the week in the green. XRP led with a 13.2% gain.

The total crypto market capitalization stands at ~$1.19 trillion. Bitcoin’s dominance index rose to 47.5%.

Bali authorities announce crackdown on cryptocurrencies in the tourism sector

The Bali province government will crack down on the use of digital assets by tourists for payments in hotels, restaurants, shopping centres and other venues. Proposed measures include deportation, administrative penalties, criminal prosecution, business closures and other sanctions.

Dogecoin daily transactions exceed 2 million

The daily transaction count on the Dogecoin (DOGE) blockchain surpassed 2.08 million. In Bitcoin’s network the corresponding figure was 471,488 transactions, and Ethereum 982,620.

Activity by meme-coin users was linked by several experts to the rising popularity of tokens of the DRC-20 standard, which allow creating new digital assets atop the blockchain.

What to discuss with friends?

- Hackers hacked the Twitter accounts of the head of The Sandbox and OpenAI CTO.

- Arthur Hayes predicted a new Bitcoin rally by 2024, and Dan Tapiero said that the bear market is over.

- An address moved 8,000 ETH.

- Media: Curve Finance chief purchased two mansions in Australia for $40 million.

What’s going on at Binance?

According to reports, Binance began a round of layoffs. The laid-off share is expected to be around 20%. CEO Changpeng Zhao described the reports FUD and said the company regularly sheds workers who are not a good fit.

This week the top executive also denied a possible bank acquisition. He said the company is not interested due to regulatory complexity and capital requirements.

On June 26, Binance will delist from listing in France, Italy, Poland and Spain 12 privacy-focused coins: Decred (DCR), Dash (DASH), Zcash (ZEC), Horizen (ZEN), PIVX (PIVX), Navcoin (NAV), Secret (SCRT), Verge (XVG), Firo (FIRO), Beam (BEAM), Monero (XMR) and MobileCoin (MOB).

Bitcoin miners’ total revenue in May surpassed $916m

Bitcoin miners’ total revenue in May reached $916 million. The share of fees in total revenue for the month was about 13.7%. The rapid rise is likely linked to higher on-chain activity amid the Ordinals and BRC-20 hype.

Also on ForkLog:

- The Tornado Cash Ethereum-mixer DAO returned governance control.

- Analysts predicted Bitcoin breaking out of its current price range.

- The Multichain token price unexpectedly rose by 36%.

- In Ukraine’s NKЦБФР spoke about the development of the Bitcoin market in Ukraine.

Experts from dWallet Labs found a $500m vulnerability in Tron

The security group 0d from dWallet Labs identified in the Tron network a critical vulnerability in the multi-signature mechanism, affecting assets worth about $500 million.

«The bug allowed any signer (regardless of weight) of a multisig account to completely bypass Tron’s security settings, regardless of the threshold and number of signatories»,

On February 19 they contacted the blockchain project’s team via the bounty-program interface. The network’s developers quickly acknowledged the vulnerability and rolled out a fix within a few days.

Skale Network unveiled Levitation Protocol on ZK-Rollups

The Skale Network team presented Levitation Protocol — a scaling solution based on zero-knowledge proofs and ZK-Rollups.

The new L2 protocol is designed to enable developers of dapps to use rollups for seamless interaction with the network of the second cryptocurrency.

In May the crypto industry lost more than $45m to rug-pull schemes

According to Beosin, losses from rug pull in May more than doubled the damage from DeFi protocol exploits and totaled over $45 million. The largest incident was the alleged exit scam by the DeFi project Fintoch’s team on May 24, resulting in clients losing assets worth $31.6 million.

What else to read?

In the usual digest, the main cybersecurity events of the week were gathered.

The DeFi sector continues to attract heightened attention from cryptocurrency investors. ForkLog has compiled the most important events and updates of recent weeks in the digest.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!