Week in Review: Bitcoin holds above $20,000 as Voyager Files for Bankruptcy

The price of the leading cryptocurrency has returned to the $20,000 level, Voyager Digital filed for bankruptcy in a New York court, Celsius repaid a loan in the MakerDAO protocol, and other events of the past week.

Bitcoin price back above $20,000

On Tuesday, July 5, the leading cryptocurrency held above the $20,000 level and by Friday had reached $22,500. By week’s end, prices had cooled — at the time of writing, Bitcoin was trading near $20,800.

Analysts at Glassnode noted that the record drop in Bitcoin’s price in June effectively knocked out the remnants of “market tourists”, leaving the front line only with hodlers. In Cumberland believe that the market recovery will determine the pace of asset liquidations by troubled firms in favour of more successful players in the industry.

Bloomberg Intelligence strategist Mike McGlone predicted a rise in Bitcoin over the next six months. In his view, Bitcoin is exhibiting the same behaviour as at the end of the bear market in 2018.

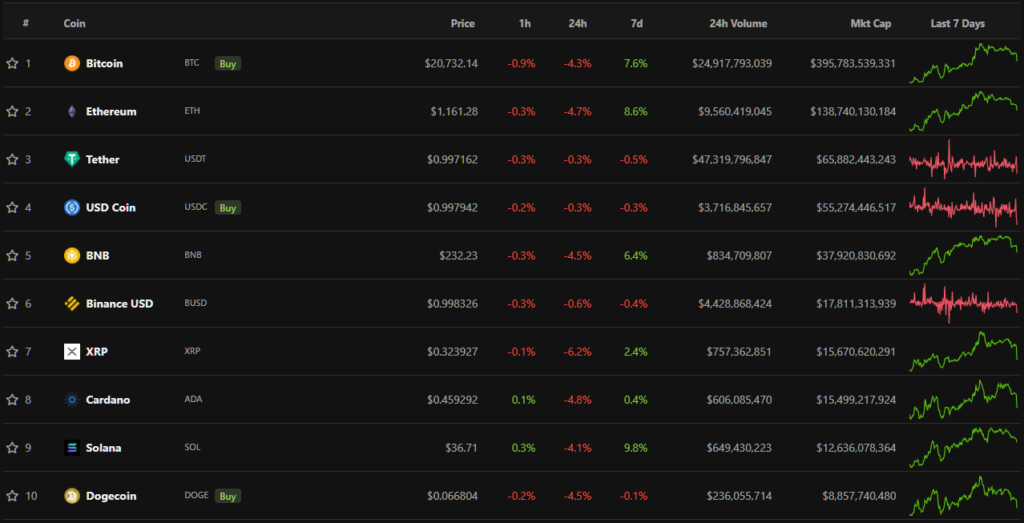

Nearly all digital assets from the top-10 by market cap closed the week in the green. The exception was Dogecoin. The best performers were Solana (+9.8%) and Ethereum (+8.6%).

The aggregate market capitalization of the cryptocurrency market stood at $966 billion. Bitcoin’s dominance index rose to 41.2%.

Voyager Digital files for bankruptcy

On Tuesday, July 5, the crypto broker Voyager Digital filed for bankruptcy in a New York court. The company’s liabilities are estimated at between $1 billion and $10 billion with around 100,000 customers.

According to the bankruptcy filing, Alameda Research was the second borrower by the volume of funds raised ($376.8 million) from Voyager Digital after Three Arrows Capital.

Earlier, the company provided the broker a loan of $200 million in USDC and opened a revolving line of credit for 15,000 BTC. Binance CEO Changpeng Zhao criticized the deal and said he would “never have agreed to such an arrangement”.

Voyager Digital began investigating the US Federal Deposit Insurance Corporation (FDIC). The agency contends that the broker misled users by claiming their assets were protected by the agency’s program.

Celsius repaid the loan in MakerDAO and withdrew collateral of 23,962 WBTC

Over the week, Celsius actively paid off the loan in the MakerDAO protocol. On July 7, Celsius paid off the full amount and withdrew 23,962 WBTC of collateral (~$500 million). A few hours later, 24,463 WBTC were transferred to the address of the FTX exchange. Despite concerns from experts about possible market selling, Bitcoin rose during this period.

Former Celsius contractor KeyFi Inc. filed a lawsuit against the lending platform, accusing it of failing to meet contractual obligations. Its founder Jason Stone stressed that the defendant owes his organization a “significant amount” of money.

According to Arkham analysts, Celsius placed around $534 million of client funds in high-risk leveraged crypto trading strategies via KeyFi. On these investments the platform lost $390 million.

Media also reported reductions at Celsius. Similar plans were announced by Ignite and Bullish. The mining company Compass Mining will lay off 15% of staff and reduce executive salaries.

BitMEX will restrict accounts of Russian residents, trading on the exchange from the EU

The crypto-derivatives exchange BitMEX has implemented a range of restrictions for Russian residents using the platform from the EU. The policy changes were made in response to EU sanctions.

The restrictions affect Russian residents, including those “trading on behalf of any legal entity that has access to the exchange’s services from the EU,” and those located or incorporated in Russia whose traders use the exchange from the EU.

Vauld, backed by Peter Thiel, suspended operations. Media reports say it is being acquired by a competitor

Following Voyager and Celsius, trading, withdrawal and deposit operations were suspended by the Singapore-based crypto-lending platform Vauld. Management is considering a restructuring. They attributed this move to financial difficulties caused by unfavorable market conditions, counterparty issues and liquidity outflows.

Media reports that Vauld is set to be acquired by its competitor Nexo, and the parties already allegedly signed a preliminary deal.

Cardano developers activated the Vasil hard fork in the testnet

On July 3, the team behind Cardano, Input Output Global (IOG) conducted the Vasil hard fork in the testnet. Developers of apps, staking-pool operators (SPOs), exchanges and other ecosystem participants have four weeks for final testing and integration before launch on the mainnet.

What to discuss with friends?

- Korean startup lost around $24 million on a short position in LUNA.

- Domain 000.eth sold for more than $300,000.

- Elon Musk announced the termination of the Twitter acquisition deal.

- Media reports that spyware was used in the Ronin attack.

Circle CEO reveals details of USDC reserves

Co-founder and CEO of Circle, Jeremy Allaire presented details of how USD Coin (USDC) operates in the wake of Terra’s UST collapse.

USDC reserves are held in leading U.S. financial institutions such as BlackRock and Bank of New York. Of the $50.6 billion in reserve collateral (as of May 13), $39 billion (71.1%) were in U.S. Treasury bills maturing within three months; $11.6 billion were in cash.

Aave proposes launching the decentralized stablecoin GHO

Developers at Aave proposed to launch a multi-collateral stablecoin GHO native to the DeFi ecosystem, pegged to the US dollar.

As collateral, GHO will use a “diversified set of crypto assets” supported by the protocol. Users will continue to earn interest on assets staked.

Mt. Gox trustee begins preparations to reimburse creditors

Mt. Gox trustee Nobuyuki Kobayashi said that preparations are underway to make payments to creditors. The latter are asked to indicate how they want to receive funds — in a single upfront payment or in several installments, and can choose to settle part of the assets in Bitcoin or Bitcoin Cash.

U.S. class-action filed against Solana

California investor Mark Yang accused key Solana ecosystem participants of illicitly profiting from the native token SOL — Solana Labs, Solana Foundation, Anatoly Yakovenko, venture firm Multicoin Capital, its partner Kyle Samani and FalconX’s OTC unit. The suit alleges the token is an unregistered security.

Bitmain announces start of sales of Ethereum miner Antminer E9

Bitmain announced the start of sales of the ASIC miner Antminer E9, designed to mine the second-largest cryptocurrency by market capitalization. The device specifications:

- hashrate — 2400 MH/s, equivalent to 25 RTX 3080 GPUs;

- power consumption — 1920 W;

- energy efficiency — 0.8 J/M.

Core Scientific sold the bulk of its Bitcoin reserves in June

The US blockchain-hosting provider Core Scientific sold 7,202 BTC for $167 million in June at an average price of $23,000 per Bitcoin. On its balance sheet the company holds 1,959 BTC and about $132 million in cash.

Justin Sun to spend up to $5 billion to rescue crypto companies

Tron founder Justin Sun stated his readiness to allocate up to $5 billion to rescue crypto companies amid the market crisis. He noted some players have already approached him with such requests.

Sun said Tron has engaged an investment bank for advisory on potential deals. He declined to name the institution due to a non-disclosure agreement.

The $5 billion will comprise both Sun’s personal funds and Tron assets. He also noted interest in platforms with large audiences.

Also on ForkLog:

- The U.S. urged Japan to stop cryptocurrency operations in Russia.

- Bitstamp announced a monthly fee for inactive users but revised the decision under community pressure.

- In the first half of 2022 hackers stole nearly $2 billion from crypto projects.

- Peter Velle declined a key role in Bitcoin Core.

What else to read and watch?

Bitcoin has fallen below the peak of the previous cycle for the first time, the shares of public miners have tumbled, but on-chain indicators are already signaling optimism. We reviewed the main June events in the monthly report.

Sponsor of the column “Bitcoin Industry in Numbers” — the global blockchain ecosystemBinance.

ForkLog assessed the likelihood of a new wave of selling pressure from large miners.

We explored the pros and cons of DAOs, and found whether decentralized governance models are an effective alternative to traditional companies.

In educational cards we explained what Arbitrum and arbitrage are, as well as explained where to track crypto prices, how the Fed’s rate affects Bitcoin’s price and how to buy digital gold.

In traditional digests we gathered the main weekly events in the areas of cybersecurity and artificial intelligence.

The blockchain technology remains one of the hottest trends among financial, governmental and commercial organisations worldwide. ForkLog offers an overview of the most interesting recent initiatives.

On July 4, in a live ForkLog LIVE, we discussed the prospects for the NFT segment. The guest was Alexey Chusov, founder of First NFT Agency.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!