Week in Review: Bitcoin Pizza Day celebrated by the community; Ledger acknowledges possible government access to wallet assets

The cryptocurrency community celebrated Bitcoin Pizza Day, Ledger CEO Pascal Gauthier acknowledged the possibility that authorities could access assets in a hardware wallet connected to Recover, Worldcoin by Sam Altman raised $115 million, and other events of the past week.

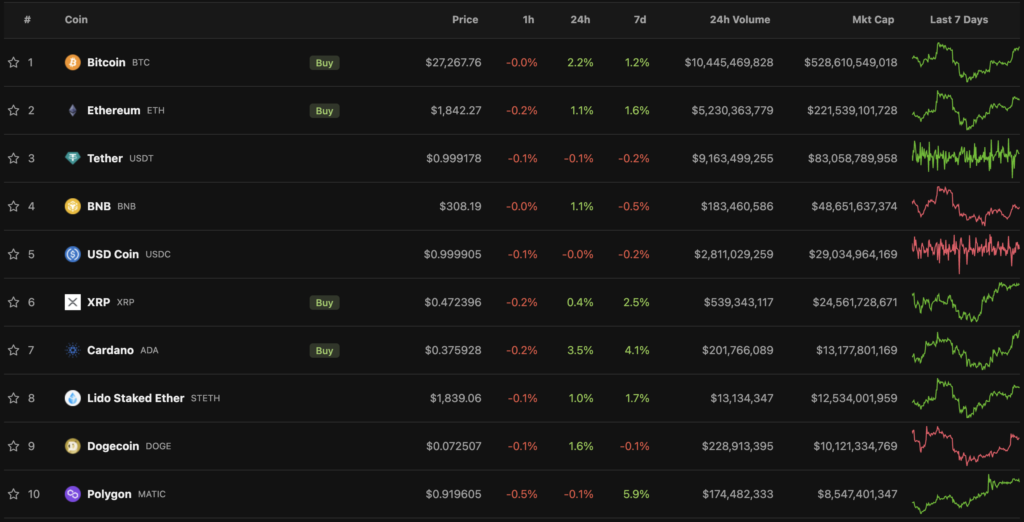

Bitcoin again tested above $27,000

Bitcoin started the week higher, but the trend was broken on Wednesday, and on Thursday the price fell below $26,000. By Sunday, prices had recovered. At the time of writing, the first cryptocurrency traded near $27,260.

Most digital assets in the top-10 by market cap closed the week in the green. The best performance was shown by the Polygon (MATIC) token, its price rising 4.1%.

The total cryptocurrency market capitalization stood at about $1.19 trillion. Bitcoin’s dominance index rose to 44.6%.

The cryptocurrency community celebrated Bitcoin Pizza Day

On May 22, the cryptocurrency community for the 13th time marked Bitcoin Pizza Day. The occasion marked a milestone for the industry: in 2010, programmer Laszlo Hanyecz bought two Papa John’s pizzas for 10,000 BTC. At the week’s start price they would have been worth about $267 million.

To mark the day, Binance handed out free pizzas, and Gate acquired 10,000 pizzas for 1.01 BTC (~$26,800 at the time of purchase).

Worldcoin by Sam Altman raised $115 million

The Tools for Humanity team, which includes the developers of Sam Altman’s Worldcoin, raised $115 million in a Series C round led by Blockchain Capital. Other investors included Andreessen Horowitz, Bain Capital Crypto and Distributed Global.

Ledger CEO acknowledged the possibility of government access to assets in the company’s hardware wallet

Authorities could access funds held in a Ledger wallet connected to the Recover key-recovery service via court order, confirmed Ledger CEO Pascal Gauthier, .

According to him, such a scenario is unlikely, and such government actions would be possible only in cases of serious grounds like terrorism or drugs.

The hardware wallet maker will accelerate the disclosure of the source code of the Recover service to dispel user concerns about asset security after widespread criticism of the new seed phrase recovery feature.

Amid Recover criticism from the community, sales of devices from competitor Trezor rose by 900% in a week.

Binance added NFT-collateralized lending

The Binance exchange’s NFT marketplace integrated a feature for borrowing cryptocurrency against non-fungible tokens.

At launch, eligible collateral includes digital assets from premium collections Bored Ape Yacht Club, Mutant Ape Yacht Club, Azuki and Doodles. For now, you can borrow Ethereum only against NFTs.

What to discuss with friends?

- An American woman found her husband’s stash of 12 BTC during a divorce.

- Another solo miner earned $177 000 from mining a Bitcoin block.

- The High Court of Montenegro denied Do Kwon bail.

- Elliptic: shipments of opioids from China to the US are paid for in Bitcoin.

Changpeng Zhao sees bullish market signals thanks to Chinese television

A crypto-related CCTV report on China’s Central Television sparked chatter in local communities, noted Binance CEO Changpeng Zhao. He said that historically such reports have triggered bullish rallies.

The report discussed licensing platforms for trading digital assets in Hong Kong. In the footage, journalists showed a device resembling a Bitcoin ATM with the Bitcoin logo and a buy option in the menu. Elsewhere, the acronym NFT appeared.

Elon Musk urged not to rely too heavily on Dogecoin

Elon Musk advised investors not to make “not to make too big bets” on the meme cryptocurrency Dogecoin (DOGE) and not to invest all their money in the asset.

He said that DOGE remains his favourite cryptocurrency. The billionaire says the coin is best among other digital assets because it has “great humor” and “dogs.”

Multichain cross-chain protocol token collapsed due to network hiccups

Users of the Multichain (MULTI) cross-chain protocol began complaining about transactions stuck in the blockchain due to an error during the network upgrade.

The issue emerged on May 21. The project team said the difficulties arose during technical work on the cross-chain routers’ nodes. Over the week, MULTI fell by more than 50%.

The project pledged to compensate users who suffered losses from the “force majeure.” At the same time, Binance temporarily suspended deposits in 10 tokens used in protocol operations.

Hotbit exchange announced closure

The cryptocurrency exchange Hotbit announced it is ceasing operations after five years. All users were asked to withdraw funds by June 21. One reason given by the team was “deteriorating operating conditions.”

STEPN developers enabled payments via Apple Pay

The Move-to-Earn project STEPN added the option of direct Apple Pay payments for iOS device users. A project representative added that 30% of the tech giant’s fee is far from ideal, but the integration will allow more people to join the project.

Base mainnet details unveiled

The Base mainnet—the Coinbase Layer-2 solution—will launch after Bedrock is activated on the Optimism network. The update will introduce low fees, faster deposits, and a number of other changes.

As the mainnet launch approaches, talks of Base integration began in the DeFi community around Aave.

Also on ForkLog:

- Vitalik Buterin warned against overloading Ethereum’s consensus.

- Strike integrated USDT into its app from Tether.

- In the run-up to FTX’s restart, the exchange’s token rose nearly 30%.

- The BNB Chain team set the Luban hard fork date.

What else to read?

They discussed the concept of ethical AI and tried to understand whether it matters for building safe artificial intelligence.

In new educational cards, they explained how to unstake Ethereum and what the Fragment blockchain platform from the Telegram team is.

In traditional digests, the main weekly events occurred in cybersecurity and artificial intelligence.

The cryptocurrency industry is attracting an increasing number of institutional players. This is evident in infrastructure investments and the growing attention companies are giving to Bitcoin as an asset class. The most important events of the past weeks are in ForkLog’s review.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!