Week in review: bitcoin tops $105,000 as Ukraine shelves crypto regulation

Bitcoin broke above $105,000, Russia’s State Duma backed the digital ruble, Ukraine’s president pulled a crypto bill—and other highlights of the week.

Bitcoin climbs above $105,000

On May 12, the price of the leading cryptocurrency briefly rose to $105,700. The main catalyst was the US administration’s announcement of a 90-day “truce” in the trade war with China.

The asset failed to hold above $105,000 and, during pullbacks over the week, approached the psychological $100,000 level.

On Sunday evening, May 18, digital gold decisively broke back above $105,000.

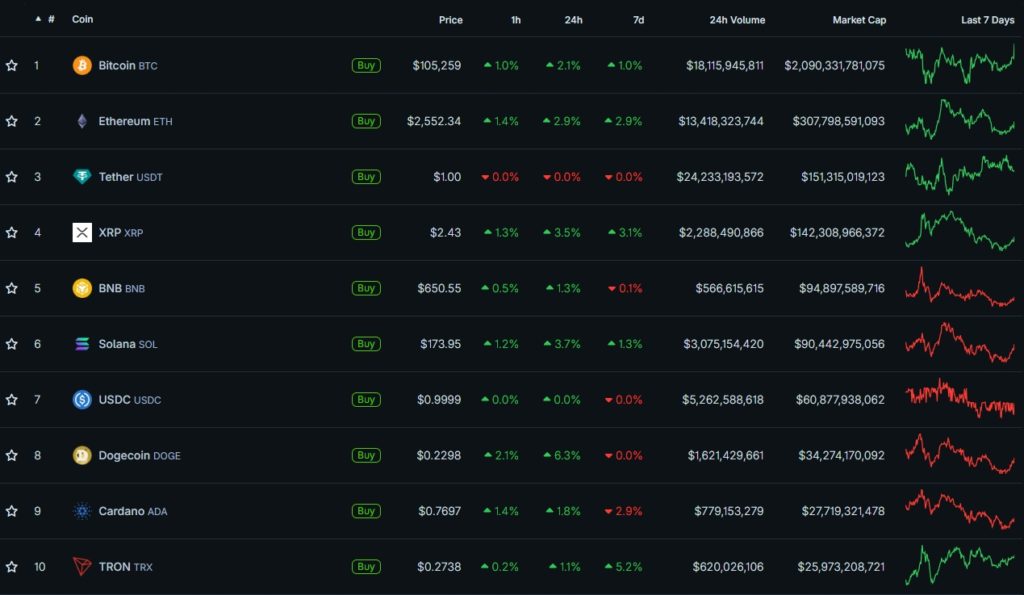

Over the past 24 hours bitcoin rose 2.1%, and 1% over the week.

A number of leading altcoins posted stronger moves alongside the flagship’s price action.

Dogecoin rose 6.3% in 24 hours, Solana 3.7%, and XRP 3.1%.

On a weekly basis, TRON led with a 5.2% gain.

The crypto fear-and-greed index has remained firmly in positive territory in recent days.

Crypto market capitalisation stands at $3.47 trillion; bitcoin’s dominance slipped to 59.9%.

Duma committee backs phased rollout of the digital ruble

A bill to phase the digital ruble into broad circulation won the support of the State Duma’s financial markets committee.

The lower house will consider the bill on May 20.

“Mass deployment of the digital ruble will take place after working through the details and holding consultations on the economic model that is most attractive for clients of institutions,” the Bank of Russia explained.

The regulator plans further expansion of the CBDC testing programme.

The central bank also tightened requirements for foreign digital rights (ИЦП) to access the market. A key criterion is the absence of the ability to block on the part of issuers, payment agents and controlling parties.

The directive takes effect on May 26, 2025. The Bank of Russia noted that only legal entities that are qualified investors will be able to purchase such rights.

What to discuss with friends?

- Altman spoke about AI habits of baby boomers and millennials.

- An expert suggested the emergence of “dark stablecoins”.

- The new Pope called AI a pressing issue for humanity.

- Experts explained how trade wars affect Bitcoin and Ethereum.

Zelensky pulls crypto bill from consideration

Ukraine’s Presidential Office blocked consideration of a bill to regulate cryptocurrencies in the country.

The document was removed from the Verkhovna Rada’s agenda indefinitely by order of the head of state, MP Yaroslav Zheleznyak said.

He argued the decision was influenced by the position of Ruslan Magomedov, chair of the National Securities and Stock Market Commission.

Among the objections were non-compliance with MiCA and the lack of coordination of the text with regulators, law enforcement and foreign partners.

Zheleznyak called Magomedov’s arguments “manipulation”.

Coinbase to become the first crypto firm in the S&P 500

From May 19, Coinbase shares will join the S&P 500, replacing Discover Financial Services.

Trading in the exchange’s shares began on Nasdaq in April 2021 at $381.

On the news, the stock rose to $207.22, still below December’s peak of $343. The week closed at $244, valuing the company at $67.8 billion.

According to Bernstein analysts, new demand for Coinbase shares after their inclusion in the S&P 500 could reach about $9 billion. VanEck’s head of digital-asset research, Matthew Sigel, offered a similar forecast—around $10 billion.

Meanwhile, the exchange reported theft of user funds through the bribery of overseas support staff. According to the statement, the leak affected no more than 1% of clients. The attackers obtained users’ names, addresses and email addresses, but not passwords or private keys.

Coinbase refused to pay the $20 million ransom demanded by the hackers and took steps to strengthen security. The exchange estimated the costs of resolving the incident and compensating users at $180–400 million.

According to Bloomberg, Binance and Kraken were also subjected to similar social-engineering attacks. Internal policies and technology allowed the platforms to repel them.

Also on ForkLog:

- The BIS estimated crypto turnover in global trade flows.

- Solana’s founder proposed a meta-blockchain concept.

- Yuga Labs sold the rights to the CryptoPunks NFT series.

- Ethereum announced “trillion-dollar security”.

Tornado Cash developer Roman Storm to be charged in the US

The US Department of Justice intends to bring criminal charges against Tornado Cash developer and co-founder Roman Storm.

Federal prosecutors allege the programmer conspired to launder money, evade sanctions and operate an unlicensed money-transmitting business via Tornado Cash.

One count related to operating an unlicensed money-transmitting business was dropped.

Proceedings against Storm continue despite an internal memo circulated last month about a change in the DOJ’s approach to cases involving crypto-mixing services.

What else to read?

We examined a new segment of AI-based games, testing five apps that use AI algorithms and large language models.

We spoke with Ray Youssef, founder of the P2P platform NoOnes, about the impact of institutional capital on the industry and preserving crypto’s original spirit of freedom.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!