Week in review: CommEX announces its first airdrop; Solana climbs above $115

The price of the leading cryptocurrency again tested $44,000, Bitcoin mining difficulty reached a fresh high, CommEX announced its first airdrop, Saga smartphones were resold as part of the week’s events.

Bitcoin fails to hold above $44,000

Beginning the week at $42,000, on Wednesday the first cryptocurrency tested the $44,000 level, but could not hold it.

As of writing, the digital gold is trading at $43,600.

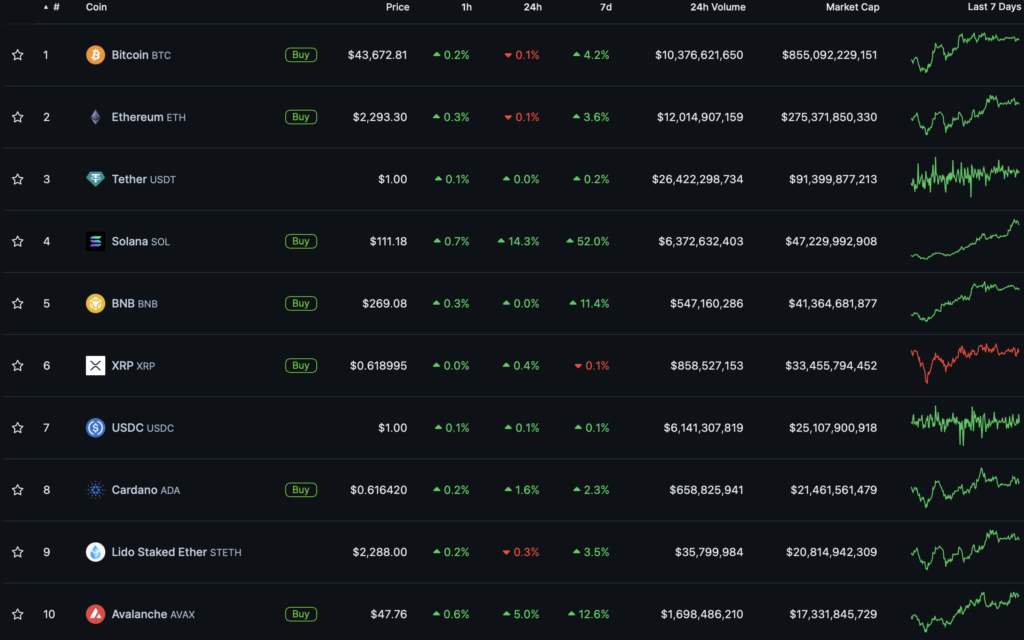

Most of the top-10 by market cap finished the week in the green. Solana (SOL) up 52%.

The total market capitalization of the crypto market is $1.75 trillion. Bitcoin’s dominance index is 52.3%.

Bitcoin mining difficulty hits new high

As a result of another recalculation mining difficulty increased by 7%. The metric reached a new high at 72.01 TH/s.

The average hash rate for the period since the previous change was 512.55 EH/s. The inter-block interval was under 9.5 minutes.

CommEX announces its first airdrop

The cryptocurrency exchange CommEX launched a loyalty program and announced the start of its first airdrop. By December 27, one million bonus points will be distributed among active traders.

For participation, the trade volume on Simple Futures must exceed 100 USDT.

Other verified users will also be eligible for the same prize pool. In addition, an extra 200,000 points will be awarded to CommEX clients from Russia who complete a set of tasks. These include registering a new account, passing verification, or making trades worth more than 100 USDT on the P2P platform, on spot or futures markets.

The airdrop ends at 23:59 UTC on December 27 (02:59 MSK on December 28).

What to discuss with friends?

- The token of a project involving Vitalik Buterin’s mother rose 25% in a day.

- Michael Saylor: Bitcoin will fall to zero or rise to $1 million.

- In Russia a neural network “Comrade Major” was created to deanonymize Telegram channel authors.

- Shiba Inu will get its own domain name.

Speculators begin reselling Saga smartphones for $5,000

Web3-smartphones Saga from Solana began selling on eBay at prices above $2000 due to the BONK meme-coin airdrop hype.

Some devices sold for even more — two phones went for $5,000, another was bought for $3,361. Saga phone sales surged more than tenfold after traders found an arbitrage opportunity.

Saga holders receive a guaranteed 30 million BONK airdrop. Given the recent rise of the coin, their value more than offsets the smartphone. At peak asset values, users earned around $900 in the meme cryptocurrency for a $599 device.

Later the team had to cancel some orders for Saga due to “supply issues” with a third-party distributor. Amid rising demand, the US and EU stock of 20,000 devices was sold out. There is no quick way to replenish it.

FTX proposes a plan to return funds to customers

FTX filed an amended restructuring plan, under which assets will be valued at the rate on the filing date — November 11, 2022.

On that day Bitcoin traded around $17,000. In early November 2022, the FTT token was valued at about $26, whereas now — around $3.8.

The plan states that creditors belonging to certain classes will be able to vote on the changes. In the authors’ view, the approach they propose “reflects a multitude of compromises to create a better, fairer and more economical outcome”.

One creditor noted that the new restructuring plan contradicts the Terms of Service of FTX, which state that digital assets are users’ property.

Voting on the plan is expected in 2024.

Also it became known that from August to October FTX spent more than $118 million on legal and consulting services. Thus expenses amounted to $1.3 million per day or $53,000 per hour.

The largest bill was from Alvarez and Marshall ($35.8 million over three months). Sullivan and Cromwell billed $31.8 million for their work at an average hourly rate of $1,230.

According to some estimates, the total amount of costs paid since the start of the FTX bankruptcy case stands at around $350 million.

Also on ForkLog:

- Experts named the main driver of the rally in the crypto market.

- The Ordinals boom pushed Bitcoin fees to record highs.

- Anthony Pompliano: ETF won’t double the price of Bitcoin overnight.

- CoinGecko: in the course of 50 largest airdrops tokens were distributed worth $26.6 billion.

Namada developers announce testnet and airdrop

The Cosmos ecosystem level-1 Namada blockchain announced the launch of a public testnet, participants will receive the right to a 30 million NAM airdrop (3% of total issuance).

Namada Shielded Expedition is the final stage before the main protocol launch. As part of testing, users will play a role-playing blockchain game to test the resilience of the CometBFT consensus algorithm.

Testnet testers will compete in a “mining on asteroids” race, where they must farm ROID coins. Based on the results, a leaderboard will be drawn, and those at the top will receive the NAM airdrop, equivalent to the earned tokens.

In addition to the testnet participant airdrop, Namada allocated 65 million NAM (6.5% of total token supply) to developers of decentralized apps and to Cosmos Hub and Osmosis participants.

What else to read?

This week ForkLog explained what the Fear and Greed Index is in cryptocurrencies.

In the traditional digest, we gathered the week’s main cybersecurity events.

The crypto industry continues to attract more institutional players. This is reflected in new investments in infrastructure and the growing attention companies pay to Bitcoin as an asset class. The most important events of recent weeks are in ForkLog’s review.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!