Week in Review: Crypto firms sever ties with Silvergate as Ethereum team pins down a tentative Shanghai activation date

Cryptocurrency firms severed ties with Silvergate Bank amid rumors of its insolvency, Bitcoin traded below $22,000, the Ethereum team pinned down a tentative Shanghai activation date on the mainnet, and other events from the past week.

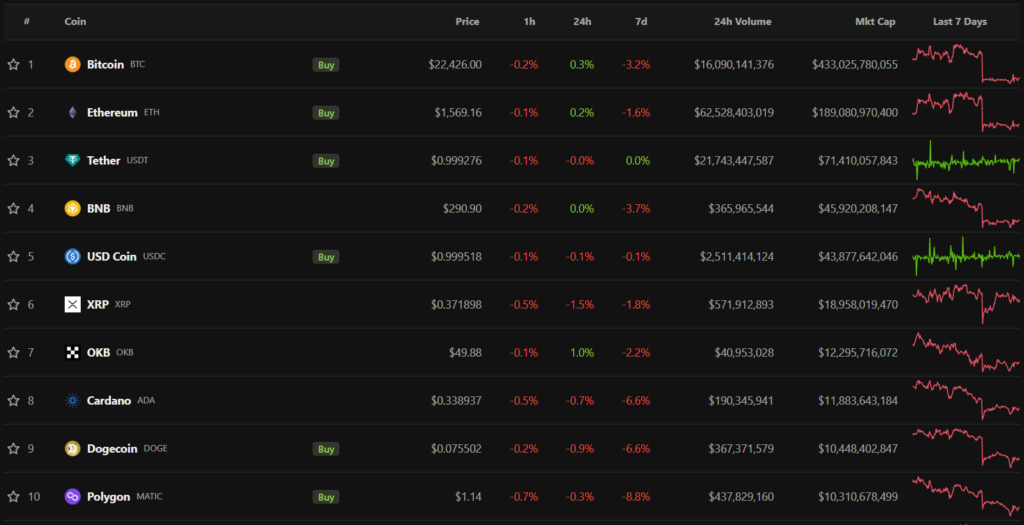

Bitcoin price tests below $22,000

In the night of March 3, the price of the first cryptocurrency briefly dipped below $22,000, shedding 4.5% in 24 hours. By week’s end the rate had modestly recovered — as of writing, digital gold was trading near $22,420.

Over the week, all top-10 cryptocurrencies by market cap finished in the red. The worst performer was Polygon’s native token, MATIC, which fell 8.8%.

The total market capitalization stood at $1.01 trillion. Bitcoin’s dominance index remained unchanged at 40.2%.

Coinbase announced the halting of BUSD trading and severed ties with Silvergate Bank, along with other major players

From March 13, 2023, the American cryptocurrency exchange Coinbase will halt trading of the stablecoin Binance USD (BUSD). The market capitalization of BUSD fell below $10 billion.

LedgerX, the FTX Group’s cryptocurrency derivatives platform, reported on February 28 that it had ended its cooperation with Silvergate Bank. The next day Coinbase issued a similar statement.

On March 2, Silvergate Capital Corporation’s market capitalization plunged by more than 50% amid reports that its annual report to the U.S. Securities and Exchange Commission would be delayed. Speculation within the community spread about insolvency and a possible Wells Fargo takeover of its assets.

Subsequently, major industry players backed the move to discontinue ties with Silvergate. Among them were were Circle, Paxos, Crypto.com, Gemini, Bitstamp, Bakkt, CBOE and Galaxy Digital. Some, such as Tether and MicroStrategy, denied any association with the company.

The Ethereum team implemented the Shapella hard fork on the Sepolia testnet and approved the Goerli upgrade date

On February 28, Ethereum developers successfully carried out the Shanghai-Capella (Shapella) upgrade on the Sepolia testnet and approved the Goerli upgrade for March 14.

Goerli will be the last testnet before the upgrade goes live on the mainnet. According to lead developer Tim Beiko, this will occur around mid-April.

This week the Ethereum team activated the ERC-4337 standard, which implements the concept of account abstraction. ERC-4337 allows turning user wallets into smart-contract accounts to make Ethereum addresses more user-friendly and remove the key-person risk — losing keys.

Forbes points to Binance practices reminiscent of “FTX maneuvers”

In late 2022, Binance moved about $1.78 billion in USDC stablecoins issued on the BNB Beacon Chain and BNB Smart Chain to Cumberland, Alameda, and other market makers “for undisclosed purposes,” stated Forbes.

Binance.US CEO Patrick Hillman noted that moving billions of digital assets between wallets is normal business practice for the exchange. The founder of the company, Changpeng Zhao stated that he was very reluctant to spend time on yet another FUD piece filled with accusations, distorted facts, and mentioning his ethnicity as a significant factor.

Later, members of the U.S. Senate Banking Committee sent Binance a letter requesting detailed information on KYC/AML policies and anti-money-laundering procedures. They accused the platform of regulatory evasion and ties to criminals, calling it “a hub for illicit financial activity”.

Unity adds blockchain-based SDK tools to its store

The Unity game development platform added 13 new Web3-based SDKs to its Unity Asset Store.

The new section “Decentralization” includes tools from Algorand, Aptos, Flow, Dapper Labs, Immutable X, MetaMask, Solana and Tezos. The functionality will allow game developers to integrate blockchain technologies such as NFTs and metaverses into their products.

SEC intensifies pressure on the industry

In December 2022, the SEC issued a subpoena to Robinhood regarding the platform’s cryptocurrency services, according to the online broker’s annual report.

The Commission also accused former FTX CTO Nishad Singh of deceiving customers, orchestrating “a series of fictitious transfers within a group of entities and creating fraudulent documentation for auditors.”

According to documents, Singh developed code that allowed the affiliated Alameda Research to access FTX users’ funds. The court hearing this week showed that Alameda’s total borrowings from the exchange amounted to amounted to $9.3 billion. At the same time, FTX assets are valued at $2.2 billion, of which only $694 million is liquid.

In the March 2 hearing, the court noted the SEC’s position on selling Voyager Digital assets to Binance.US was ambiguous, and it demanded explanations from the agency.

Exchanges suspend hryvnia deposits and withdrawals for Ukrainian users

On March 2, crypto platforms reported a temporary halt of operations via hryvnia bank cards. Binance and Kuna and stated that this occurred amid intensified government crackdowns on illegal gambling.

In ForkLog UA’s commentary, Binance representatives noted that the platform’s P2P service remains operational.

Trezor accelerates hardware wallet production, and Trust Wallet adds Ledger support

Hardware wallet maker Trezor took control of chip production for the flagship Model T. The move aims to optimise device manufacturing and shorten the supply cycle from two years to a few months.

The Trust Wallet team implemented support for Ledger hardware wallets through a browser extension.

What to talk about with friends?

- Bybit halted USD bank transfers due to issues on a partner’s side.

- In Ukraine, a free educational course on cryptocurrencies started started.

- In TikTok, a video featuring the “Bitcoin fraudster number one” from Colombia went viral.

- In Bali, $284,000 in cryptocurrency was stolen from a Russian blogger.

App Store hosts Jack Dorsey’s Twitter alternative. TBD launches an LN unit

Bluesky — a decentralized alternative to Twitter, backed by co-founder and former CEO Jack Dorsey — appeared in the App Store for iOS. The app is available in beta testing by invitation only. According to reports, it has been downloaded about 2,000 times since February 17.

Bitcoin-focused subsidiary Block — TBD — announced the launch of a Lightning Network ecosystem development unit named s=.

Bitzlato warns of AML flags on Bitcoin withdrawals

Since March 1, Bitzlato users, whose infrastructure was seized by French prosecutors, have been able to begin partial withdrawals.

According to Anton Shkurenko, now a freelance consultant to Bitzlato, clients could access up to 50% of their Bitcoin balance, but more than half want to leave their funds and wait for the P2P platform’s launch.

At present, all assets on Bitzlato are marked by AML services as high risk.

In the UAE a free zone for crypto companies will be launched

The government of Ras Al Khaimah (RAK), one of the UAE emirates, plans to create a free zone for digital-asset companies. According to the statement, RAK Digital Assets Oasis will become a hub for unregulated activity by industry participants. The application window will open in Q2 2023.

Also on ForkLog:

- predicted Brad Garlinghouse that crypto firms would leave the United States.

- planned to hire 500 employees by mid-2023.

- The LaunchZone token devalued by 82% following a hack.

- Robinhood launched an iOS version of its crypto wallet for all users.

What else to read?

In a traditional analytical report they described the outflows of Ethereum and Bitcoin from centralized platforms, the OpenSea–Blur rivalry, improving market sentiment and the potential for further market recovery.

In a new exclusive feature we analyze why the FTX collapse is being compared to the 2008 crisis: we recall what preceded the Wall Street meltdown, how events unfolded in 2008 and 2022, and compare regulators’ responses and consequences for the participants.

The controversial Ordinals project is rapidly gaining traction, sparking heated debates in the community. We explained how the protocol affects Bitcoin’s blockchain.

At the end of February, ForkLog prepared its traditional calendar of key events for the coming month.

In traditional digests, the main events of the week in the fields of cybersecurity and artificial intelligence were compiled.

The cryptocurrency industry is drawing more institutional players. This is reflected in new investments in infrastructure and the growing attention companies pay to Bitcoin as an asset class. The most important events of the past weeks are in the ForkLog review.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!