Week in Review: Fed holds key rate, SBF found guilty

Bitcoin failed to hold above $35,000, Bitcoin mining difficulty rose to a fresh high, Fed kept the policy rate, MicroStrategy bought another 155 BTC, jurors found Samuel Bankman-Fried (SBF) guilty, and other events from the week.

Bitcoin fails to hold above $35,000

This week, the leading cryptocurrency traded mostly in a range between $34,000 and $35,000. On Wednesday, November 1, prices neared the $36,000 mark, but the next day they retraced back to the previous levels.

At the time of writing, Bitcoin was trading at around $34,800.

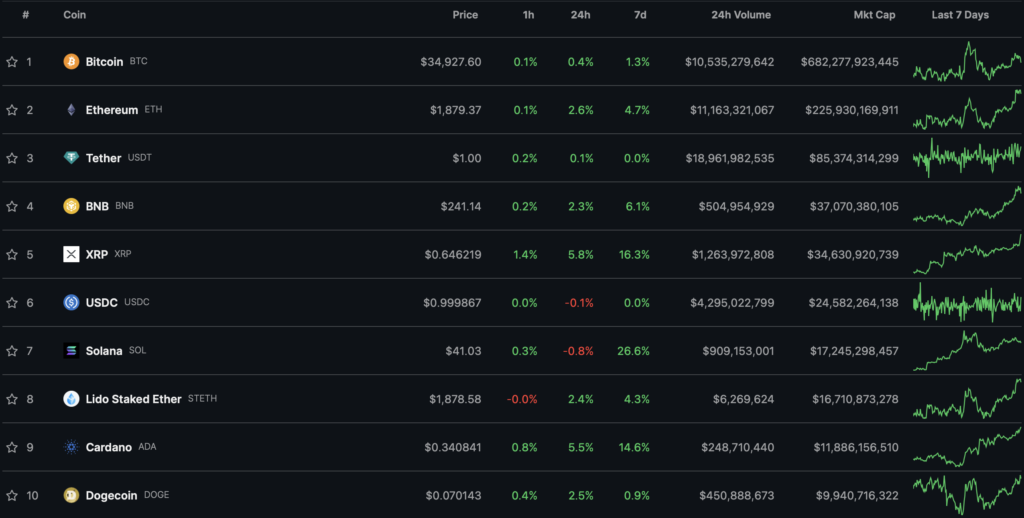

All assets in the top-10 by market capitalisation finished the week in the green. The biggest movers were Solana (+26.6%), XRP (+16.3%) and Cardano (+14.6%).

Total market capitalisation stands at $1.36 trillion. Bitcoin’s dominance index is 53%.

Bitcoin mining difficulty posts a fresh all-time high

Following the latest adjustment, mining difficulty rose by 2.35%, hitting a new record high at 62.4 T.

The average hash rate of the network rose to roughly 450 EH/s for the first time. The interval between blocks was under 9.5 minutes.

Fed holds the policy rate at 5.25–5.50%

On November 1 the Fed held the policy rate at 5.25–5.50% per annum. The decision was in line with market expectations. According to the Fed, inflation in the United States remains high, the unemployment rate is low, and economic activity continues to grow at a brisk pace.

What to talk about with friends?

- The TON blockchain set a world record for transaction speed.

- Another solo miner mined a Bitcoin block.

- 6,500 BTC came into motion after six years.

- CoinGecko reminded about the ‘Uptober’ effect on the crypto market.

Fifteen years since the Bitcoin white paper

On 31 October 2008, a person or group under the pseudonym Satoshi Nakamoto published the Bitcoin white paper. In the nine-page technical document, the concept of a peer-to-peer payment system is described, which later sparked a revolution in financial technology.

To this day, it remains unknown who lies behind the pseudonym of the creator of the first cryptocurrency.

The Bitcoin network launched in January 2009. Two years later, Satoshi Nakamoto disappeared, and the public has not managed to determine who authored the document underpinning the multi-billion-dollar industry.

MicroStrategy increases Bitcoin reserves to 158,400 BTC

In October, MicroStrategy bought 155 BTC for $5.3 million, bringing its bitcoin reserves to 158,400 BTC (about $5.6 billion).

According to the company’s Q3 financial report, total Bitcoin purchases during the period amounted to 6,067 BTC at an average price of $27,531.

Founder Michael Saylor notes that since the firm announced its Bitcoin investment on 10 August 2020, its shares have risen by 242%.

Bitcoin prices in that period have risen by 192%, while shares of tech giants like Google or Apple posted only double-digit gains.

Also on ForkLog:

- Worldcoin’s user base surpassed 1 million.

- The Fear and Greed Index reached a two-year high.

- The SEC launched an investigation into PayPal’s stablecoin.

- Marathon Digital launched a pilot Bitcoin mining project on garbage.

Jury finds Samuel Bankman-Fried guilty

On 2 November, jurors found FTX founder Samuel Bankman-Fried guilty on all charges. The final sentence by Judge Lewis Kaplan of the Southern District of New York is due on 28 March 2024.

Each count carries a maximum penalty of 5 to 20 years. In total, Bankman-Fried faces up to 115 years in prison.

WalletConnect restricts access for Russians

Web3-protocol WalletConnect, which allows connecting wallets such as MetaMask or Safe, announced a restriction on access for clients in Russia.

“In light of the latest legal notices and warnings from OFAC, WalletConnect has restricted protocol availability in Russia,” the project’s X account said.

The decision took effect on Monday, 30 October, and affected parts of Ukraine. According to the statement, service has since been restored.

What else to read?

This week, they explained what universal basic income, how the introduction of a spot ETF could affect Bitcoin’s price and why in the art market neural art is not accepted.

In the traditional digest, we summarised the week’s main cybersecurity developments.

The decentralised finance sector continues to attract heightened attention from crypto investors. ForkLog has gathered the most important events and news of recent weeks in the digest.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!