Week in Review: LocalBitcoins to Close, and Kraken to Pay $30 Million to the SEC

LocalBitcoins has announced it will cease operations, Kraken will restrict staking services for US clients, the Tron community has approved a new fee model, and other events of the week.

Bitcoin tests levels below $22,000

The latest interview with Jerome Powell, the head of the Fed, at the Economic Club of Washington triggered volatility in the crypto-asset market. After breaking above the $23,000 level on the night of February 8, the Bitcoin price began to correct. At the time of writing, the digital gold is trading near $22,000.

However, Glassnode noted that the Bitcoin market is undergoing a cyclical transition, which occurs amid a sharp shift in the balance of aggregate profits and losses.

On the daily chart moving averages (MA) formed the pattern “golden cross,” and on the weekly chart the “death cross” — precursors of bullish and bearish markets, respectively.

The last time a “golden cross” was observed was September 2021 — two months before Bitcoin reached its all-time high.

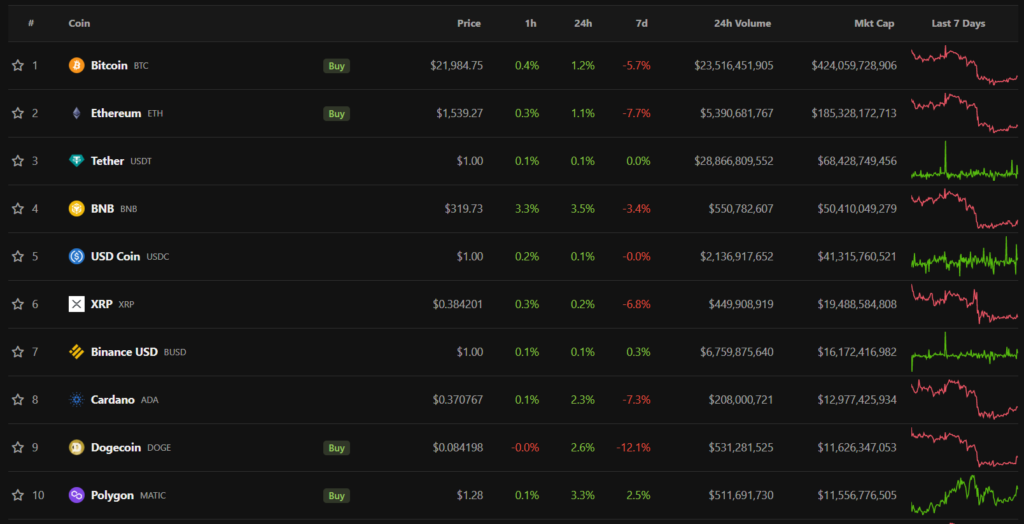

Nearly all top-10 assets by market cap closed the week in the red. The exception was the Polygon (MATIC) token. Its price rose 2.5%.

Total market capitalization of the crypto market stood at $1.07 trillion. Bitcoin’s dominance index fell to 39.5%.

LocalBitcoins Announces Closure

The popular P2P platform LocalBitcoins announced that it will cease operations. Company representatives said the decision was prompted by a protracted crypto winter.

From February 9, registration on LocalBitcoins was unavailable. Its wallets would operate only in withdrawal mode — users had 12 months to withdraw.

FTX Group sent closed letters to politicians demanding the return of donations previously received from former head of the exchange Sam Bankman-Fried. According to court documents, the amount could be about $93 million.

Tron community approves new fee model

On February 2 the Tron team proposed revising the fee calculation model. It envisages a mechanism for dynamic regulation of energy consumption in contracts, including to combat “low-value or fraudulent transactions.”

Because of this, on February 6 the Trust Wallet developers suspended withdrawals of USDT on the Tron network. The next day the update went out for Android, and another day later — for iOS.

Later in the week Binance revised the withdrawal-fee structure for Tron network assets, but subsequently, under community pressure, canceled the decision.

What about troubled companies?

Earlier in the week media reported that Holdnaut, a crypto-lending platform, and its claims against FTX were being considered for sale. Journalists reported that the process was at the negotiating stage with investors.

Digital Currency Group (DCG) and its Genesis subsidiaries, undergoing bankruptcy proceedings, reached a principled agreement on restructuring terms with major creditors. The deal envisages a gradual write-down of Genesis’s credit portfolio and the sale of insolvent entities.

According to FT, DCG began selling shares in some of the largest crypto funds under Grayscale Investments at a substantial discount.

Coin Cloud, which operates more than 4,000 Bitcoin ATMs in the US and Brazil, filed for bankruptcy. The Las Vegas-based company’s liabilities to around 10,000 counterparties are estimated at $100–500 million.

Voyager Digital users will recover part of their funds through Binance.US accounts in March. The customer onboarding period on the platform began last week. The final payout amount will depend on market conditions. The creditor holds a relatively high share of altcoins, which showed weaker price dynamics than BTC/ETH.

What to discuss with friends?

- A rehabilitation centre in Spain offered a course of treatment for crypto-trading addiction.

- A court in Russia found a participant in a P2P deal guilty of fraud.

- John Ray earned $690,000 over two months as the new CEO of FTX. Legal services will cost the company almost $20 million.

- Vitalik Buterin donated 99 ETH to earthquake victims in Turkey and Syria

Kraken closes staking services for US clients. The exchange will pay a $30 million penalty to the SEC

Kraken settled accusations brought by the US Securities and Exchange Commission (SEC). The regulator’s attention was drawn to the staking program, the offer and sale of which Kraken did not register.

Kraken did not admit or deny the charges, but agreed to shut down the staking program for US clients and pay a $30 million penalty. According to Dune Analytics, the exchange is among the top three Ethereum stakers, behind only Lido and Coinbase.

CEO Brian Armstrong opposed the ban on retail staking, calling it a “terrible path.”

This week SEC chief Gary Gensler called cryptocurrency regulation a priority for 2023 and urged industry participants to heed the Kraken case.

Binance introduces tax-calculation tool and halts USD transfers

Binance introduced a free service for calculating taxes and reporting — Binance Tax. The platform allows users to import their exchange transactions into the calculator to estimate potential tax payments.

Binance Tax is in an early launch phase and currently supports only some types of transactions. Moreover, access to the service has been granted only to residents of Canada and France.

Since February 8 Binance paused US dollar transfers due to a counterparty. According to the platform’s CEO Changpeng Zhao, the restrictions affected 0.01% of active users.

The exchange also updated the reserve verification procedure (Proof-of-Reserves) by including zk-SNARK. Currently available for verification are: BTC, ETH, BNB, USDT, BUSD, USDC, LTC, XRP, SOL, LINK, CHZ, DOT and SHIB.

Founder of 3AC to launch OPNX for trading claims

Co-founder of the collapsed hedge fund 3AC Su Zhu announced the opening of a waiting list for admission to the OPNX exchange. The platform will provide the ability to trade claims and derivatives on them.

Investors harmed by the collapse of centralized intermediaries will be able to swap stuck funds for cryptocurrency, or use them as collateral. The platform values the claims market at $20 billion.

Crypto firms will not advertise at the Super Bowl after the FTX crash

Unlike in 2022, the upcoming February 12 Super Bowl will not include crypto-related advertisements. This year four crypto companies expressed interest, but after the FTX crash the deals were not completed.

The previous year was remembered for record industry spending — Coinbase, FTX, Crypto.com, eToro and others, and a 30-second ad was priced at $6.5 million.

Uniswap community voted for deploying the protocol on BNB Chain

Despite resistance from major UNI stakeholders, Uniswap users supported the deployment of the third version of the decentralized exchange protocol on the BNB Chain.

Support for the relevant Plasma Labs proposal came from 65.89% of participants, while 33.57% opposed.

ChatGPT spurred the rise of AI crypto assets

Amid growing popularity of ChatGPT, the total market capitalization of tokens related to artificial intelligence and big data reached $5 billion. According to CoinMarketCap, from February 6 to 7 the price of major coins such as GRT, AGIX, FET and OCEAN rose by 20% or more.

This week Google invested $300 million in a competitor to ChatGPT and unveiled the Bard chatbot. Subscribe to the Telegram channel ForkLog AI to not miss news from the world of artificial intelligence.

Also on ForkLog:

- PayPal clients purchased cryptocurrency worth $604 million.

- The Optimism team announced the second airdrop of OP tokens.

- Joseph Lubin excluded Ethereum from being classified as a security in the United States.

- Tether in Q4 earned $700 million in net profit.

What else to read?

Traditional digests gather the week’s main events in cybersecurity and artificial intelligence.

The DeFi sector continues to attract heightened attention from crypto investors. ForkLog has assembled the most important events and news of recent weeks in this digest.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!