Week in Review: Telegram launches anonymous blockchain numbers, and 3AC founders summoned to court

The founders of hedge fund 3AC were summoned to court, Telegram launched anonymous blockchain numbers, and the head of Binance along with the former MicroStrategy CEO criticised Sam Bankman-Fried, among other events of the week.

Bitcoin back to $17,000

On Monday, December 5, the price of the leading cryptocurrency tested above $17,000. On December 8 it rose above this level again, and for the rest of the week traded in a relatively narrow range.

As of writing, Bitcoin is trading near $17,160.

The Galaxy Digital founder Mike Novogratz retained his forecast for Bitcoin to rise to $500,000. However, given significant changes in the macroeconomic environment, he believes this will take at least five years.

Standard Chartered envisaged Bitcoin dropping to $5,000 in 2023. The bank’s chief strategist Eric Robertson says investors will shift from the digital version of gold to its physical counterpart.

CEO of Euro Pacific Capital Peter Schiff predicted Bitcoin would fall below $5,000. He is convinced that the 70% correction is not the limit, and the FTX collapse will continue to shape market sentiment in the coming year.

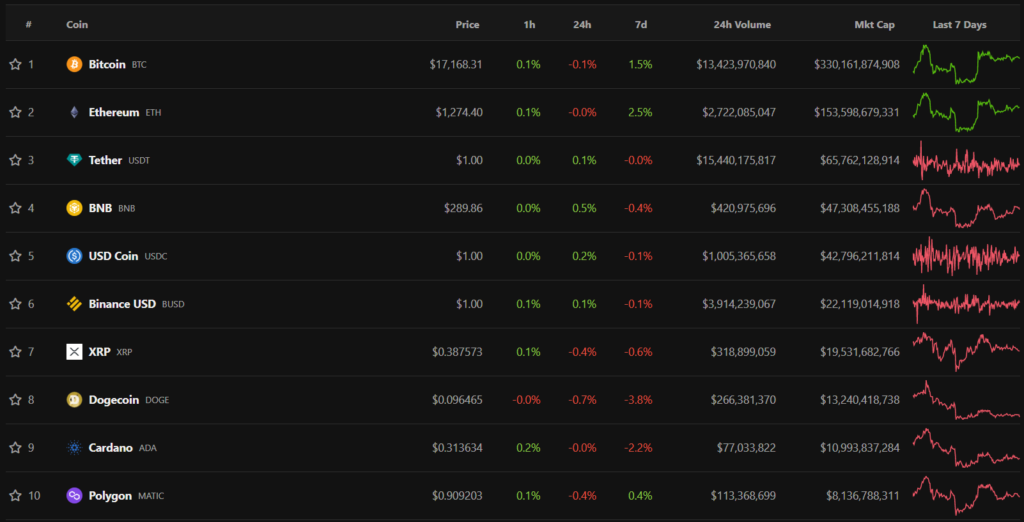

Top-10 cryptocurrencies by market capitalisation finished the week with mixed results. The best performers were Bitcoin (+1.5%) and Ethereum (+2.5%). The laggards were Dogecoin (-3.8%) and Cardano (-2.2%).

The total cryptocurrency market capitalisation rose to $892 billion. Bitcoin’s dominance index climbed to 37%.

“The Wolf of Wall Street,” the former American broker Jordan Belfort, advised investors to avoid altcoins and focus on Bitcoin and Ethereum. He compared the market to the dot-com bubble of the early 2000s and reminded that back then only a few firms such as Amazon prevailed, while 99% of investments in the sector went to waste.

Warning signs about the risk of wiping out the price of several popular crypto assets were raised by former hedge-fund manager and host of Mad Money Jim Cramer. He argues that, against the backdrop of a tighter Fed monetary stance, remaining in speculative assets is dangerous. He named Ripple (XRP), Cardano (ADA), Polygon (MATIC) and Dogecoin (DOGE), suggesting they could be completely devalued.

Changpeng Zhao and Michael Saylor unleash criticism on Sam Bankman-Fried

The Binance chief Changpeng Zhao called the founder and former CEO of the collapsed FTX, Sam Bankman-Fried, “one of the greatest fraudsters in history.” In a series of tweets he also refuted popular theses circulating in the community after the FTX meltdown, including involvement by Binance, the aim to “sink” a rival, and more.

Ex-MicroStrategy CEO Michael Saylor accused Bankman-Fried of “shitcoinery.” He also criticised the former FTX head for issuing loans from customers’ funds, and called the platform “unethical and illegal offshore venture” that was inflated by venture investors.

To Bankman-Fried’s defence, investor and Shark Tank star Kevin O’Leary, stated his innocence until proven guilty. It later emerged that O’Leary was not only a platform shareholder but also received $15 million as an ambassador. Nevertheless, his assets were also blocked on FTX.

Founders of Three Arrows Capital Su Zhu and Kyle Davies summoned to court

A federal bankruptcy judge approved subpoenas for the founders of Three Arrows Capital (3AC), Su Zhu and Kyle Davies. Creditors intend to locate additional assets of the crypto hedge fund.

The document requires the recipients to provide within two weeks all financial information about the companies, “including journals, documents, records and papers relating to the debtor’s property or counterparties.”

Earlier this week creditors of 3AC filed a request to sell the founders’ yacht for $30 million.

Telegram launches sales of anonymous numbers on Fragment

In the latest app update, Telegram added the ability to register an account without a SIM card, using anonymous blockchain-based numbers. They can be purchased with Toncoin (TON) on Fragment. These numbers start with +888, with prices ranging from $15 to $62,000.

Bankman-Fried dodges invitation to testify before US Congress

The former FTX CEO Sam Bankman-Fried (SBF) evaded a direct reply to Representative Maxine Waters’ invitation to testify at the hearing of the US House Financial Services Committee on December 13.

SBF said he would appear on Capitol Hill once he has finished “studying and considering what happened.” Crypto-community members expressed dissatisfaction with the former FTX chief’s response.

Waters again insisted on his appearance. She said the committee is ready to schedule additional hearings if new information emerges. After reports that Waters had no intention of subpoenaing SBF, she said the “subpoena is on the table” and explained that she seeks voluntary testimony from the former FTX head in the House.

At the end of the week SBF broke his silence and said he would appear at the December 13 hearing, noting that he has no access to information about the company.

Brian Armstrong rejects accounting flaws as a cause of the FTX collapse and allows Coinbase revenue to fall

The head of the American platform Coinbase, Brian Armstrong, is convinced that even the most naive person cannot believe that a multi-billion-dollar hole in FTX’s balance sheet was caused by an accounting error.

“These are customer funds that were used in his hedge fund, plain and simple,” — noted he said.

The Coinbase CEO also noted that, against the backdrop of FTX’s collapse and the crypto market crash, the company’s 2022 revenue could halve.

This week Coinbase launched an initiative to promote the USD Coin (USDC). The exchange scrapped the conversion fee for the rival USDT.

USDC is issued by the Centre consortium, which includes Coinbase and Circle. The latter this week rejected a move to go public via a SPAC deal.

G SushiSwap chief signals a “significant deficit” in the project’s treasury

Decentralised exchange SushiSwap faces a “significant deficit” that threatens its operations. To remedy the situation, the head Jared Grey proposed temporarily directing all fee revenue to the project treasury. Current funds would cover about a year and a half.

What to discuss with friends?

- In Nigeria, dissatisfied AAX customers beat up exchange staff.

- Ifecell and WhiteBIT facilitated offline cryptocurrency operations.

- Ledger unveiled the Stax device, designed by the architect of Apple’s iPod.

- Finico’s top executive Edward Sabirov was arrested in the UAE.

Media report increased claims against Genesis and lawsuit against Grayscale

The liabilities of crypto broker Genesis Global Capital reached $1.8 billion and are likely to grow. On December 3, the Financial Times reported that Gemini clients did not receive about $900 million from the OTC platform as part of the Earn lending program for Bitcoin.

Fir Tree Capital Management filed a lawsuit against Grayscale Investments seeking internal documents to assess potential conflicts of interest and mismanagement of GBTC. Additionally, the fund demands Grayscale resume the trust’s share repurchase program in light of the record 47% discount of the trust.

ConsenSys tightens MetaMask user data storage

In response to community criticism about collection of confidential user data in MetaMask, explained that it will reduce the retention period for IP identifiers and wallet addresses to seven days.

Bloomberg: LedgerX for sale

According to the agency, LedgerX, a regulated cryptocurrency derivatives exchange that used to be part of the FTX group, has been put up for sale. At least ten companies, including Blockchain.com, Gemini and Bitpanda, are said to have shown interest.

Binance paused withdrawals of some assets due to “abnormal” price moves

The Binance exchange paused withdrawals for a number of assets and limited some user accounts due to “abnormal price movements in certain trading pairs.”

“We are aware of abnormal price movements in certain trading pairs on Binance, including assets such as SUN, ARDR, OSMO, FUN and GLM. This activity is not tied to a hack or theft of API keys; funds are safe,” the exchange said.

According to Zhao, the investigation found the anomaly to be related to “market behaviour.” He added that Binance temporarily blocked withdrawals for accounts that “profited” from relevant trades.

Ethereum team targets Shanghai hard fork activation

The Ethereum plans to activate the Shanghai hard fork, aimed for roughly March 2023. The update includes EIP-4895, which will allow withdrawals of ETH from the Beacon Chain staking contract.

Also on ForkLog:

- Kim Kardashian and Floyd Mayweather won a court case over EthereumMax advertising.

- In Kazakhstan adopted a bill taxing miners.

- HashEx analysts warned of billions in risk for Ethereum stakers.

- Bitcoin mining difficulty fell by 7.32%.

What else to read?

The traditional report released on November’s key industry changes. It analysed the FTX meltdown, the subsequent capitulations by investors and miners, and a number of other metrics.

In traditional digests, the week’s main events in cybersecurity and and artificial intelligence were highlighted.

The crypto industry is attracting an increasing number of institutional players. That is evident from new infrastructure investments and growing attention to Bitcoin as an asset class. The most important events of the past weeks are in ForkLog’s review.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!