Week in review: the Fed cuts rates as the EU readies sanctions on Russia’s crypto business

Fed cuts rate; EU targets Russian crypto; Monero sees biggest reorg in 12 years.

The Fed cut its policy rate, the European Union will for the first time impose sanctions on Russian crypto platforms, Monero experienced its largest block reorganisation in 12 years, and other events of the week.

Bitcoin stuck in a range

The leading cryptocurrency started the week below $116,000 and ended it at roughly the same level.

Momentum tied to expectations for the Fed meeting pushed prices close to $118,000, but proved fleeting. The asset failed to hold its peak; some analysts suggested this may have been the top of the current cycle. They see a possible correction towards $90,000.

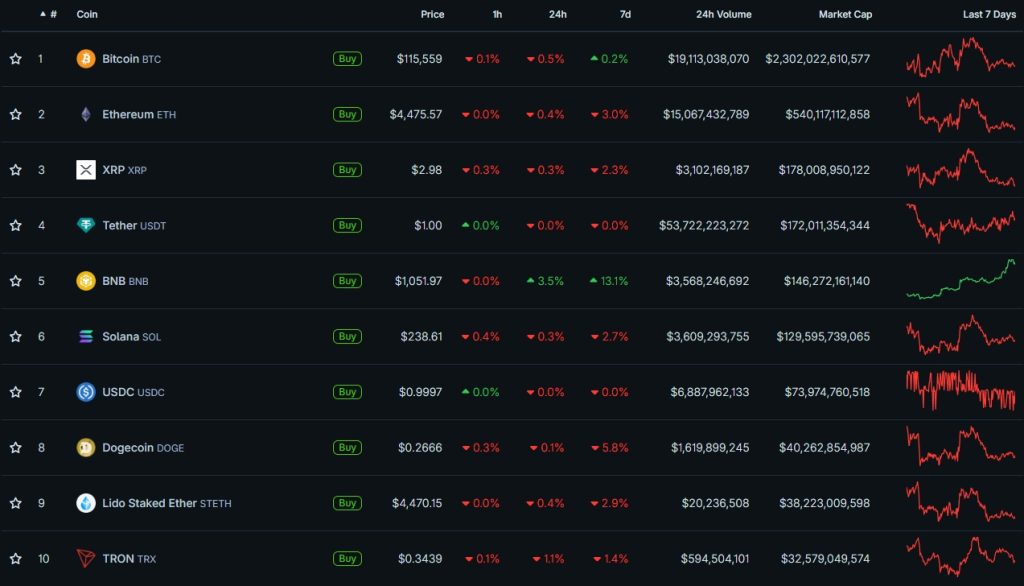

Most large-cap altcoins fared worse. Dogecoin fell 5.8% over the week; Ethereum slipped 3%; Solana declined 2.7%.

One exception was BNB, which set a fresh record above $1,000. The token rose more than 13% on the week. The rally was helped by reports of talks between Binance and the US Department of Justice that could allow the exchange to end independent monitoring of its operations years early. Yet CryptoQuant, analysing spot volumes, said the move has structural underpinnings rather than being a short-lived boom.

The crypto market’s capitalisation was little changed over the week, holding at $4.13 trillion, as did bitcoin’s dominance at 55.7%.

According to CoinMarketCap, the altseason index exceeded the threshold of 75, though it remains below the yearly high of 87.

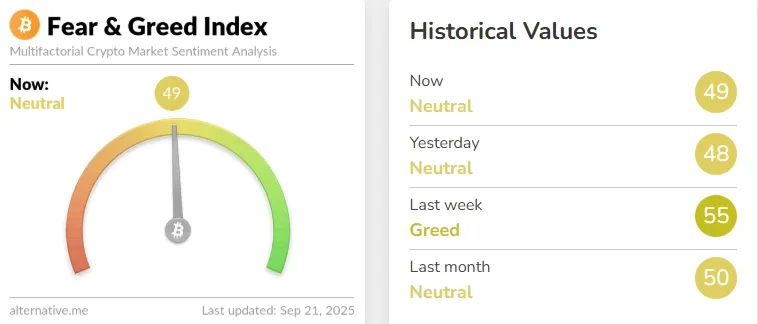

The crypto Fear & Greed Index stays in neutral territory at 49.

The Fed cuts its policy rate

On 17 September the Fed cut its key rate for the first time since December 2024 by 0.25%—to 4–4.25%. The outcome matched investors’ expectations.

“Recent data indicate a slowdown in economic activity in the first half. Job gains have moderated, and the unemployment rate has increased slightly while remaining low. Inflation has risen and remains elevated,” the statement said.

Conventional wisdom holds that lower rates favour risk assets such as bitcoin and other cryptocurrencies.

Fed chair Jerome Powell said the FOMC had not reached a consensus on further monetary easing.

“Ten of the 19 Committee members forecast two or more cuts to the policy rate by year-end, while nine forecast either fewer cuts or none,” he said.

What to discuss with friends?

- Solana’s founder warned about the reality of the quantum threat to Bitcoin.

- Vitalik Buterin explained the purpose of the queue to withdraw ETH from staking.

- In the Ethereum network, DYDX tokens worth $26 million “stuck”.

- Meta unveiled its first smart glasses with a display.

The EU to impose first sanctions on Russian crypto platforms

The European Commission announced it is preparing the 19th sanctions package against Russia. The measures will cover crypto platforms and transactions in digital assets.

“We are targeting the financial loopholes that Russia uses to circumvent sanctions. For the first time, our restrictive measures will extend to crypto platforms,” European Commission president Ursula von der Leyen said.

According to the statement, all cryptocurrency transactions for Russian residents will be blocked.

Foreign banks linked to Russia’s alternative payment systems and transactions with companies registered in special economic zones will also be restricted.

Monero suffers its largest block reorganisation in 12 years

The Monero network was rolled back by 18 blocks, invalidating 117 transactions.

The reorganisation began on 14 September at block #3,499,659, when the Quibic mining pool released a hidden chain that turned out to be longer than the main one. Network nodes automatically accepted it as valid, overwriting previous blocks.

A researcher under the nickname Rucknium confirmed the incident on GitHub. A crypto podcaster known as Xenu called it “the largest reorganisation in Monero’s history”.

Also on ForkLog:

- Ethereum marked three years since The Merge.

- Polkadot will set a 2.1bn cap on DOT supply.

- Ethereum developers approved the rollout schedule for Fusaka.

- In New York, the first quantum computer was installed.

Binance executive comments on amendments to Ukraine’s crypto bill

Kirill Khomyakov, head of regional markets at Binance for the CIS, Central and Eastern Europe and Africa, spoke about proposed changes to Ukraine’s crypto regulation bill.

Earlier this month, Ukraine’s Verkhovna Rada approved at first reading the bill “On Virtual Assets Markets”, which will define the status and taxation of cryptocurrencies in the country.

Speaking at the Binance Odesa Meetup, Khomyakov said the amendments intended to “make users’ lives easier” were submitted by Binance, other exchanges and the Ministry of Digital Transformation. He expects the bill to change significantly by the second reading.

The exchange’s proposals primarily concern the tax regime and the protection of clients’ data privacy, he added.

He also outlined some of the exchange’s plans in Ukraine, including streamlining interactions with banks and issuing a hryvnia card.

In Europe, Binance expects to obtain a MiCA licence by year-end.

Further reading

We unpacked the core ideas of the Virginia school—a post-war American strand of neoclassical economic theory. Its adherents argue for minimising state intervention in markets.

We examined the roadmap of the new Privacy Stewards for Ethereum (PSE) team within the Ethereum Foundation. The initiative focuses on bringing privacy to all layers of the network, up to and including applications.

In our weekly digest we rounded up the key events in cybersecurity.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!