Weekly Recap: Bitcoin’s Volatility, CZ’s Sentence, and Hong Kong’s BTC-ETF Launch

The leading cryptocurrency rebounded after a correction, Changpeng Zhao was sentenced to four months in prison, the Federal Reserve maintained its key rate, spot ETFs based on Bitcoin and Ethereum began trading in Hong Kong, and other events of the past week unfolded.

Bitcoin Returns to $64,000 Level

The leading cryptocurrency started the week at $64,000. On Tuesday, April 30, digital gold plunged below $60,000. The following day, Bitcoin fell past the $57,000 level before beginning to recover.

By Friday, May 3, the leading cryptocurrency had stabilized above the psychological level of $60,000 following a U.S. labor market report. The next day, digital gold soared to $63,000.

At the time of writing, Bitcoin is trading at $64,400.

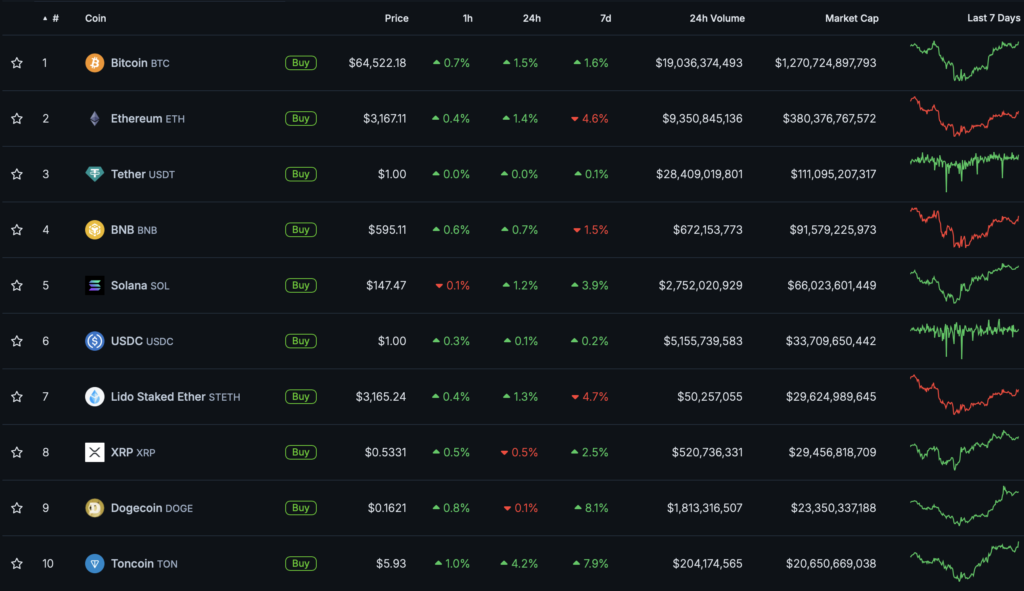

Most digital assets in the top 10 by market capitalization ended the week in the “green zone.” Exceptions were Ethereum (-4.6%) and BNB (-1.5%).

The total cryptocurrency market capitalization stands at $2.5 trillion. Bitcoin’s dominance index is 55%.

MicroStrategy Acquires 122 BTC and Announces Blockchain Identification Solution

Throughout April, MicroStrategy acquired an additional 122 BTC ($7.8 million), bringing its Bitcoin reserves to 214,400 BTC (~$13.5 billion).

A total of $7.54 billion was allocated for the purchase of crypto assets at an average rate of $35,180 per coin.

Since December 31, the company has acquired 25,250 BTC for $1.65 billion — at $65,232 per BTC. The trend of increasing reserves in digital gold by the corporation has continued for 14 consecutive quarters.

MicroStrategy plans to launch a decentralized identification protocol, MicroStrategy Orange, based on Bitcoin.

The solution stores and interacts with users’ personal information using unspent transaction outputs on the blockchain.

The company has not yet announced the launch timeline or application areas for the service.

Binance Founder Changpeng Zhao Sentenced to Four Months in Prison

A federal court in Seattle sentenced Binance founder Changpeng Zhao (CZ) to four months in prison on charges of money laundering and other illegal activities.

“I will serve my time, complete this chapter, and focus on the next chapter of my life (education). I will remain a passive investor in the crypto industry (and a hodler). The industry has entered a new era. Compliance is very important,” he wrote.

Prosecutors had sought a harsher sentence of 36 months in prison. During the hearings, CZ apologized and expressed his willingness to take full responsibility. Previously, he repented for “poor decisions.”

CoinDesk explained the “short sentence” by CZ’s reputation. The judge, lawyers, and even prosecutors acknowledged during the hearings that he was not a “typical defendant” in criminal cases. In their view, Zhao was a philanthropist who broke the law for the first time and a family man who surrendered to face the consequences.

Topics to Discuss with Friends

- A solo miner secured a Bitcoin block, earning $218,500.

- A trader lost $152,000 in half an hour due to insider trading.

- TON announced no plans to release a Web3 smartphone.

Federal Reserve Maintains Key Rate for Sixth Consecutive Time

On May 1, the U.S. Federal Reserve maintained the key rate range at 5.25–5.5% per annum. The decision matched market expectations.

According to CNN, JPMorgan and Goldman Sachs expect the first Fed rate cut in July, while Wells Fargo anticipates it in September. Bank of America analysts do not foresee a reduction until December.

Some Fed representatives, according to the publication, allowed for the possibility of a rate increase instead of a cut.

Spot Bitcoin and Ethereum ETFs Begin Trading in Hong Kong

On April 30, trading of six spot ETFs based on Bitcoin and Ethereum officially began on the Hong Kong Stock Exchange (HKEX).

Issuers included China Asset Management, Harvest Global, Bosera, and HashKey.

ChinaAMC reported that the subscription volume during the initial offering for its Bitcoin-based product was 950 million HKD ($121.4 million), and for the Ethereum-based product, 160 million HKD ($20.5 million).

HKEX representatives emphasized that the listing of the first exchange-traded fund on virtual assets in Asia strengthens the city’s position as a leading market in the region.

In the first quarter, the net inflow into the three previously launched Bitcoin futures ETFs amounted to 529 million HKD (~$67.6 million).

In addition to Hong Kong residents, the instruments are available to qualified non-resident investors after completing KYC. Mainland Chinese residents still cannot invest in the new product category.

Also on ForkLog:

- USDC surpassed USDT in monthly transactions.

- A trader lost $68 million due to address spoofing fraud.

- Roger Ver was arrested for tax evasion.

Willy Woo Predicts Bitcoin at $1 Million by 2035

By 2035, the “fair price” of the leading cryptocurrency will reach $1 million, according to analyst and CMCC Crest co-founder Willy Woo.

“This is if we take the user growth curve as a guide for valuation. Remember, I said fair, not peak price in a bull market hype,” he noted.

The expert recalled that in the early stages of development, digital gold did not even have a price until 1,000 users emerged. By August 2011, there were several trading platforms in the crypto industry for a proper Bitcoin valuation.

According to Woo, after 2012, the first cryptocurrency’s quotes were largely driven by user growth.

What Else to Read?

This week, ForkLog explained the purpose of liquid restaking tokens and how different protocols solve the Byzantine Generals problem.

In traditional digests, we compiled the week’s main events in the fields of cybersecurity and artificial intelligence.

The cryptocurrency industry is attracting an increasing number of institutional players. This is evidenced by new infrastructure investments and the growing attention companies are paying to Bitcoin as an asset class. The most important events of recent weeks are in ForkLog’s review.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!