Whales hoover up $360m of Ethereum on the dip

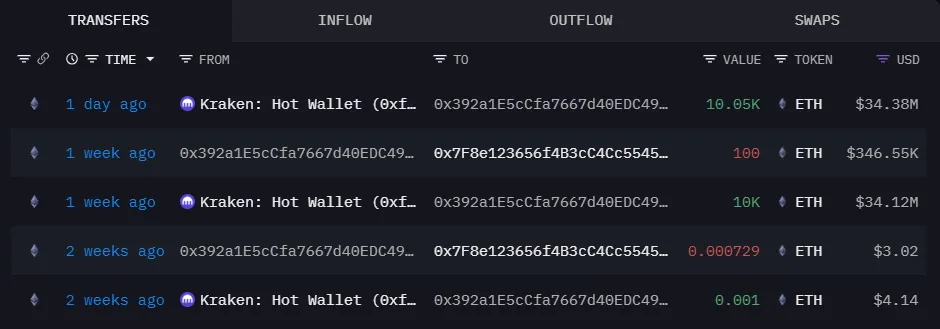

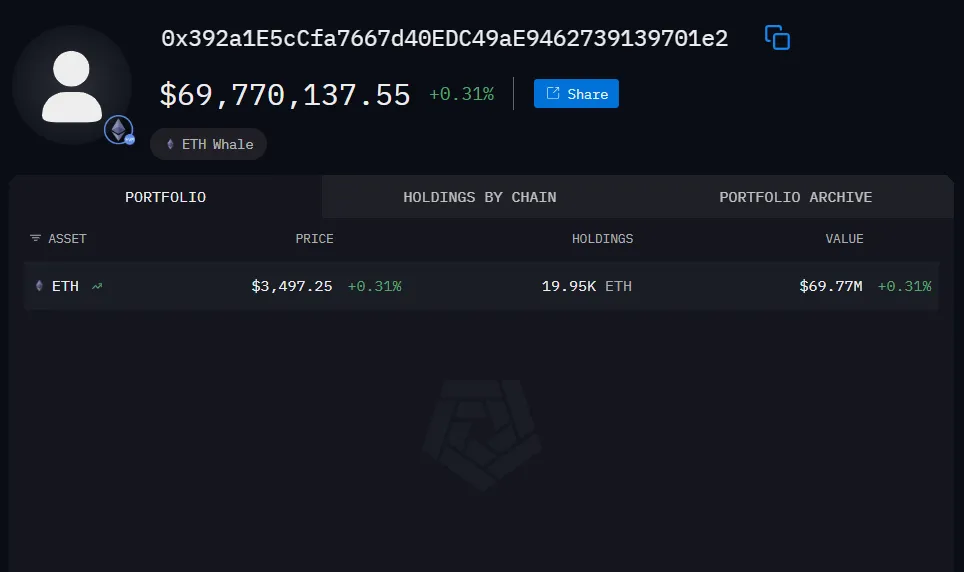

Whales bought $360m of ETH as prices fell; one address snapped up two 10,000-ETH tranches.

Over the past week, large investors bought more than $360m of Ethereum. As prices fell, one user twice bought 10,000 ETH.

The first $34m purchase was made on November 5. A second transaction lifted the investor’s exposure to about $70m.

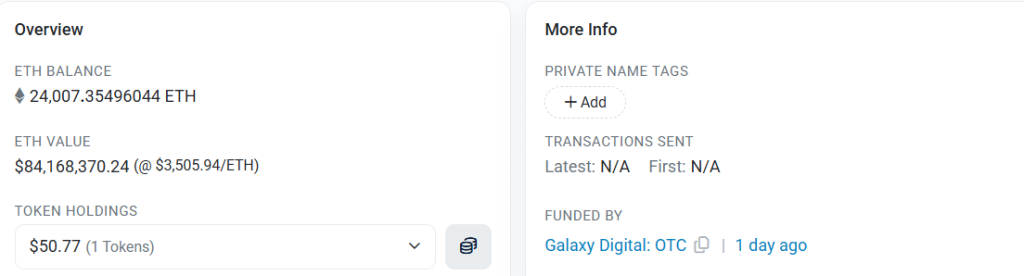

According to Etherscan, another whale acquired 24,007 ETH for $84m via Galaxy Digital’s over-the-counter platform.

The largest transaction was the purchase of 58,811 AaveETH worth $206m.

SynFutures CEO and co-founder Rachel Lin believes the scale and pace of the trades point to institutional investors rather than retail.

She says buyers are betting on medium-term gains and are ready to tolerate short-term volatility. They expect catalysts such as monetary-policy easing or the launch of new products for institutions.

Lin added that accumulation could continue if macroeconomic risks do not intensify.

At the time of writing, Ethereum trades around $3500, up 1% on the day.

Bitcoin whales

Over the same period, large holders of the digital gold accumulated more than 45,000 BTC. This was the second-largest weekly inflow in 2025, noted an analyst using the moniker caueconomy.

The Second Largest Whale Accumulation of 2025

“In the last week, whales accumulated more than 45,000 BTC, marking the second-largest weekly accumulation process in these wallets.” – By @caueconomy pic.twitter.com/Djjl6qdCiv

— CryptoQuant.com (@cryptoquant_com) November 12, 2025

According to the expert, record buying volumes were seen in March amid a market slump and high uncertainty.

Caueconomy argues that whales are again exploiting retail capitulation to absorb their coins.

Bitcoin is trading around $103,000 (-1.4% over 24 hours).

Derivatives market cools

An analyst using the pseudonym Darkfost noted that derivatives account for 70–80% of total trading volume.

Leverage Unwind Continues

“In bullish market phases, these periods often precede trend reversals, helping to clean up the market and allow it to rebuild on healthier foundations.” – By @Darkfost_Coc pic.twitter.com/Z6RGY0RnHx

— CryptoQuant.com (@cryptoquant_com) November 13, 2025

He argues that a highly leveraged market is unstable and prone to sharp volatility due to liquidations. After the October events, a de‑leveraging phase began.

Over the past three months, open interest (OI) has fallen by 21%, indicating fewer and smaller leveraged positions. For comparison, during corrections in September 2024 and April 2025, OI fell by 24% and 29%, respectively.

In the expert’s view, in bull phases such “clean-ups” often precede trend reversals, allowing the market to recover.

In November, Santiment specialists analysed the break in the four‑year correlation between bitcoin’s price and the stock market. They concluded the coin is undervalued.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!