When Will Bitcoin Rally Begin? An Analysis of Indicator Data and Expert Opinions

On October 25, Bitcoin’s price suddenly broke out of the grip of a protracted flat, surpassing the $20,000 level. Many market participants likely asked themselves: is this a genuine reversal, or a coming “fake-out”?

ForkLog analysed the most relevant on-chain indicators, gathered interesting opinions and determined when to expect the recovery in Bitcoin’s price.

- Policy Fed policy continues to exert pressure on markets, including the crypto market. However, correlation is gradually weakening, so a break in the statistical link between Bitcoin and traditional risk assets cannot be ruled out.

- Many on-chain indicators signal that the bear phase has bottomed. Some of them have been in the oversold zone for several months.

- Among optimistically inclined experts, the forecast for an active market recovery before the end of 2022 prevails.

Fundamental factors of the coming rally

Relation to traditional markets

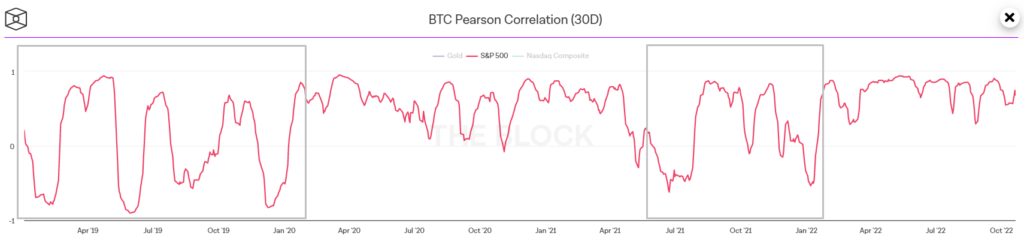

There used to be a view of Bitcoin as a safe-haven asset. Indeed, up to January 2020 and through a relatively buoyant 2021, Bitcoin often showed a negative correlation with the “barometer of the US economy” — the S&P 500.

At the start of 2022, the Federal Reserve began a rapid cycle of rate hikes. The policy of “expensive money” aimed at reducing inflation placed substantial pressure on global markets.

Bitcoin was not an exception — since the start of the year its price had fallen by 56%, and from its historical high around $69,000 by about 70%. S&P 500 quotes also declined by more than 20% in 2022.

Against the backdrop of a tighter US monetary policy, investors began viewing digital gold more as a risky asset, alongside equities and commodities. Many sought to “cash out,” while some saw a safe haven in high‑quality bonds and in precious metals.

In the third quarter the situation changed somewhat: Bitcoin fell by only 1%, showing the strongest performance relative to fiat currencies (excluding the US dollar), major stock indices, gold and oil.

According to CoinGecko analysts, the correlation of the crypto market with the S&P 500 has slightly decreased—from 0.92 to 0.85. LookIntoBitcoin suggested that Bitcoin could break away from traditional risky assets. This could happen as investors realise that most threats come from governments and fiat currencies.

Another positive note: Tesla, in its Q3 earnings report, reported that it continues to hold Bitcoin on its balance sheet, worth $218 million.

Eight Global founder Michaël van de Poppe sees this as a powerful signal.

🔥 — BREAKING: $TSLA didn’t sell their $BTC in Q3 2022 and still hold 11,000 #Bitcoin

You should hold too.

— Michaël van de Poppe (@CryptoMichNL) October 19, 2022

In his view, if the largest EV maker is not rushing to sell digital gold, other market participants should likewise stay calm.

On‑chain analysis

Many indicators signal that the bear market has bottomed.

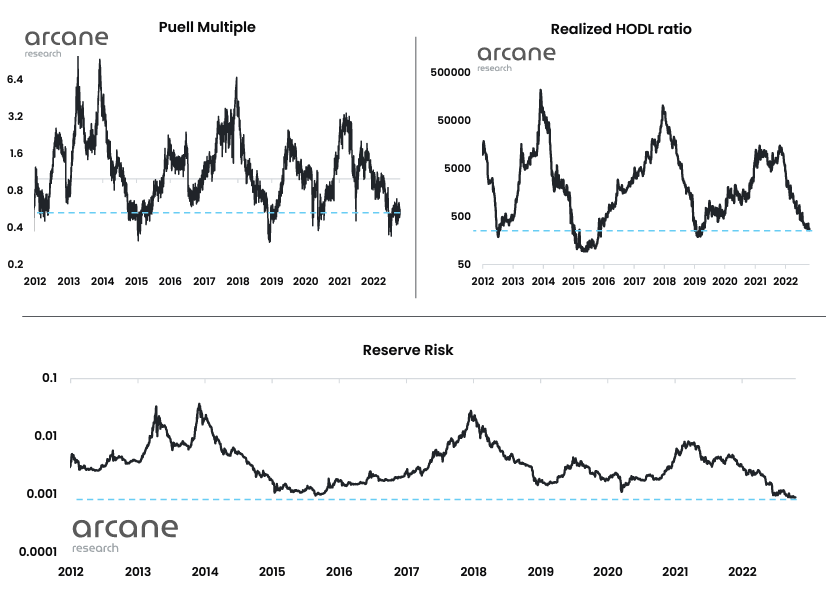

As early as July, Puell multiple fell to levels seen in mid‑December 2018, when Bitcoin traded just above $7,000.

Similarly, the long-term RHODL Ratio indicator shows current values that align with the start of 2019 — the bear bottom of the previous market cycle.

The Reserve Risk indicator has reached the lowest readings in the entire history of observations. This implies that long-term investors have little incentive to sell digital gold.

«Low Reserve Risk values indicate that coins are accumulating (hodlers hodl) despite falling prices», explained Arcane Research.

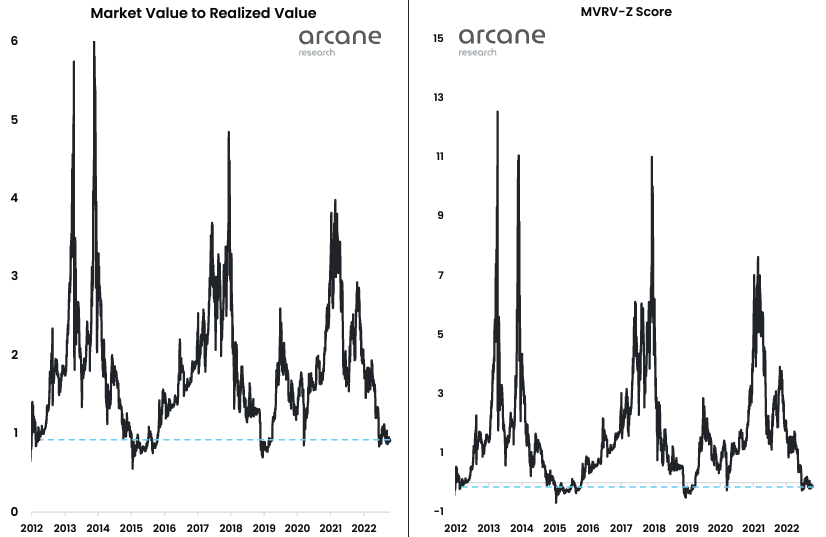

MVRV indicates that Bitcoin’s realized capitalization is higher than its market capitalization. Earlier, similarly low readings of the indicator coincided with the extremes of previous bear phases.

Researchers argue that the current indicator levels “show a very attractive entry point for investors ready for a new wave of Bitcoin strength.”

Another important on‑chain factor is the total amount of Bitcoin and digital gold held on wallets of long‑term crypto investors that has not moved in the last six months has reached a five‑year high. reached a five‑year high.

The rise in the metric implies a reduction in the active circulating supply of Bitcoin. This bodes well for the price if demand remains growing or steady.

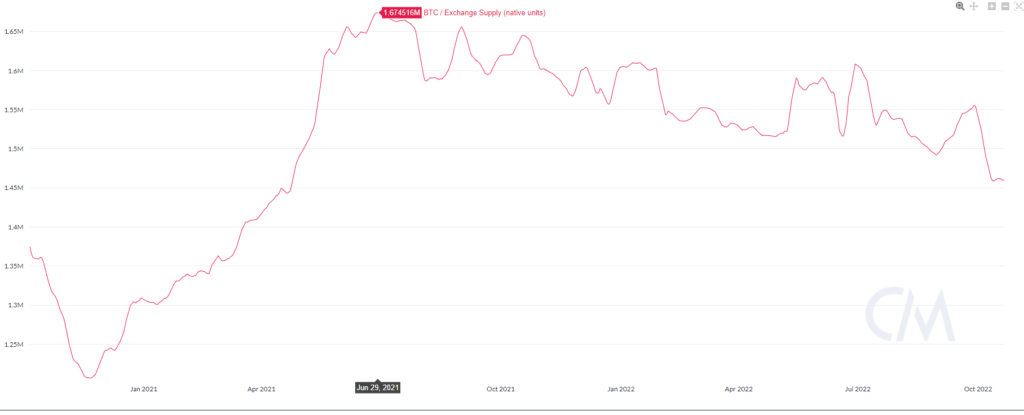

Against the backdrop of the metric above, Bitcoin balances on centralized exchanges have been shrinking. A persistent downtrend has been evident since June 2021, pointing to diminished bearish pressure on the asset’s price.

In addition, the inactive supply that has not moved for the last six months is at a historical low (18.12%).

#Bitcoin supply that was moved in the last 6-months is approaching all-time-lows, currently at 18.12% of circulating supply (3.485M $BTC).

Historically, very low volumes of mobile supply typically occur after prolonged bear markets.

Dashboard: https://t.co/KYdlMcwDv6 pic.twitter.com/rXIu2sukU9

— glassnode (@glassnode) October 18, 2022

«Historically, very low volumes of mobile supply typically occur after prolonged bear markets», explained Glassnode.

One might think nothing stands in the way of a rally — Bitcoin is deeply oversold, active supply is shrinking, hodlers remain true to their strategy. Yet a serious obstacle remains — market sentiment.

The Crypto Fear and Greed index has signalled anxious sentiment for over a month.

Analysts at QryptoQuant noted the continuation of the bear trend.

In their assessment, Bitcoin buyers since December 2020 are now in the red. Consequently, the long‑term SOPR is unlikely to resume an uptrend in the near term.

On the other hand, the current situation presents a potentially favorable period for buying digital gold for the long term. For example, using the dollar‑cost averaging strategy (DCA).

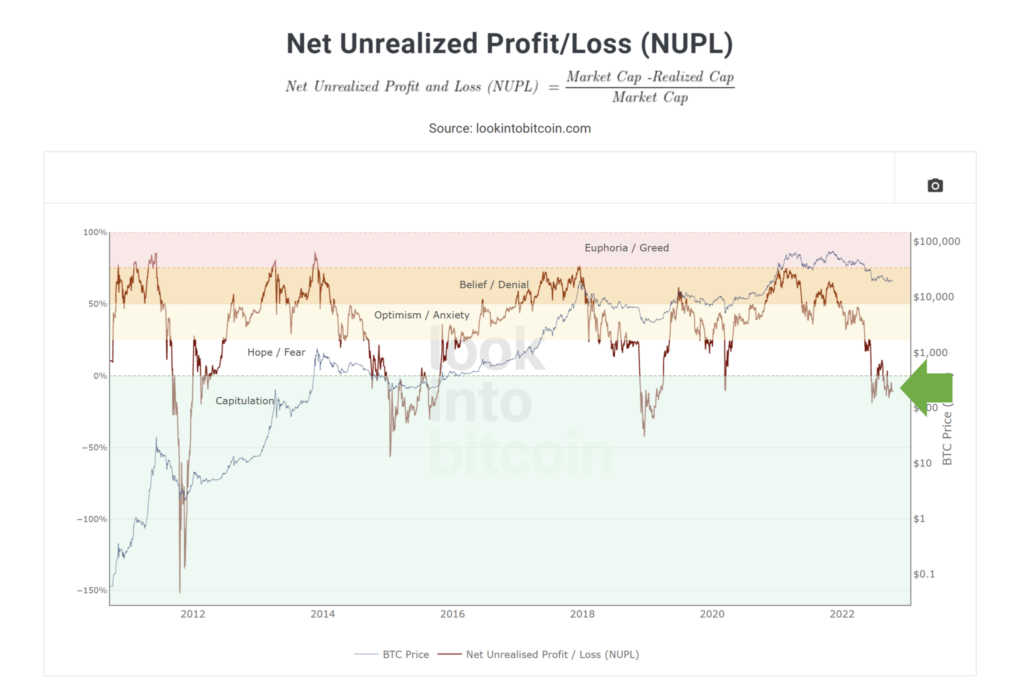

According to LookIntoBitcoin analysts, the Net Unrealized Profit/Loss (NUPL) sits in negative territory for the last four months. Based on prior capitulation cycles, the time has come to accumulate Bitcoin.

«Buying Bitcoin near these levels, when NUPL is in capitulation, historically demonstrates an excellent risk‑reward for a long‑term oriented investment strategy», said the experts.

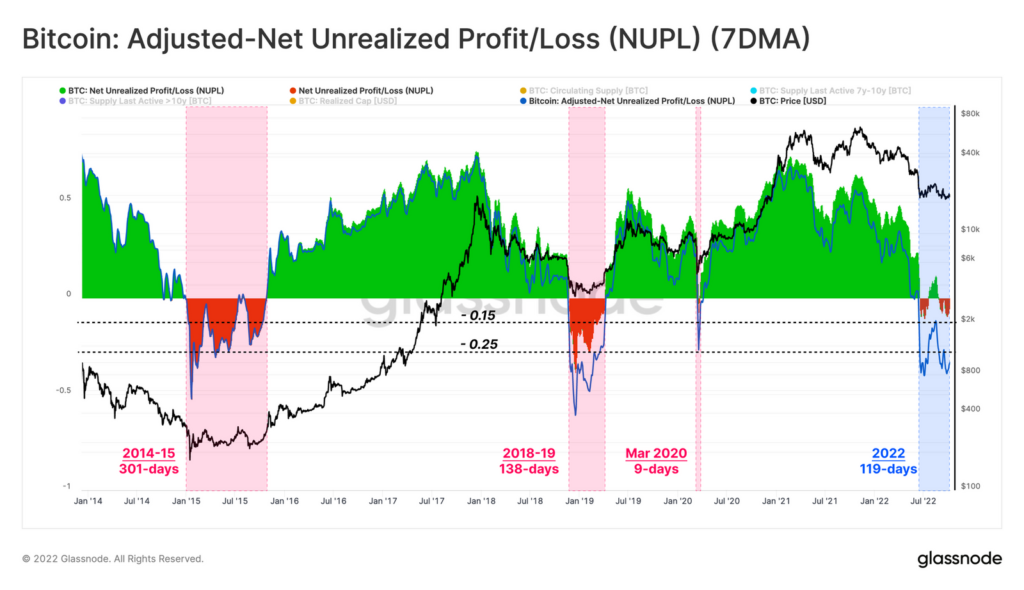

NUPL has been below zero for over 100 days. In previous bear phases in 2014–2015 and 2018–2019 this period was 301 and 138 days respectively. The pandemic shock in March 2020 (9 days) can be considered an exception.

Specialists at LookIntoBitcoin also reviewed the duration of bear phases after halvings. In 2013 this period was 779 days, in 2017 — 891. Under the current downtrend it has surpassed 900 days.

In Glassnode they are confident that it may take several more months to end the current phase.

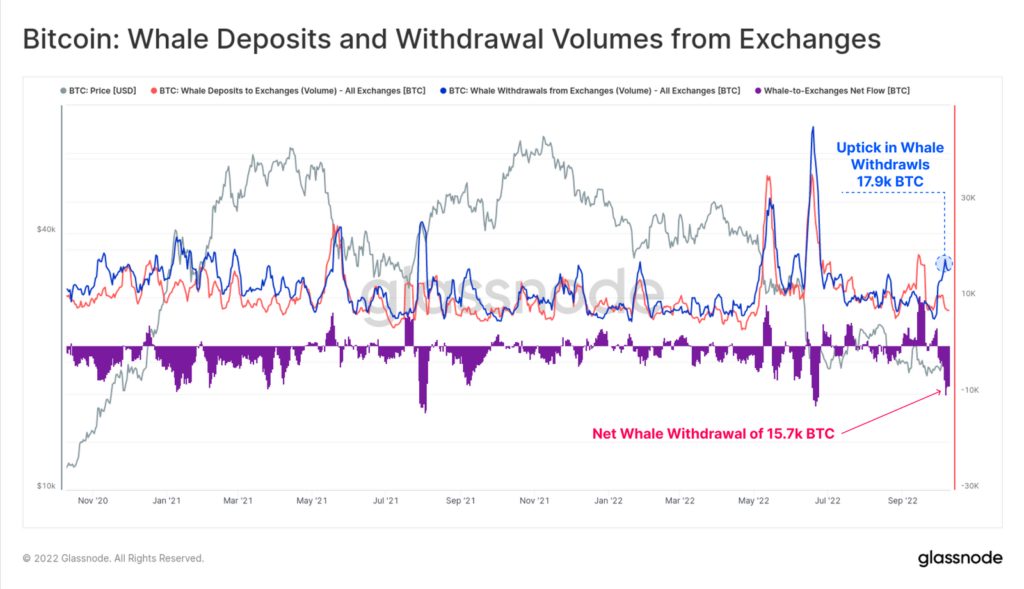

Experts drew attention to the largest whale outflow from exchanges since June 2022 (15,700 BTC). The behavior of major market players is typically indicative of price trend directions, they emphasized.

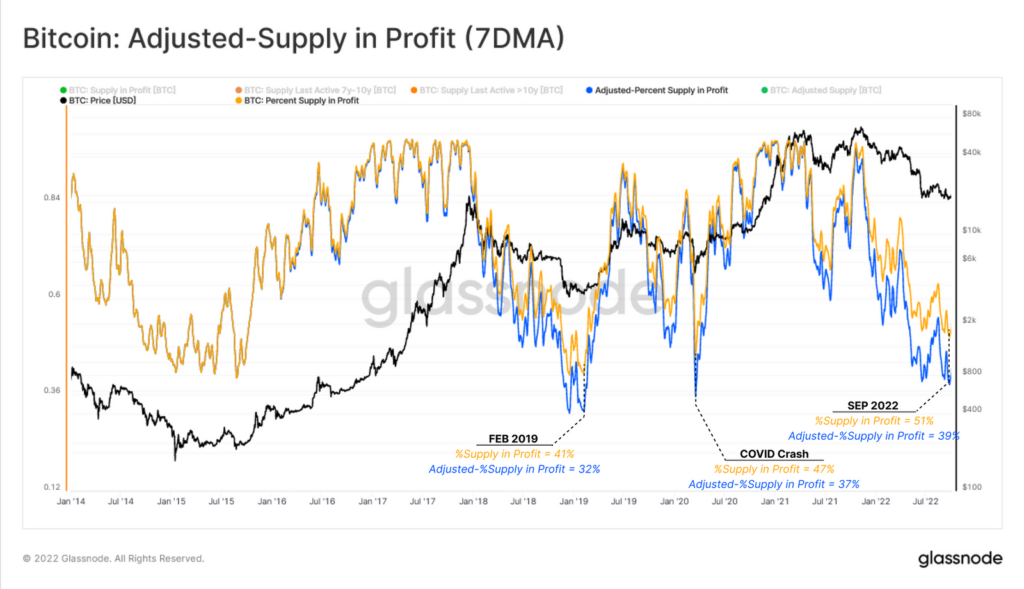

By the metric of profit-bearing supply, the market has approached a cyclical bottom. After correcting for long‑inactive 7+ year supply, the share stood at 39%. In 2019 and 2022, reversals occurred at 32% and 37% respectively.

Mining

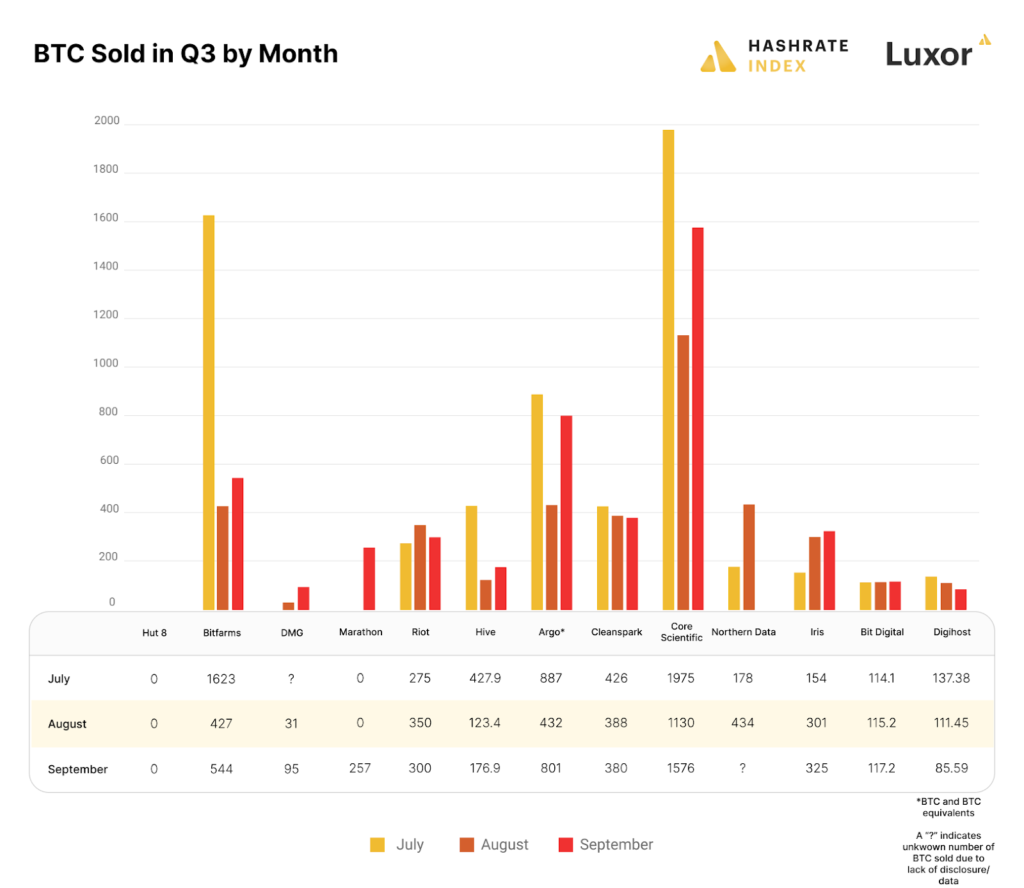

Throughout the third quarter the market remained under pressure on miners’ financial stability, note Hashrate Index analysts. Nevertheless, the pace of bitcoin production being realized slowed.

In June, large players liquidated a total of 23% of Bitcoin reserves, realising 14,600 BTC. In July, firms sold 5,767.9 BTC with total mined 3,478 BTC.

In August and September 2022, public mining companies sold fewer bitcoins than they mined. This was the first such instance since May.

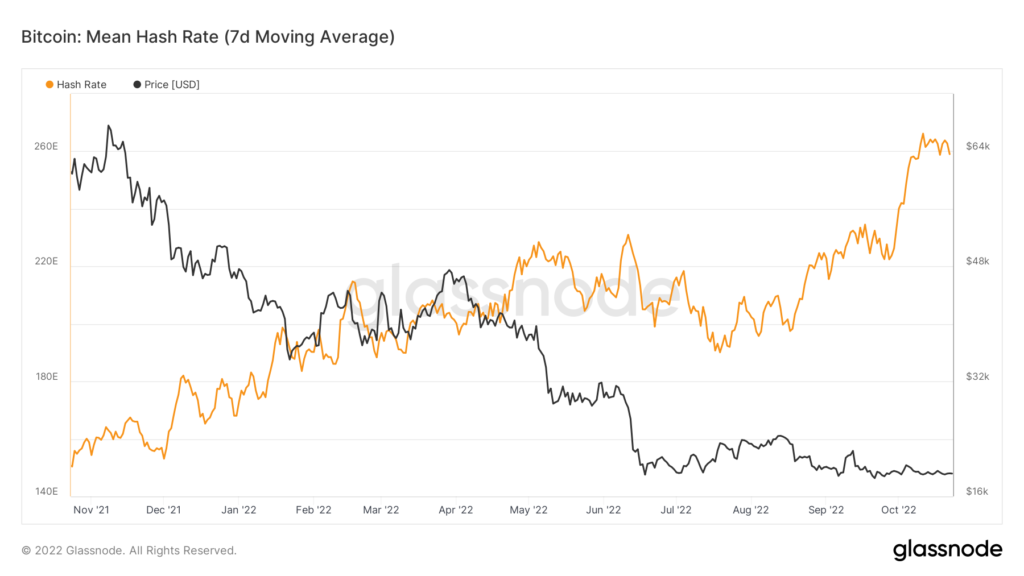

In the United States, where public miners conduct the largest share of operations, the cost of producing 1 BTC compared with a year ago has more than doubled in some states. The reasons are higher hash rate and rising electricity tariffs.

The consequence is a rise in mining difficulty. This, in turn, depresses mining profitability. A stagnating market only exacerbates the situation.

Many Bitcoin miners operate on the edge of break-even even with equipment like the Antminer S19j Pro, Hashrate Index analysts stressed.

Glassnode experts noted that the hash price has reached a record low of $66,500 per Exahash.

The #Bitcoin Hash Price has reached an all-time-low of $66,500 per Exahash.

This means that $BTC miners are earning the smallest reward relative to hashpower applied in history, and likely puts the industry under extreme income stress.

Live Chart: https://t.co/RQzSsh9FnF pic.twitter.com/ExfpR5sOOq

— glassnode (@glassnode) October 24, 2022

Thus, further declines in Bitcoin price in the face of rising hashrate and difficulty could trigger miner capitulation. Capitulation generally precedes consolidation and a trend reversal.

Volatility

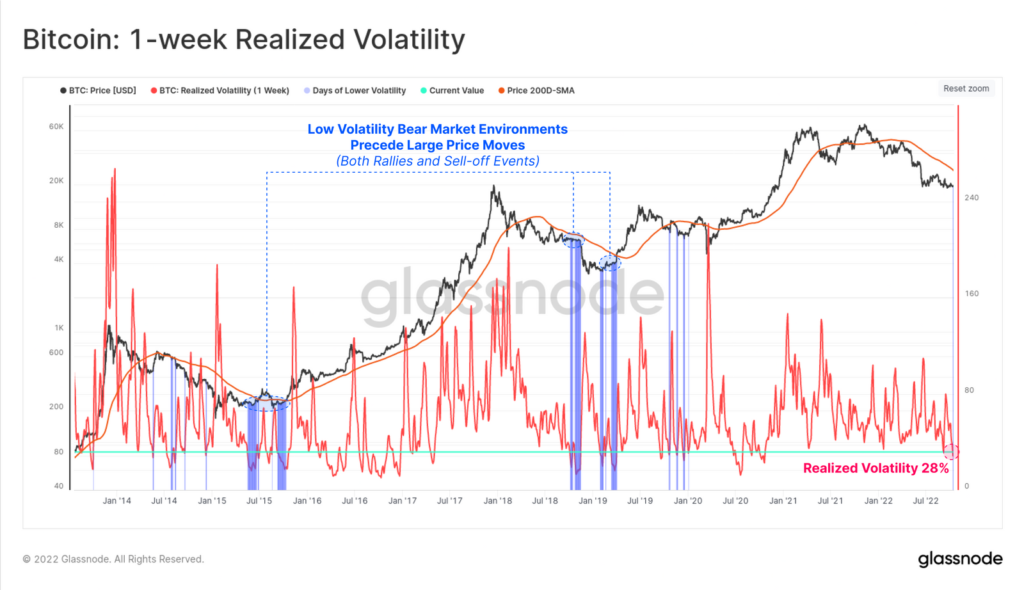

Bitcoin’s Realised Volatility over a 1-week window has fallen to levels close to historic lows. Such episodes are typically followed by substantial price moves.

At the end of October, the 30‑day volatility metric for Bitcoin approached a six‑year low, trading below Nasdaq and S&P 500 equivalents. Arcane Research warned that market participants should prepare for a powerful move.

Bitcoin’s 30-day volatility is currently lower than that of the Nasdaq and S&P 500 while nearing a 6-year-low, sitting slightly higher than low levels recorded in 2018, 2019, and 2020. pic.twitter.com/5IAeud7ceD

— Arcane Research (@ArcaneResearch) October 25, 2022

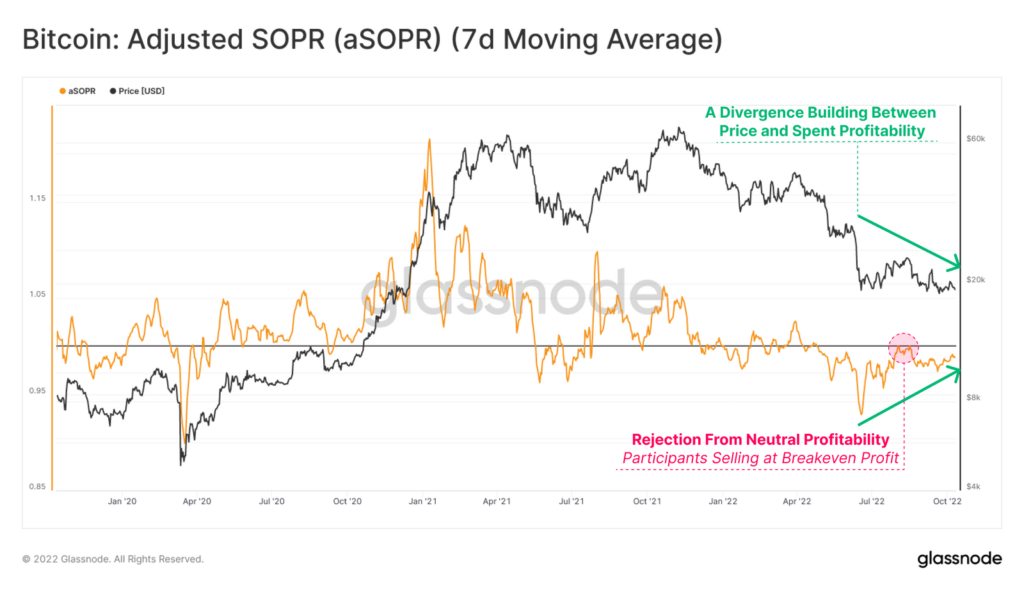

Analysts note that similar ranges of price volatility were seen in 2018, 2019 and 2020. Each period of unusually low volatility was followed by a strong price rebound for Bitcoin. In addition, analysts at Glassnode highlighted a notable divergence between price and the indicator aSOPR. Amid a prevailing downtrend in prices, the amount of losses realized has been shrinking, suggesting sellers are losing steam.

As aSOPR moves toward the breakeven level of 1.0 from below, the chances of a volatility spike rise—either in the form of a breakout or as another pullback from that threshold.

Positive forecasts

Galaxy Digital founder Mike Novogratz expressed the view that the current bear phase of the cryptocurrency market could last another six months.

«You know, a bear case means we have two to six months left of pain. In a bull market the market starts to break. And we’ll see many breakages. Not necessarily in cryptocurrencies, but in the wider world», said he.

According to him, the selling impulse in the digital-asset market is largely exhausted.

He linked bear pressure to the Federal Reserve’s aggressive rate hikes. Meanwhile, the policy affected digital gold more than many other assets.

«I think when a pause in rate hikes comes, we’ll see Bitcoin rise. Like other cryptocurrencies. Will we reach a pause? At some point, yes», said Novogratz.

According to him, the Fed’s rate-hiking campaign has deprived Bitcoin of its status as a “strong hedge against inflation.” The Fed’s policy has affected Bitcoin more through its correlation with traditional financial assets than through inflation itself.

Bloomberg Intelligence senior commodities strategist Mike McGlone presented an unabashedly “bullish” forecast: by the end of 2022 digital gold will outperform its rivals.

The expert described rate hikes by central banks as a “strong tailwind” for Bitcoin and Ethereum.

MicroStrategy founder Michael Saylor forecasted Bitcoin’s price surpassing the all-time high of $69,000 within the next four years.

He is convinced Bitcoin has bottomed in the current bear phase and expects to reach $500,000 in the next decade.

Saylor also stated that the leading cryptocurrency has strong potential to replace gold as a store of value given governments’ inability to control it.

An equally bold forecast was presented by famed trader Tone Vays, who said Bitcoin would hit $100,000 next year ahead of the halving.

However, the expert warned of a possible slide in digital gold’s price to $14,000 before the bull run.

According to Vays, growth could be driven by capital flows from Europe to the US and the “fear of missing out” syndrome.

«They missed their chance to catch the 2018 bottom. This is another opportunity. If Bitcoin ever falls below $10,000, investors will seize it immediately», explained the trader.

He also noted Bitcoin’s decentralisation and censorship resistance. According to Vays, these characteristics will enable widespread adoption of the asset.

«We’re seeing governments, central banks and conventional banks freezing accounts. This year alone we’ve seen the West and the US confiscate funds tied to Russian passports», the trader said.

ARK Invest chief Kathie Wood recently reminded of her expectations for the cryptocurrency’s market cap.

She forecast a rise to $4.5 trillion when Bitcoin traded around $250. It was then that Wood asked renowned economist Arthur Laffer to study the Bitcoin white paper.

The ARK Invest CEO was interested in Bitcoin’s prospects as a unit of account, a store of value and a medium of exchange. Laffer spoke positively about the cryptocurrency.

«I have searched for this ever since we abandoned the gold standard. Bitcoin is a rules-based monetary system»

Laffer also compared the prospects for digital gold’s capitalization with the size of the US monetary base.

As of 30/10/2022 Bitcoin’s market capitalization stood at $398.5 billion, according to CoinGecko. The historical peak above $1.2 trillion was recorded in November 2021, when Bitcoin’s price neared $70,000.

Against the backdrop of a market revival on 25 October, Michaël van de Poppe forecasted Bitcoin’s price to reach $30,000 in the coming weeks.

«In two to three weeks Bitcoin will make a meaningful breakout. My bet is higher. Probably $30,000», wrote the analyst.

Negative forecasts

CNBC’s Mad Money host Jim Cramer is confident that the Fed will continue a tight monetary policy, which will wash out speculative assets like cryptocurrencies.

According to Cramer, the commitment to curbing inflation may bring some pain to American businesses and households. This will continue until authorities “put an end to the gambling.”

In his latest remarks, the ex‑manager of hedge fund Cramer & Co included cryptocurrencies among the assets at risk. He said he no longer believes Bitcoin is a store of value. He also categorized NFTs and the shares of unprofitable public companies among speculative assets.

The Fed is telling you to sell the cryptos and the nfts and the ipos and the SPACs before they take your life’s savings. No more nonsense!!!

— Jim Cramer (@jimcramer) August 30, 2022

«The Fed tells you to sell cryptocurrencies, NFTs, IPO and SPAC, before they take your savings. No more nonsense!», emphasized the expert.

Relying on data from past market cycles, Arcane Research allowed for Bitcoin to drop to $10,350. They believe the bear phase bottom may be reached somewhere in late Q4 2022.

Analysts noted that in recent years Bitcoin has been increasingly influenced by macro factors: financial markets, changes in the Fed’s rate, US elections and crypto regulation.

Researchers stressed that the second quarter was the worst for Bitcoin investors in the history of the cryptocurrency.

According to them, the decline was driven by a cocktail of unpleasant events, including Terra’s collapse and its consequences for the entire industry.

Some Twitter users believe the bear market has not yet reached its final phase and that investors should prepare for further declines.

It’s probably not the bottom. Be ready for bitcoin to go lower. This winter will be hard.

— Crypto Joker///BTC,ETH,AVAX (@Mirna_lesvi) September 22, 2022

«Probably not the bottom. Be prepared for Bitcoin to fall further. This winter will be painful», wrote a September poll participant on Cointelegraph.

A commenter on Twitter added a graph illustrating the “bottoms of Bitcoin.”

— The Crypto Native 🏝️ (@thecryptonative) September 22, 2022

One of the commentators wrote the following:

«This is not the bottom yet, but if you want to buy now and hold, that’s fine too».

A gloomy view would be incomplete without the opinion of the ardent Bitcoin critic and gold advocate Peter Schiff. In August he expressed confidence that Bitcoin is unlikely to reach fresh highs and is more likely to drift toward $10,000 and below.

He argued that the current rally in the crypto market, including a roughly 70% surge in Ethereum since July, is not sustainable. He called it a “sucker rally.”

«The market will fall. I think people should take advantage of the rally that exists now and exit. Many are still in profit on these tokens. Some bought Bitcoin four, five, six years ago and are in the green. The same with Ethereum. People should exit, because otherwise the market will take that profit», said the gold advocate.

Conclusion

Experts’ opinions are often subjective and vary widely, which is reflected in the broad range of price forecasts. Therefore such predictions should be taken with a fair degree of skepticism.

The market continues to be heavily influenced by Fed rate decisions, as well as the geopolitical situation. Bitcoin is likely to rebound rapidly once U.S. monetary policy eases—a development that will come sooner or later.

Markets are cyclical by nature. Accordingly, a trend reversal is not far off. Long‑term investors should be heartened that most on‑chain indicators point to Bitcoin being deeply oversold.

Following a prolonged flat, a strong move usually follows. Some metrics already hint at an upcoming spike in volatility, suggesting investors should buckle up.

Follow ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!