Trader outlines likely scenarios for Bitcoin price movement

The practical trader and founder of the project Crypto Shaman, Vadim Shovkun, explains the current market situation.

As noted in overview for October 28, there has been no material negativity in the market ahead of the U.S. elections. We examine the current situation amid upheavals.

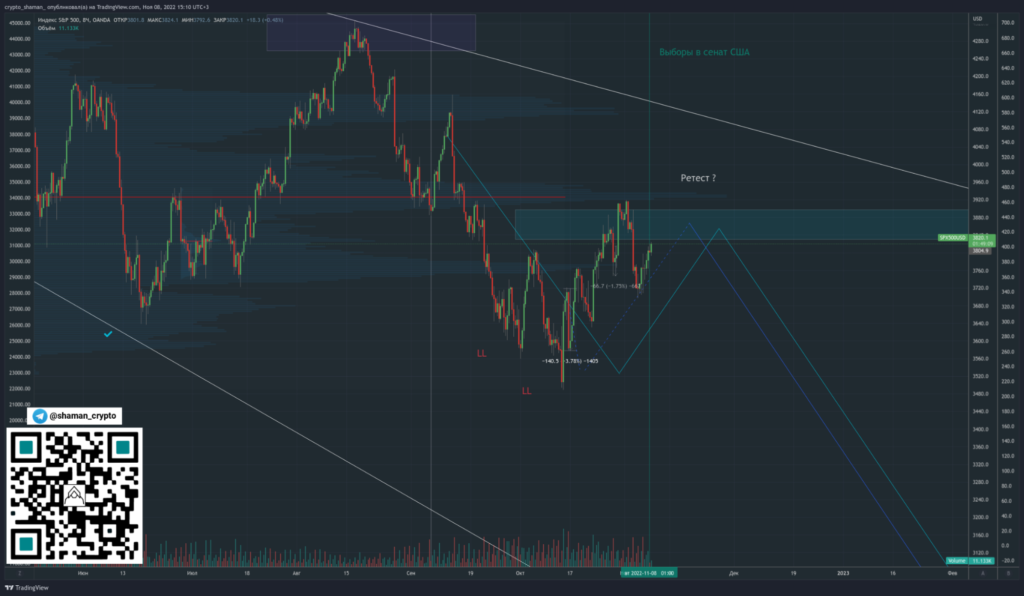

S&P 500

The stock index formed a retest of the PoC from the move over the past six months. In the medium term, there is no positive outlook for Bitcoin.

On November 2, the U.S. Federal Reserve raised the target range for the federal funds rate by 75 basis points—bringing it to 3.75–4% per year. The inflation rate continues to rise.

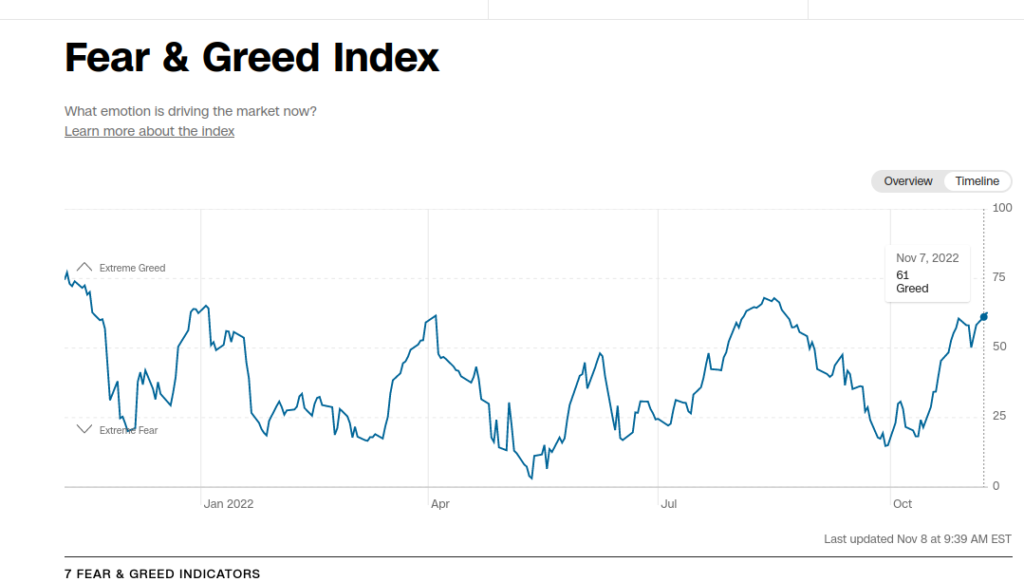

The fear-and-greed index on the stock market remains at 61, though a month ago it was below 20.

There are no grounds for growth. The current near-term positive will soon end.

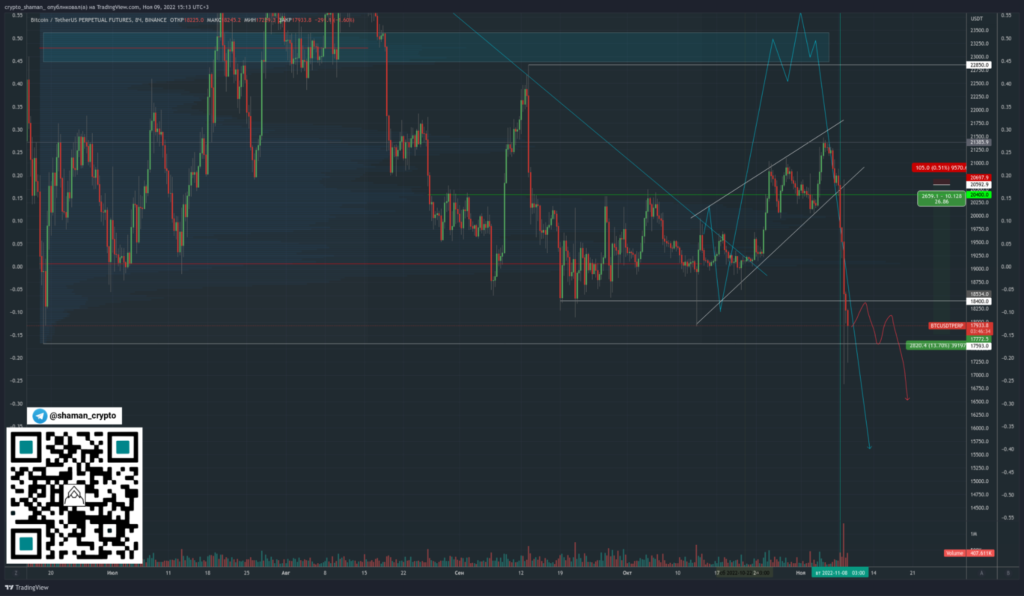

BTC

FTX exchange crisis has triggered a chain reaction that will lead to further declines in the crypto market. The Solana (SOL) crash of 34% in a day is only the first major move. The Terra ecosystem — which collapsed in May — was a minor player in the shadow of FTX.

The fear-and-greed index for the digital-asset market stalled at 21, which may seem low. But this is not extreme fear — historically Bitcoin has paused or bounced when the index has fallen below 10.

The chart below shows Bitcoin consolidating below the $18,400 level. Overnight, the price could not regain the $18,400–$20,400 range. On the eight-hour time frame, there is high bearish aggression with no signs of a rebound.

Conclusions

The cryptocurrency market has breached the summer lows. At the time of writing, it shows no signs of a near-term rebound. A period of sideways trading over the coming days is possible, but the overarching forecast remains for further declines.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!