Aave Earns $6 Million in a Day Amid Crypto Market Downturn

On August 5, the daily fee volume of the lending platform Aave reached $6 million, driven by the liquidation of positions worth $350 million.

Aave Protocol withstood market stress across 14 active markets on various L1s and L2s, securing $21B worth of value.

Aave Treasury was rewarded with $6M in revenue overnight from decentralized liquidations for keeping the markets safe.

This is why building DeFi is FTW.

— Stani (@StaniKulechov) August 5, 2024

“Aave withstood market stress across 14 active markets on various L1 and L2, securing $21 billion worth of value. The protocol’s treasury received a daily income of $6 million from liquidations,” stated the platform’s founder, Stani Kulechov.

For instance, the forced closure of one position in WETH worth $7.4 million brought Aave a revenue of $802,000.

According to CoinGecko, Ethereum’s decline over the past 24 hours was 23.8%. The native token of the lending platform decreased by 28.5%.

Data from Parsec Finance indicates that the sell-off in the cryptocurrency derivatives market resulted in $1 billion in liquidated positions, with $350 million in DeFi protocols.

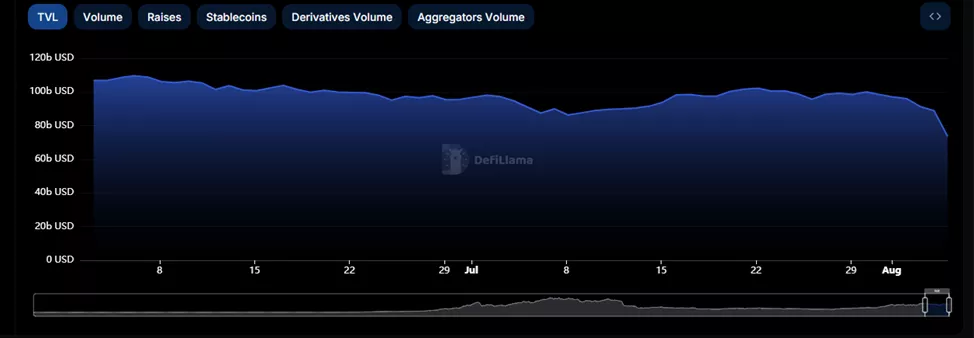

According to DeFi Llama, the total value locked in decentralized finance platforms plummeted to $73.6 billion. The previous day, the figure was $88.8 billion.

Earlier, ForkLog discussed with experts the reasons for the dump and explored the conditions under which major coins might begin to recover. Details can be found in the article.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!