Abu Dhabi’s Sovereign Fund Reveals Investment in BlackRock’s Bitcoin ETF

The government-owned Mubadala Investment Company of Abu Dhabi disclosed an investment in BlackRock’s spot Bitcoin ETF amounting to $436.9 million.

The transaction took place in the fourth quarter of last year, coinciding with the company’s acquisition of a commercial license to operate in the UAE capital.

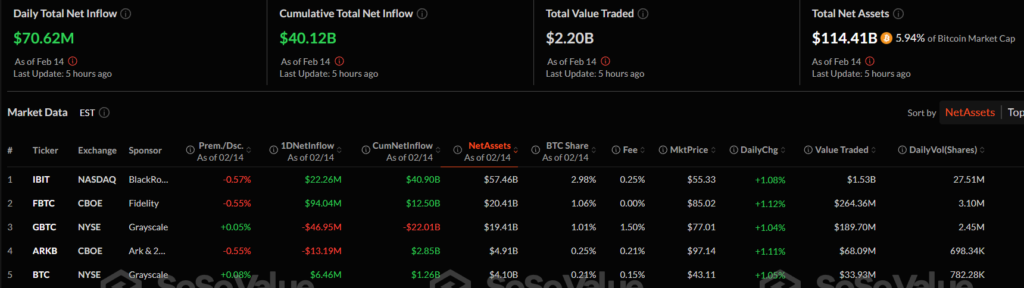

BlackRock’s IBIT is the largest spot Bitcoin fund by assets under management, totaling $57.46 billion.

Mubadala Investment Company effectively serves as a sovereign fund managing Abu Dhabi’s capital.

In 2023, the capital’s authorities invested in Bitcoin mining.

Barclays

The global financial firm Barclays also disclosed investments in IBIT. According to a document, the firm holds 2,473,064 shares of the fund, with an estimated value of $131.2 million.

In its third-quarter 2024 report, Barclays revealed a minimal position in the Grayscale Bitcoin Mini Trust ETF (BTC), which it no longer holds. However, the financial giant’s stake in IBIT represents only about 0.04% of its $356.9 billion portfolio.

According to Fintel, Barclays ranks among the top 10 holders of BlackRock’s spot Bitcoin fund shares. The largest institutional investor in IBIT is Goldman Sachs (~$1.3 billion).

In a 13F filing today, Goldman Sachs reported the following positions as of December 31. For each position, the change in shares occurred during October, November and December (so this includes the post-election period):

$1.27 billion IBIT (24,077,861 shares). This is an 88%…

— MacroScope (@MacroScope17) February 11, 2025

The investment bank also holds FBTC from Fidelity, valued at approximately $294 million. Thus, Goldman Sachs’ total investment in Bitcoin ETFs exceeds $1.6 billion.

Other major investors include Paul Tudor Jones’ Tudor Investment Corporation, DRW Securities, and the State of Wisconsin Investment Board.

Earlier, the Abu Dhabi-based platform M2 enabled clients to trade cryptocurrencies directly from their bank accounts.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!