Analyst Predicts Bitcoin Surge Beyond $200,000

A metric from fractal analysis suggests a potential rise in Bitcoin’s price beyond $200,000 in the current cycle, according to CoinDesk, citing a report by BCA Research.

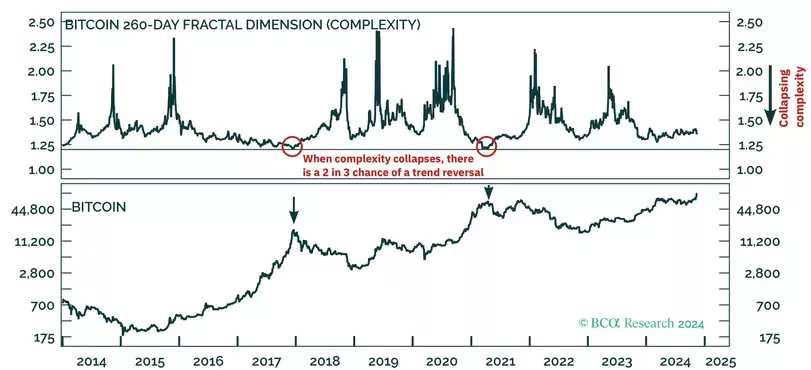

The forecast by Dhaval Joshi, chief strategist at Counterpoint, is based on the 260-day fractal complexity of the digital gold market. A decline in this indicator typically signifies that the price trend is being driven by an increasingly narrow group of investors, which foreshadows the peak of the current movement, its imminent exhaustion, and reversal.

According to the analyst, the metric’s value has not yet approached the level of 1.2, which would indicate the onset of a new crypto winter.

“Therefore, while we should expect a short-term correction, Bitcoin’s structural upward trend remains intact with a final target of $200,000 and beyond,” Joshi stated.

He also highlighted the potential impact of the network effect on the cryptocurrency’s price as global wealth increases.

“In the case of both gold and Bitcoin, the network effect arises from the collective belief that they are non-confiscatable assets available within the fiat monetary system,” the expert noted.

This results in a need to convert part of one’s wealth into cryptocurrency as a hedge against hyperinflation, banking system collapse, or state expropriation, the analyst added. This leads to an expansion of the user base and an increase in purchasing demand.

Earlier, CryptoQuant founder and CEO Ki Young Ju raised his forecast for Bitcoin’s target price in the current cycle to $135,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!