Bitcoin back to $89,000 as altcoins lead the rebound

- Cryptocurrencies remain under pressure from a weak macro backdrop; Nvidia’s earnings, due overnight into February 27, could prove pivotal.

- In Ethereum options, demand is rising for $2,000-strike contracts alongside a rotation out of calls.

- At MakerDAO, three positions totaling $340 million are at risk if the price of the second-largest cryptocurrency falls.

The price of digital gold recovered to $89,000 after nearing $86,000 the previous day amid large liquidations and record outflows from ETFs.

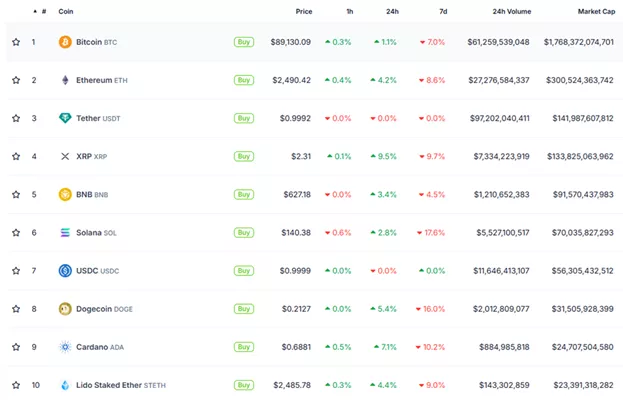

A brisker bounce is evident among altcoins. Gains among the top ten by market value range from 2.8% to 9.5%.

Bitcoin again slipped below $86,000. It has since recovered to $86,750.

Most altcoins also turned red. Ethereum fell to $2,400.

CoinDesk noted rising odds of policy easing by the Fed in May after a drop in US consumer confidence.

QCP Capital warned that in volatile markets cryptocurrencies are the first assets to be liquidated as traders rush to cut risk.

Asia Colour — 25 Feb 25

1/ #BTC has finally broken out of its range, dipping below $90K for the first time in a month, triggering over $200M in liquidations. Despite this, skews remain steady, and 1M IV hovers around 50v.

Macro pressures are mounting.

— QCP (@QCPgroup) February 25, 2025

The firm also flagged Nvidia’s earnings and management guidance due overnight into February 27.

In the current environment, the analysts urged caution. In their view, recent demand for bitcoin has been driven mainly by organisations such as Strategy using raised capital.

Asia Colour — 24 Feb 25

1/ Just 2 days after the @Bybit_Official hack—where ~$1.4B in #ETH was stolen—crypto markets have barely reacted. Prices & implied vols remain stable, a sign of how much the market has matured since FTX’s collapse in 2022.

— QCP (@QCPgroup) February 24, 2025

They estimate crypto accounted for about 19% of capital raised over the past 14 months. QCP Capital did not rule out that the market is nearing saturation, which could dampen institutional buying if spot remains “sluggish”.

“Rising bitcoin dominance and falling altcoin prices suggest that alt bulls have already taken their positions. Any new inflows will be directed to digital gold,” the specialists forecast.

Ethereum at $2,000?

Thomas Erdezi, head of product at CF Benchmarks, noted a rise in open interest at the $2,000 strike in Ethereum options, reflecting investor caution. At the same time, there is a rotation out of calls as market participants have trimmed expectations of a breakout.

“Traders are rolling positions to the downside around $2,000,” the expert commented.

COO of Bitget Wallet, Alvin Kan, drew attention to the risk of $340 million across three MakerDAO positions being liquidated if the asset’s price falls to $1,926, $1,842 and $1,793.

“The sell-off has put those who opened leveraged longs in a difficult spot. […] If forced closures accelerate, downside pressure will intensify,” Kan suggested.

He noted that what happens next depends on changes in leverage and on the ability of spot demand to absorb the shock.

“If bulls step in or liquidity stabilises, the market could stage a sharp reversal,” the Bitget Wallet COO concluded.

According to Binance CEO Richard Teng, the crypto drawdown is short-lived and will not last long.

Earlier, Eric, son of US President Donald Trump, urged accumulating bitcoin on the dip. On February 4 he also recommended buying ETH after a major correction.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!