Bitcoin Miners Eye AI and Diversification Post-Halving

Mining companies may increasingly diversify into AI to offset reduced revenues following the halving, according to CoinShares experts.

On April 20, at block height #840,000, the Bitcoin network’s block reward was halved from 6.25 BTC to 3.125 BTC.

This programmed event occurs roughly every four years after 210,000 blocks, negatively impacting miners’ revenue. It is anticipated that transaction fees will gradually become their primary income source.

However, according to CoinShares cryptocurrency specialist Matthew Kimmell, despite the recent Ordinals boom and the launch of the Runes protocol, average fee revenue will comprise about 15%. Only on peak days might this figure reach 30%, the expert suggested.

“It is not at all clear that fees will fully compensate for lost revenue. In fact, I do not expect this to happen,” said Castle Island managing partner Nic Carter in an interview with CNBC.

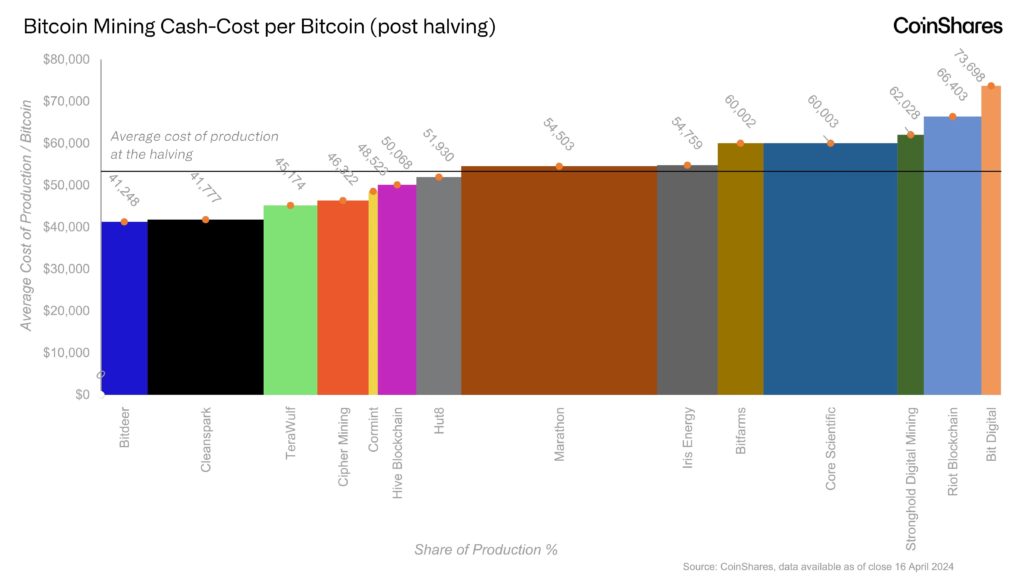

CoinShares analyzed data from 14 mining companies, collectively accounting for approximately 20% of the global Bitcoin hash rate. Post-halving, the average cost of mining 1 BTC for these firms will be $53,000, specialists calculated. Electricity costs will more than double, from $16,300 to $34,900.

Analysts forecast a 10% hash rate decline post-halving, but expect it to reach 700 EH/s by year-end. However, some miners clearly fall short of their own capacity expansion targets.

For instance, Riot aimed for 21 EH/s by Q2 2024, but has remained at 12.4 EH/s for about six months. Bitfarms also intended to deploy 12 EH/s by April, yet its hash rate has stalled at 6.5 EH/s since the start of the year. Bitdeer reported a reduction from 7.2 EH/s to 6.7 EH/s.

Experts believe the introduction of more efficient miner models could offset declining mining profitability. They also noted a growing trend: industry participants increasingly focus on AI computing as a lucrative activity. Hive and Hut 8 have already seen this business account for 3.6% and 2.9% of their revenues, respectively.

Core Scientific provides high-performance computing (HPC) hosting under contract with Coreweave. TeraWulf and Bitdeer are actively expanding their capabilities in this area.

“Some data centers are located near major metropolitan areas, making them candidates for low-latency HPC use,” said Core CEO Adam Sullivan.

Yet, the transition from mining to AI computing is not straightforward, CoinShares noted. The latter requires much higher reliability in power supply and data transmission networks.

Sullivan confirmed that few miners in North America could repurpose their facilities for AI needs.

Industry Players Approach Halving with Cautious Optimism

Riot CEO Jason Les noted that approval of spot Bitcoin ETFs in the US has led to an influx of new money into cryptocurrency, pushing it to new highs. He anticipates continued growth, as exchange-traded funds will soon appear in Hong Kong as well.

He stated that the company prepared for the halving by reducing electricity costs, strengthening its balance sheet, and scaling operations.

Regarding hash rate growth, he explained that a new facility in Corsicana, Texas, was connected to the grid only last week. Now, the firm can increase Bitcoin production using the latest generation of efficient equipment.

Marathon CEO Fred Thiel spoke about a shift in business scaling strategy—focusing on infrastructure rather than fleet upgrades.

As a result of acquisitions, if in December 2023 the firm owned 5% of the facilities housing miners, by April this figure had risen to 53%. This allowed a 20% reduction in Bitcoin mining costs.

Thiel noted that the company recently launched a project to generate energy from methane emitted at landfills. Essentially, this division subsidizes the company’s mining, allowing cost reductions. Marathon expects this new direction to generate significant revenue post-halving in 2028.

Stronghold Digital Mining CEO and Chairman Greg Beard stated that miners whose sole advantage is more efficient devices will find themselves at a disadvantage.

“Companies with access to cheap electricity are in a better position. Operating costs will be lower, allowing them more flexibility in capital allocation,” he emphasized.

Bitdeer Chief Strategy Officer Haris Basit reported that their main strategy has become investing in data centers and strengthening vertical integration through in-house development and innovation. This has led to new revenue sources like the AI Cloud service and recently announced 4-nm miners.

“Bitcoin halving occurs like clockwork every four years. It is a known variable that serves as a guide for us to focus on improving operational efficiency,” he commented.

Earlier, Fineqia International analyst Matteo Greco expressed the view that the halving of the block reward will lead to a demand shock and strengthen the mining sector.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!