Bitcoin Options Open Interest for March Expiry Reaches Record High

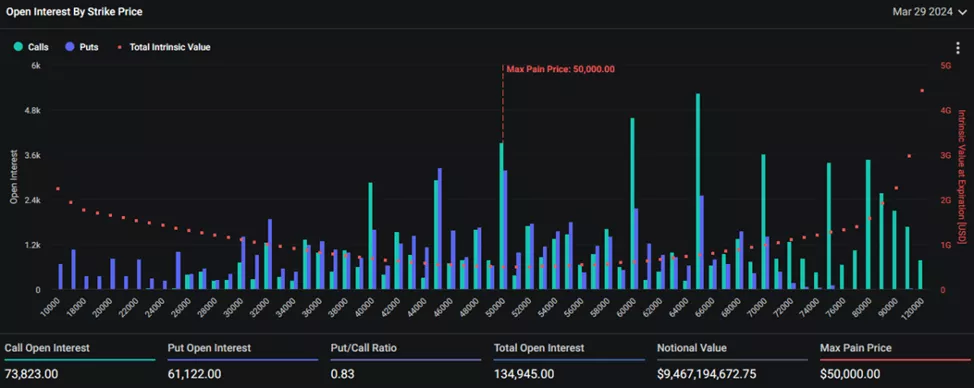

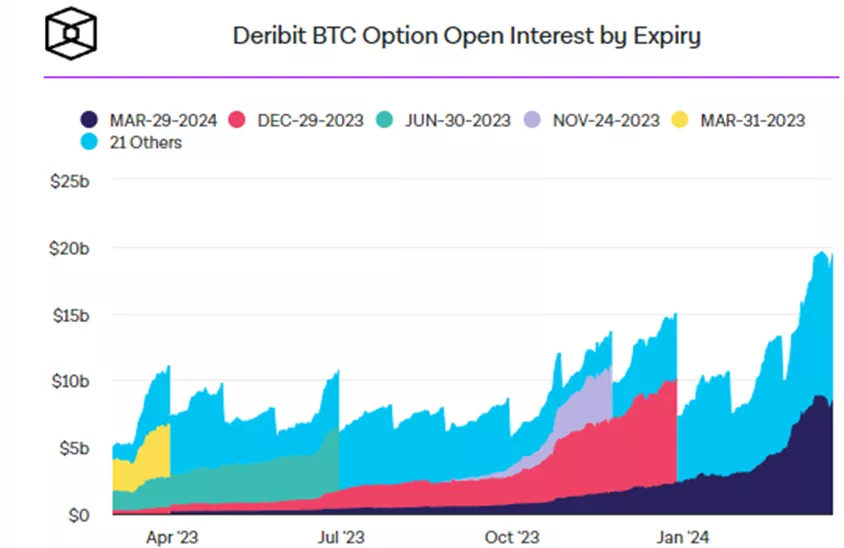

The open interest (OI) for bitcoin options expiring on March 29 has surged to an unprecedented $9.5 billion, according to The Block, citing Deribit.

Contracts expiring on Friday account for 40% of the total OI, noted representatives of the crypto derivatives platform.

According to The Block, open interest for bitcoin options expiring in March peaked at $8.6 billion. In January and February, these figures for end-of-month contracts were $3.74 billion and $3.72 billion, respectively.

Of the mentioned $9.5 billion on Deribit, options will expire “in the money” at the current bitcoin price of $70,000. The “maximum pain” level is at $50,000.

According to platform representatives, the current situation implies that a large number of options are profitable due to the recent price surge.

This may lead derivatives traders to hedge their positions or speculate on further price movements. Such activity could potentially exert upward pressure on the price of the leading cryptocurrency or increase volatility, they explained.

According to Deribit’s Chief Commercial Officer Luuk Strijers, the cryptocurrency market remains quite optimistic given the derivatives data.

The expert noted the presence of OI for bitcoin options with a nominal value of $100,000 at $1.2 billion.

“The parameters are decent […] for both bitcoin and Ethereum contracts with short maturities and improve when viewed over a longer distance. This means that calls are more expensive and in greater demand than puts,” he added.

According to the top manager’s estimates, the year-to-date average put-call ratio for Ethereum has risen from 0.3 to 0.5. For March expiry, it stands at 0.83, for April — 0.64, for June — 0.33, and 0.31 for September.

“In other words, there are more short-term bearish views and more optimistic positioning over the long term,” he explained.

Earlier in March, ForkLog reported that investors had formed a significant volume of OI with a strike price of $70,000 for call options expiring on March 29.

Previously, Goldman Sachs noted a resurgence of interest in digital asset-related products among its clients.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!