Bitcoin’s Current Dip Seen as Prelude to $100,000 Surge

The recent decline of Bitcoin to $93,000 is expected to be short-lived, with prices still on track to reach six figures by the year’s end, according to trader Bluntz Capital.

likely thats the pullback done on #btc here, i think up from here and its aint going as low as ppl think pic.twitter.com/pVeiFZzVC4

— Bluntz (@Bluntz_Capital) November 25, 2024

“Further growth is expected, and it won’t fall as low as people think,” the expert wrote.

This view is shared by K33 Research. Analysts linked the pullback to Bitcoin’s tendency to weaken towards the end of the month.

“Bitcoin is consolidating ahead of the long Thanksgiving weekend [November 28], as traders anticipate a drop in implied volatility. […] We remain confident that the price will surpass $100,000 in the coming weeks and maintain a bullish outlook for 2025,” they added.

Charlie Sherry from BTC Markets described the correction to $93,000 as “healthy” within the historical model of sharp growth.

According to him, such pullbacks “demonstrate a cyclical pattern that allows the market to consolidate gains and reduce leverage before further advancement.” The expert views the decline as the final push before reaching a six-figure level.

The specialist suggested that the correction could deepen (closer to $80,000), which would still fit within the “behavior of the previous bull run.”

Factors Behind the Decline

According to CryptoQuant, in the past 30 days, holders have offloaded 728,000 BTC (~$68 billion), marking a reversal after purchasing 250,000 BTC in October. The pace is the highest since April.

Long-term holders have offloaded 728,000 #Bitcoin in the past 30 days.

This marks the highest sell-off since April. pic.twitter.com/oWqqgIUeSR

— CryptoQuant.com (@cryptoquant_com) November 26, 2024

Standard Chartered explained the retreat of the leading cryptocurrency as a result of its diminished appeal as a hedge for TradFi investors amid a decline in the term premium for US government bonds.

Analysts noted that increased confidence in US Treasury bonds could reduce Bitcoin’s attractiveness in the short term, contributing to its price decline.

The upcoming expiration of monthly options will also have an impact. According to Deribit, contracts for 18,000 BTC with strikes ranging from $85,000 to $100,000 will expire at the end of the week, which could lead to “price stagnation.”

The long-term prospects for digital gold remain unchanged — Standard Chartered confirmed a forecast of $125,000 by the end of December, with growth to $200,000 by the end of 2025.

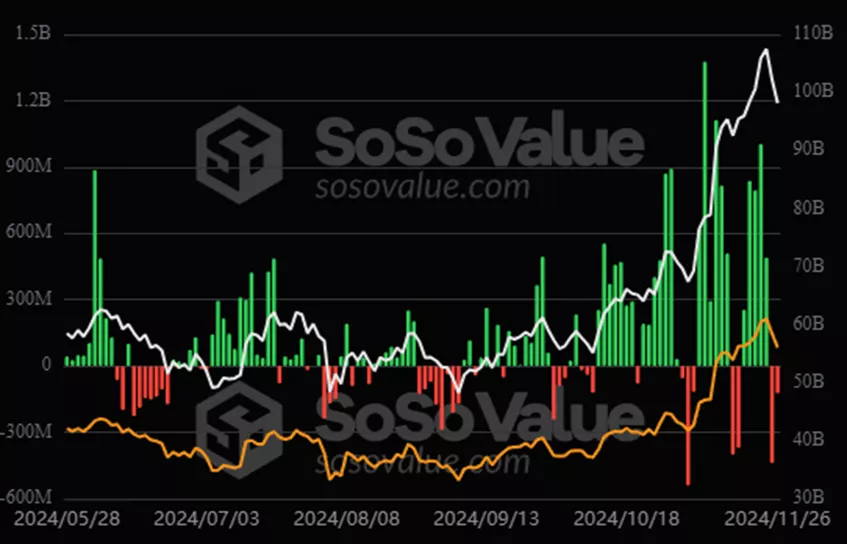

This is supported by continued coin purchases by MicroStrategy (MSTR) and investors through ETFs.

On November 26, outflows from spot exchange-traded funds based on digital gold slowed from $438.4 million to $122.8 million.

“The average purchase price of ETFs and MSTR since the elections is $88,700. This could be a short-term bottom. Prices may consolidate in the range of $85,000 to $88,700 before resuming an upward trajectory,” concluded analysts.

Pantera Capital has forecasted Bitcoin’s rise to $740,000.

Earlier, Bernstein identified catalysts for the first cryptocurrency’s price increase to $200,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!