BitMEX Partners with PowerTrade to Launch Options Trading

BitMEX has initiated options trading in collaboration with the PowerTrade platform.

BitMEX has partnered with PowerTrade to launch an options trading service in an effort to gain market share from Deribit. Current major competitors also include Binance OKX and Bybit. BitMEX CEO Stephan Lutz said that BitMEX hopes to reach at least $500 million in trading volume…

— Wu Blockchain (@WuBlockchain) May 8, 2024

Market makers iGreeks and DWF Labs will ensure sufficient liquidity and low slippage.

The company aims to achieve a trading volume of $500 million within three months and capture a significant market share from the leader Deribit, according to its CEO Stephan Lutz.

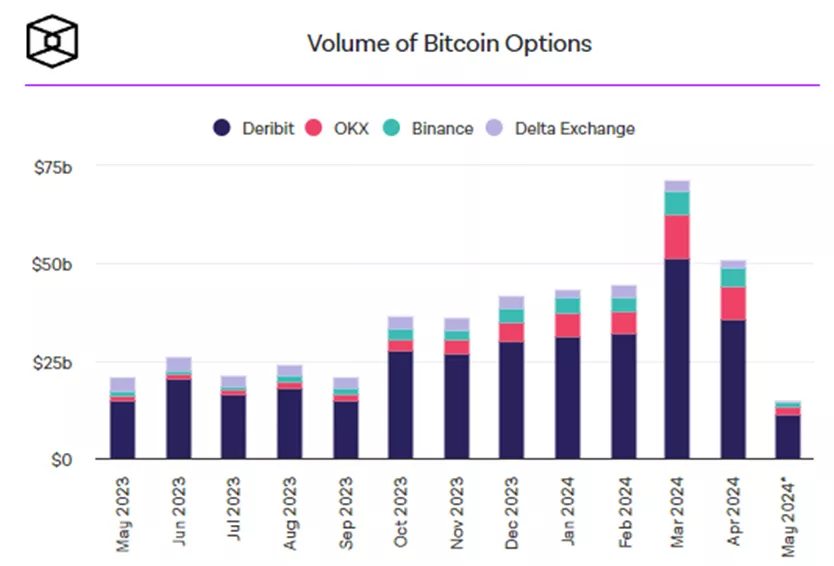

Deribit accounted for 70% of the total turnover in April, which was $51.1 billion. OKX and Binance held shares of 16% and 9% respectively, according to data from The Block.

BitMEX users have access to options on Bitcoin, Ethereum, XRP, BNB, Solana, and Dogecoin, with plans to expand the list later.

Pricing and settlements are conducted in USDC. Traders can use various assets, including Bitcoin, Ethereum, and USDT, as collateral.

Throughout May, the platform will not charge fees. Subsequently, the fee structure will mirror that of spot trading.

According to a press release, BitMEX offers a convenient and secure interface for transactions via an order book and request for quote (RFQ) with reduced counterparty risk.

“Unlike other platforms that mainly use Bitcoin or Ethereum for settlements and require additional conversion fees, BitMEX options present a more flexible and convenient product,” explained Lutz.

Other features include the use of cross-margining at market rates. This avoids the friction associated with asset conversion and collateral management, enhancing user experience and capital efficiency.

In May 2023, BitMEX launched a specialized service for Hong Kong residents as part of its preparation to apply for registration in the jurisdiction.

In April 2024, Deribit FZE became the first among crypto derivatives platforms to receive a provisional VASP license from Dubai’s Virtual Assets Regulatory Authority. The organization is relocating the firm’s global headquarters to the emirate.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!