BlackRock Identifies Bitcoin as a Unique Hedge Against Global Risks

The world’s largest asset manager, BlackRock, has released a report describing the first cryptocurrency as a “unique diversifier.”

The document emphasizes the historical price dynamics and the challenges of forecasting it. Experts believe that investors find it much harder to analyze cryptocurrencies compared to traditional assets.

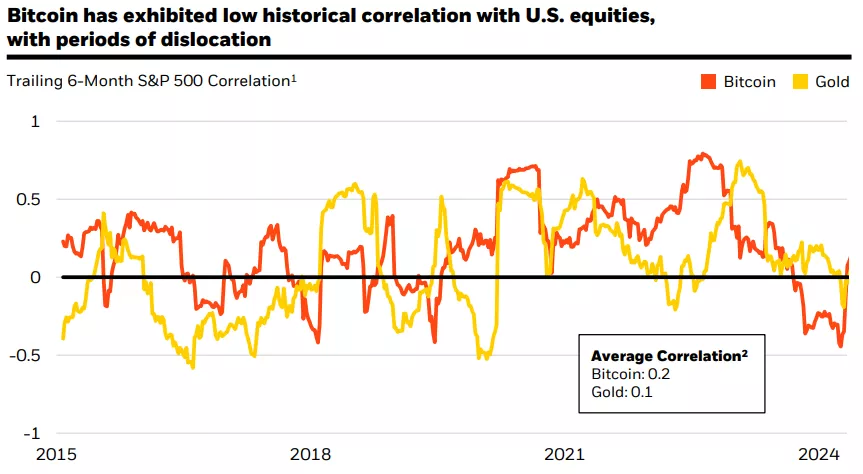

Another key point is the fleeting correlation of digital gold with American stocks and the Fed rate. According to analysts, the first cryptocurrency “reflects minimal fundamental exposure” to macroeconomic factors affecting most traditional financial instruments.

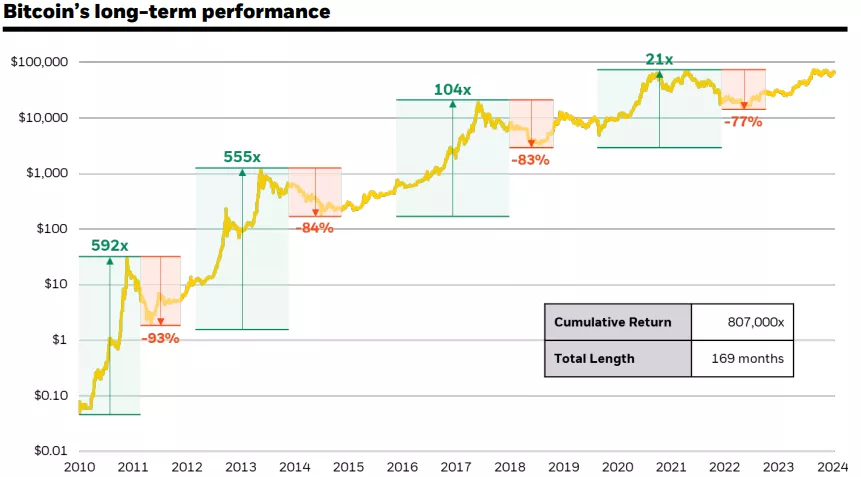

While the Wall Street giant acknowledges the risky nature of Bitcoin, it has outperformed other major asset classes in price dynamics for seven of the last 10 years. However, BlackRock highlights that in “unproductive” years, the first cryptocurrency showed the worst results.

“Such Bitcoin price movements continue to reflect, in particular, its evolving prospects over time as it becomes widely accepted as a global monetary alternative,” the report states.

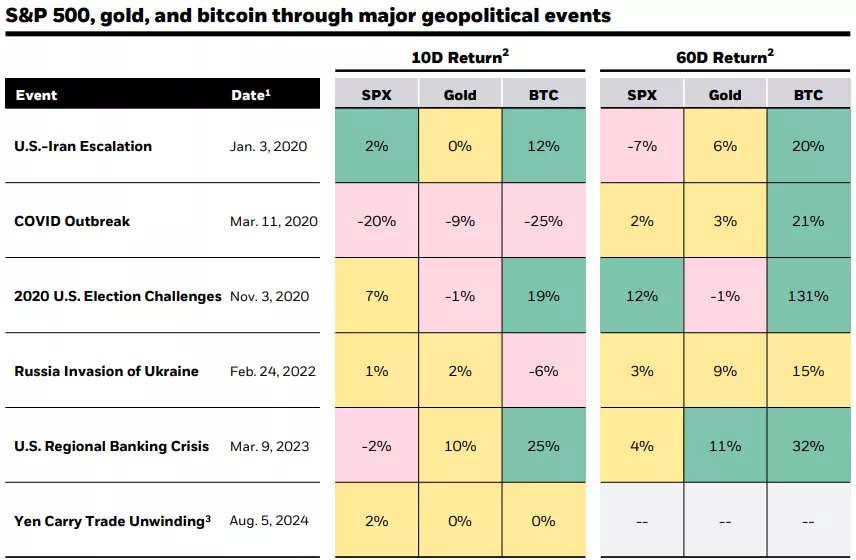

Analysts also noted that for many, the first cryptocurrency has become a “safe haven” amid geopolitical tensions. Bitcoin could also serve as a hedge against potential depreciation of the US dollar in the context of rising federal budget deficits.

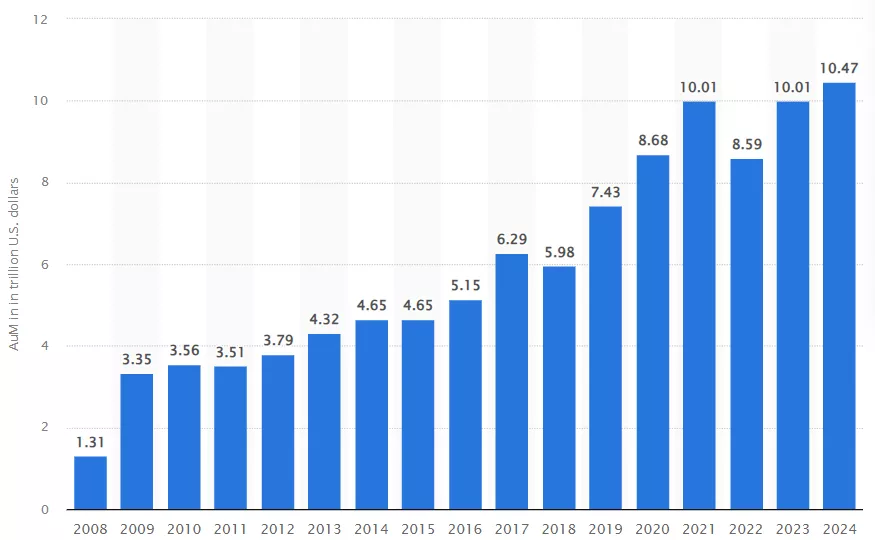

The total assets under management by BlackRock are approaching $11 trillion.

The leading spot Bitcoin ETF under the ticker IBIT has a figure of approximately $21 billion, according to SoSoValue.

Back in August, BlackRock’s crypto funds surpassed Grayscale’s products in total assets under management.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!