Ethereum ETFs post a record outflow

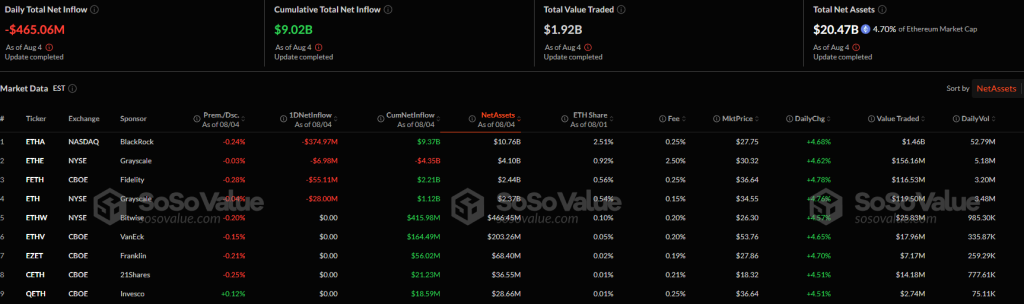

Despite the market’s recovery, net capital outflows from ether-based exchange-traded funds continued for a second day. On 4 August they hit a record $465.06 million.

The biggest outflow came from the largest product by AUM — BlackRock’s ETHA. Over the past 24 hours, $374 million was withdrawn.

Withdrawals were also recorded at:

- FETH by Fidelity — -$55.11 million;

- ETH and ETHE by Grayscale — -$28 million and -$6.98 million, respectively.

On 3 August, ETF assets under management decreased by $152 million.

Despite the rally

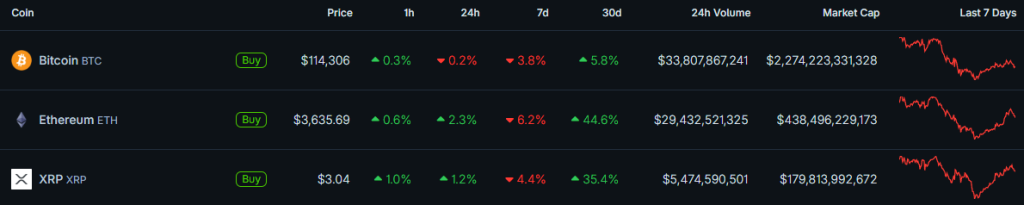

Despite record ETF outflows, ether gained 2.3% over the past 24 hours.

On-chain transaction volume in July increased by 11% compared with June.

Amid a firm price recovery, the value transferred on the network has also risen markedly.

The metric increased by 71% from the previous month — $238 billion versus $139 billion. That is the highest reading since December 2021.

Daily transaction volume on the network is also setting records:

Is there more to come?

Binance representatives told ForkLog that the outflows were preceded by a record-long streak of net inflows into Ethereum ETFs.

They also stressed that in June the price of the second-largest cryptocurrency rose by more than 50%:

“This was the best monthly result in the past three years.”

Analysts are confident: Ethereum is consolidating its position as a key infrastructure asset in the DeFi ecosystem:

“Against the backdrop of a rapidly changing global regulatory environment, such data are a good guide to assessing the asset’s prospects.”

Among the fundamental drivers of ether’s growth, they highlighted:

- rising institutional interest in ETFs;

- positive signals from the SEC and easing regulatory uncertainty in the U.S.;

- Ethereum’s growing role in DeFi.

They allow for short-term swings in August but overall “look at the market constructively and with confidence”.

What is driving the outflows

Speaking to The Block, LVRG Research head Nick Ruck suggested that the ETF outflows reflect profit-taking after ether’s recent price rise.

“This does not necessarily indicate a decline in institutional demand — especially given the record $5.4 billion inflow into the sector in July and companies’ accumulation of ETH,” the expert stressed.

A similar view was voiced by the investment director of Kronos Research:

“This is related to short-term profit-taking and a move to lower-risk strategies, rather than abandoning long-term exposure to Ethereum.”

Presto Research’s Peter Chun suggested the $465 million outflow was triggered by lacklustre U.S. employment figures, which prompted investors to sell risk assets.

“Given the recent confident market recovery, this figure will most likely reverse tomorrow. One should not attach too much importance to these daily fluctuations,” the expert added.

Hype persists

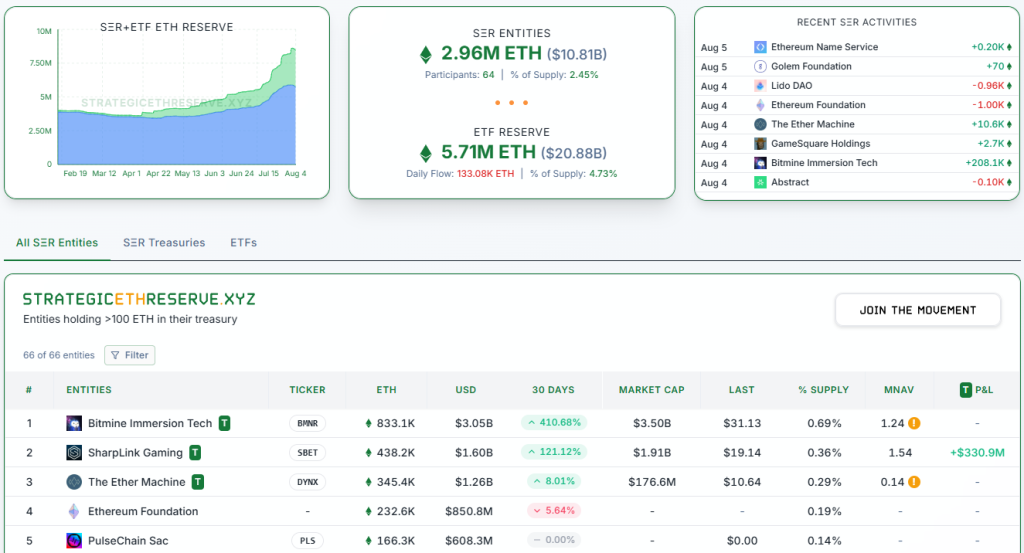

SharpLink reported that its “digital reserves” reached 521,939 ETH — about $1.9 billion at the current rate.

Between 28 July and 3 August, the company, backed by Ethereum co-founder Joseph Lubin, acquired 83,561 ETH for $264.5 million at an average price of $3634.

The “ETH concentration” metric (coins per share) rose to 3.66 from 3.4 a week earlier. Since the Ethereum strategy launched on 2 June, the metric has increased by 83%.

“100% of our ether is engaged in staking. Cumulative staking rewards have reached 929 ETH,” the firm’s representatives stressed.

However, the leader among corporate ether apologists remains Bitmine Immersion Tech, linked to the notorious “forecaster” Fundstrat’s Tom Lee. The company holds about 833,100 ETH worth more than $3 billion.

Over the past 30 days, Bitmine’s “digital reserves” have grown by 410.68%. The MNAV stands at 1.24. That means the company is valued by the market above net asset value (NAV) — a positive signal for investors.

For The Ether Machine, which ranks third, MNAV is well below 1. Investors may see this as a warning sign — a possible indication of strategic missteps, an opaque structure or low operating efficiency. In such cases, even growth in crypto reserves does not always offset a falling metric.

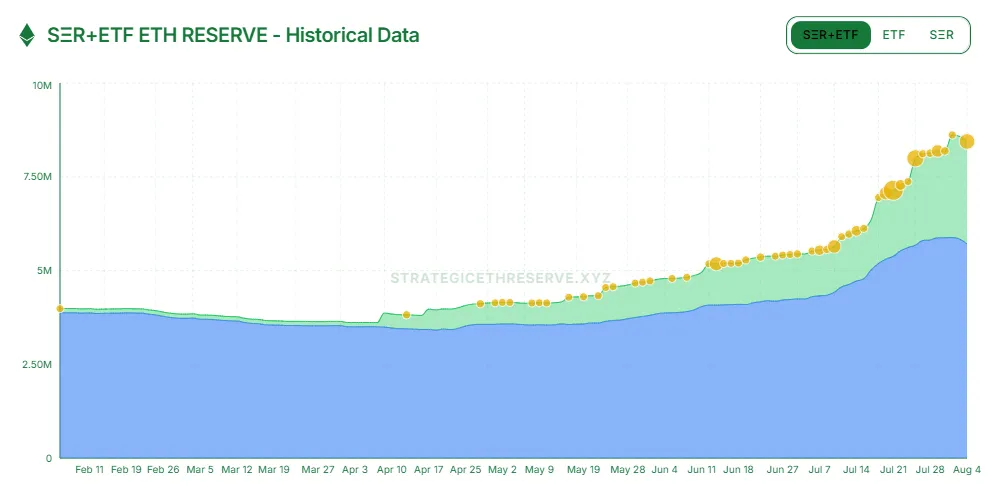

The combined Ethereum reserves on the balance sheets of 64 corporations amount to 2.96 million ETH worth $10.81 billion. That is 2.45% of the supply of the second-largest cryptocurrency.

The chart above shows companies are accumulating ether faster than ETF assets under management are growing.

Earlier, Bitwise CIO Matt Hougan advised companies with Ethereum reserves to focus on a long-term strategy.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!