Ethereum Foundation’s Sales: Impact on ETH Price Assessed by Experts

Sales of ether by the Ethereum Foundation (EF) prompt an immediate market reaction. On average, the price increases by 1.3% over the following seven days, according to CoinGecko analysts.

Does Ethereum Foundation’s (EF) sell-offs trigger any significant market movements? ?

Our latest study reveals that EF sell-offs of <9K $ETH have no significant positive correlation to price changes. pic.twitter.com/TgY2fcZwfy

— CoinGecko (@coingecko) March 25, 2025

In 149 instances (47.6%) during this period, a price decline was observed, while in 164 cases (52.4%), there was an increase.

“The results show that less than half of EF’s sell-offs lead to an immediate price drop. In most cases, this does not occur,” emphasized CoinGecko experts.

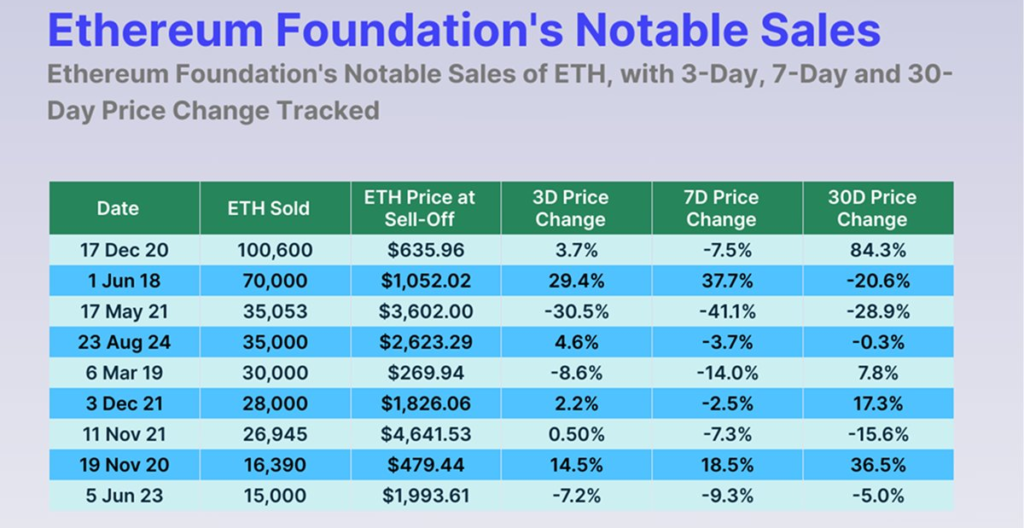

Among the most extreme cases, they noted a 41.1% drop in quotes over a week following the sale of 35,053 ETH on May 17, 2021. Conversely, after the sale of 70,000 ETH on June 1, 2018, there was a pump of +29.4% over three days and +37.7% over seven days.

According to analysts, some correlations over the weekly period appear to reflect the short-term impact of large sales by EF. However, the effect remains inconsistent, as “other market forces likely play a more dominant role in determining price movement.”

External Factors Have Greater Influence on Price

Over 30-day periods, the average change in quotes after EF sales is +8.9%. This demonstrates that any initial volatility is often smoothed out as the market recovers, noted CoinGecko specialists.

In the early stages (before 2020), the dynamics of quotes over a month after EF expenditures were predominantly positive. Analysts suggest this reflected growing confidence in the ecosystem, especially in bear markets.

“However, since 2021, the correlation has increasingly leaned towards neutral or negative values. This shift likely reflects the maturity of Ethereum and the influence of larger macroeconomic forces,” the experts stated.

They found a greater connection between price movements and external factors such as Federal Reserve rate hikes, the rise in bitcoin dominance, or general crypto market cycles.

“EF sell-offs during the analyzed period show a contradictory relationship with ETH price movements, where notable transactions sometimes coincide with sharp rises or falls. Notable events, such as the sale of 100,600 ETH followed by an 84% surge, and the sale of 35,053 ETH leading to a 41% crash, highlight this volatility,” concluded CoinGecko analysts.

Reforms in EF May Reduce Asset Sell-offs

The foundation behind Ethereum’s development has repeatedly faced criticism for regular ETH sales. Concerns also addressed the transparency of EF’s financial activities. Users questioned why the organization does not stake its funds to generate income.

In January, the organization opened a multisig wallet on the Safe platform to participate in the DeFi ecosystem. In February, EF sent $120 million worth of ETH to Aave, Spark, and Compound protocols.

This occurred amid a change in the foundation’s leadership—Xiao-Wei Wang and Tomasz Stanczak became co-executive directors, replacing Aya Miyaguchi as CEO.

Experts noted a decline in the optimism index regarding Ethereum to a yearly low. Analysts at Standard Chartered revised their price forecast for the cryptocurrency in 2025, lowering it from $10,000 to $4,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!