Experts Outline Market Dynamics Before and After Fed Meeting

Tom Lee predicts Bitcoin's rise to $200,000.

The leading cryptocurrency could reach $200,000 due to a potential rate cut by the Fed. This view was shared by Tom Lee, managing partner of Fundstrat Global Advisors, in an interview with CNBC.

“Bitcoin and cryptocurrencies like Ethereum are extremely sensitive to monetary policy. September 17 will be a key catalyst for the crypto market,” he stated.

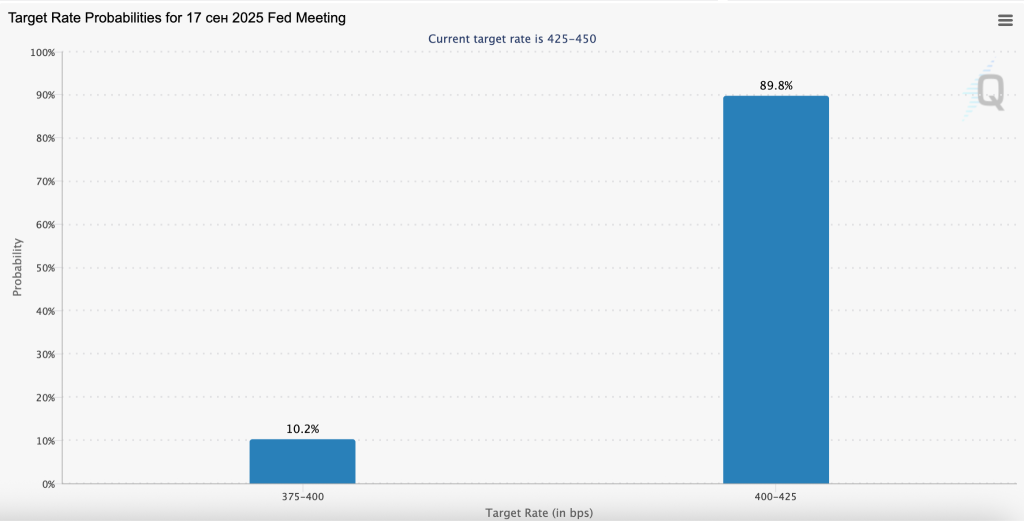

At the time of writing, market participants assess the probability of a rate cut at 100%. Most investors expect the rate to drop from the current 4.25-4.5% to 4-4.25%. However, some are betting on a lower range of 3.75-4%.

Cautious Sentiments

Investors are showing restraint ahead of the Fed’s decision. For several weeks now, Bitcoin has been trading in the range of $108,000-$112,000. Traders have shifted to neutral-bearish strategies and anticipate a correction in digital gold.

In a comment to ForkLog, Bitget’s COO Vugar Usy Zade stated that the market is currently “in a strategic waiting mode.” According to him, the current dynamics indicate the maturation of the crypto industry.

“Market participants are increasingly balancing enthusiasm with fundamental factors, creating a healthier ecosystem less prone to irrational spikes,” explained Usy Zade.

After receiving clearer macroeconomic signals, cryptocurrencies will continue their upward movement, the expert emphasized. Previously, Crypto.com CEO Kris Marszalek predicted a Bitcoin rally following the Fed’s policy easing.

However, Technobit CEO Alexander Peresichan warned that even a positive decision by the regulator does not guarantee growth. He urged investors to prepare for short-term fluctuations and temporary declines in digital asset prices.

“A looser monetary policy usually increases liquidity availability, which stimulates investments in risky assets, including digital currencies. At the same time, it’s important to understand that the crypto market’s reaction will be more dynamic and sensitive than that of traditional assets,” said the expert.

Peresichan explained that cryptocurrencies “react not only to macroeconomic signals but also to investor sentiment, regulatory news, and liquidity changes.” As a result, even a rate cut could be accompanied by sharp price volatility.

Traders Reduce Risks

According to Bitcoin researcher Axel Adler Jr., market participants have adopted a wait-and-see position amid macroeconomic uncertainty. The aggregate market index, previously under pressure from active sales, has stabilized in the neutral zone of 45-50.

This caution could create conditions for the next growth phase, the expert believes. The reduction in open positions indicates a decrease in leverage usage and a shift to defensive strategies. The market has entered a “balance phase,” where neither buyers nor sellers show clear dominance.

Historically, such consolidation periods have preceded significant upward movements. Adler Jr. emphasized that the leading cryptocurrency is forming a price base similar to the second quarter model. Then, stabilization around $80,000 after a correction to $74,000 led to a new growth cycle.

OKX’s CEO in Singapore, Gracy Lin, highlighted in a comment to CoinDesk that the market often shows calm before significant movement.

“Bitcoin is trading in one of the narrowest ranges in recent months, and volatility in the crypto industry has reached multi-month lows. […] Regardless of whether the catalyst is an unexpected rise in inflation or a dovish Fed stance, one thing is clear: low volatility rarely persists for long in the digital asset market,” she said.

At the time of writing, digital gold is trading around $112,200.

Previously, Santiment analysts predicted a Bitcoin rebound amid rising FUD.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!