Gold Enthusiasts Seize on Bitcoin’s Correction

The price of gold has reached a new all-time high, providing gold enthusiasts with fresh ammunition to criticize the leading cryptocurrency amid its recent correction.

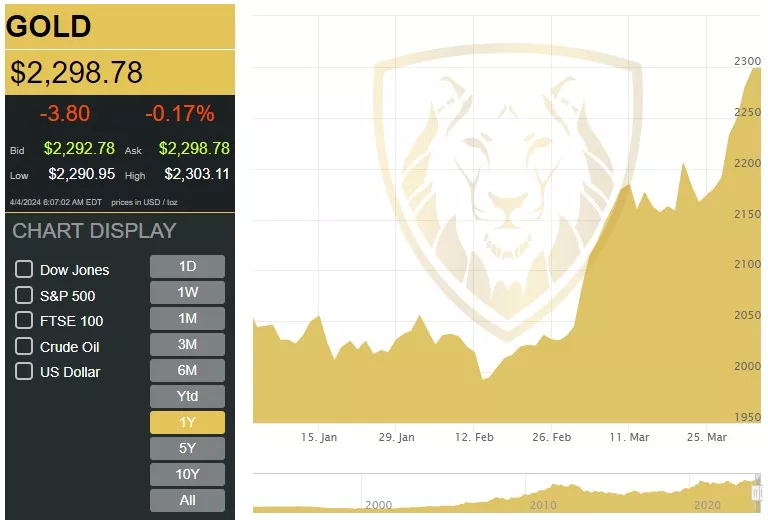

According to data from American Hartford Gold Group, as of April 4, gold prices have nearly hit $2300 per troy ounce, with growth accelerating since mid-February.

Peter Schiff, President of Euro Pacific Capital, noted that since the start of the second quarter, gold has risen by 8.7%, silver by 3.4%, while Bitcoin has fallen by 7%.

So far in Q2 2024 here are the results:#Silver up 8.7%#Gold up 3.4%#Bitcoin down 7%

The results speak for themselves.

— Peter Schiff (@PeterSchiff) April 3, 2024

In response to the reasonable objection that the period had only begun three days prior, he predicted further growth for metals, suggesting that things would only worsen for the leading cryptocurrency.

In another comment, Schiff was reminded of asset growth figures since the beginning of the year: gold at 12%, silver at 13%, and Bitcoin at 52%. Another user provided even more compelling five-year figures: 78%, 79%, and 1500% respectively.

Attention Bitcoin #HODLers. This may be your last change to sell your #Bitcoin and buy some #gold and #silver at favorable prices. If you fail to act, have fun staying poor. https://t.co/Y2JnEac7dr

— Peter Schiff (@PeterSchiff) April 4, 2024

“Attention Bitcoin HODLers. This may be your last chance to sell your coins and buy some gold and silver at favorable prices. If you remain inactive, enjoy staying poor,” urged the well-known cryptocurrency critic.

An investor known as Quasar wryly responded that he doesn’t have another 60 years to wait for precious metals to rise by the next $1500. Schiff suggested it might take 60 days.

ByteTree analyst Charlie Morris criticized Bitcoin from an environmental perspective, stating that gold reached its peak “without consuming electricity.” Previously, Bloomberg noted that in February, the cryptocurrency’s blockchain consumed a record 19.6 GW.

Daniel Batten, managing partner at CH4 Capital, offered his counterarguments:

“The energy required for gold mining primarily comes from fossil fuels, thus having a much greater environmental impact and emission intensity than Bitcoin mining, which is fully electrified and leaves no mercury or arsenic in the local soil,” the expert pointed out.

Swan Bitcoin co-founder Brady Swenson joined the discussion, confirming that he was left with “apocalyptic” impressions after visiting a gold mine.

In March, the debate over the environmental impact of cryptocurrency mining intensified following a Greenpeace report, which was sharply criticized by industry experts.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!