Hong Kong ETF Launch Eases Outflow from US Crypto Funds

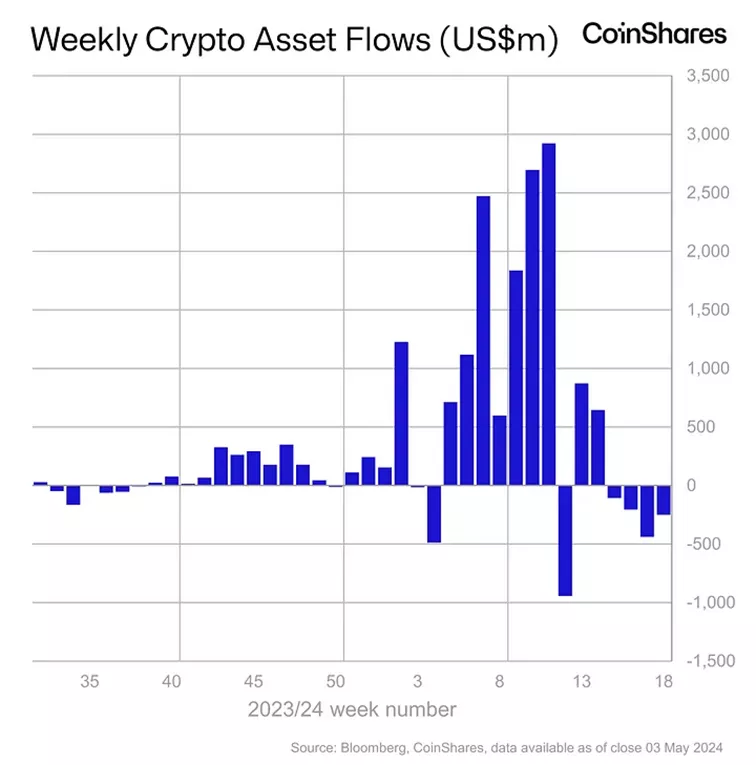

From April 27 to May 3, outflows from cryptocurrency investment products amounted to $251 million. This negative trend continued for the fourth consecutive week, according to CoinShares.

The negative result could have been even higher if not for the inflows into exchange-traded products launched on April 30 in Hong Kong ($307 million).

Analysts attributed the sharp outflow from American Bitcoin instruments to a wave of liquidations.

“We estimate the average purchase price of these ETFs was $62,200. Since the price fell 10% below this level, it could have triggered automatic sell orders,” the experts noted.

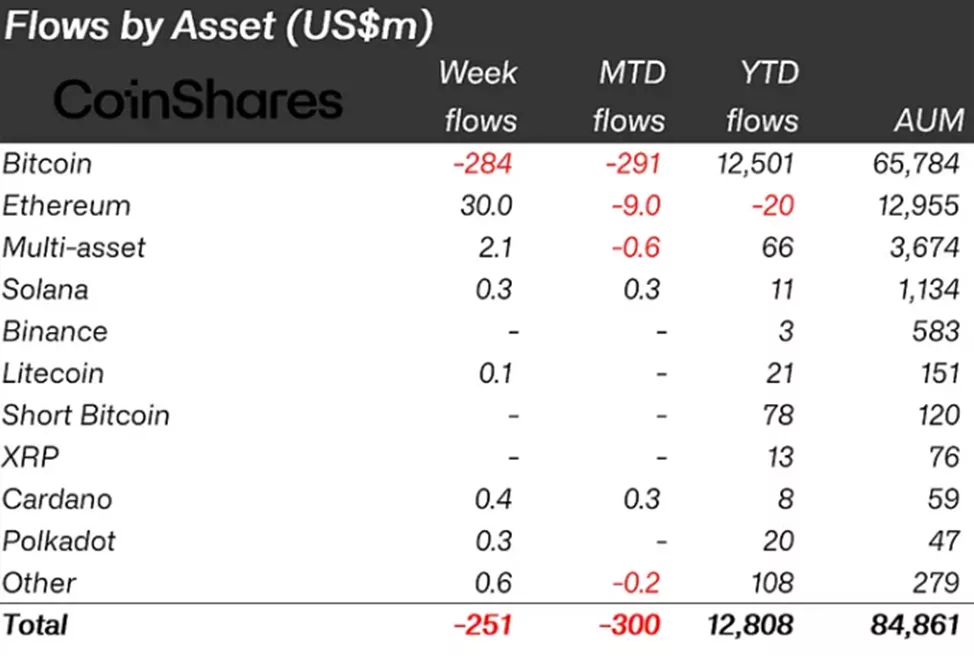

In total, clients withdrew $284 million from products related to digital gold, compared to $423 million in the previous reporting period.

The seven-week outflow from Ethereum funds reversed with an inflow of $30 million. Demand also dominated in other altcoins. Basket-based asset instruments attracted $2.1 million. The favorites were Avalanche ($0.5 million), Cardano ($0.4 million), and Polkadot ($0.3 million) respectively.

Analyst PlanB predicted the start of altcoin growth in the summer, followed by a correction in the third quarter.

Earlier, former BitMEX CEO Arthur Hayes suggested Bitcoin could surpass $60,000 and move towards $70,000 by August.

Trader and analyst Rekt Capital reported that the first cryptocurrency has exited the post-halving “danger zone” and entered a phase of re-accumulation.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!