MVRV Indicator Suggests Bitcoin’s Local Bottom Near $100,000

Bitcoin's fundamental metrics remain robust despite market panic.

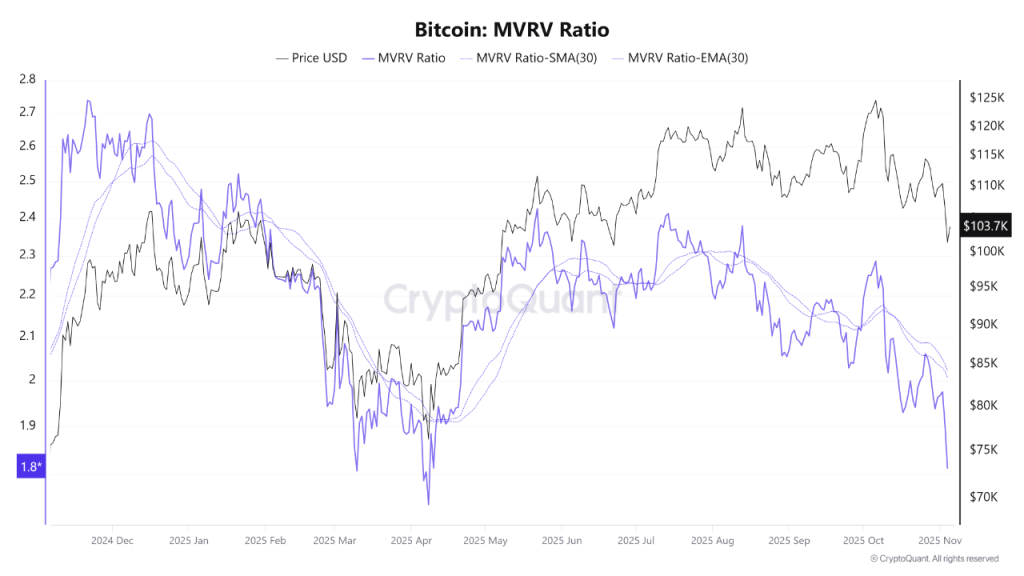

Bitcoin’s fundamental metrics remain robust despite market panic. A key signal comes from the MVRV ratio, currently at its lowest since April (1.8), as noted by contributors from CryptoQuant at XWIN Research.

“This indicates that the market value is approaching the average entry price of investors, suggesting a potential accumulation zone,” analysts noted.

A drop in MVRV to the 1.8–2 range typically signals a bottom or early recovery phase. Realized profits and losses are balancing, hinting at the end of profit-taking, added XWIN Research.

Researchers cited a price point of $99,000-101,000 as a reference.

They believe recent liquidations were mainly driven by long positions with “excessive” leverage. Additionally, long-term holders continue to profit, while short-term holders incur losses.

Exchange reserves continue to decline, indicating that coins are being moved to personal wallets for storage rather than being sold — a behavior historically aligned with stabilization phases.

Stablecoin activity also reflects a “defensive stance.” The USDT supply remains high at $183 billion, while USDC holds steady around $75 billion, supported by demand for institutional payments.

“Liquidity remains on the sidelines, awaiting clarity from upcoming US macroeconomic indicators, such as employment and trade data. Overall, on-chain signals point to a transitional market period rather than a collapse. Despite fear-induced selling and increased volatility, realized losses remain moderate, indicating a rational reorientation rather than capitulation,” analysts concluded.

At the time of writing, the leading cryptocurrency is trading around $101,700, having lost 3% over the past day.

Earlier, Sigma Capital CEO Vinit Budki suggested a potential 70% drop in Bitcoin.

For more on the dynamics of digital gold in October, read the latest ForkLog digest.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!