Accessibility and traceability: how the Bank of Russia sees the digital ruble

For a long time, discussions about the digital ruble were the subject of speculation by a handful of officials. However, on the eve of its publication, the Bank of Russia released its first report outlining its position on issuing a central bank digital currency (CBDC) in Russia. ForkLog has examined the report’s contents.

Three forms of money

In the annotation of the report, it is stated that a special working group within the Central Bank has been created to address the development of the digital ruble. The document was prepared by several departments, but the question of whether a CBDC will be issued — there is still no answer.

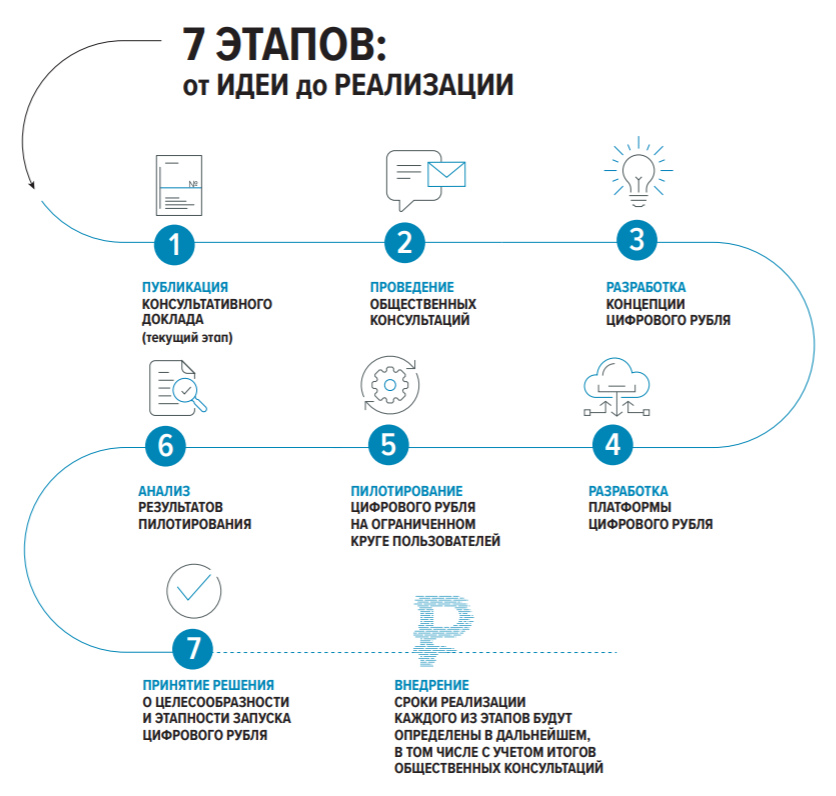

«Roadmap» for the development of the digital ruble.

It is emphasised that the digital ruble will become the third form of money, alongside cash and cashless money, and will be available to any person or organization. The authors describe their differences as follows:

«If cash is issued in the form of banknotes, each with a unique number, and non-cash money exists as records on accounts in commercial banks, then the digital ruble will take the form of a unique digital code that will be stored on a dedicated electronic wallet. The transfer of the digital ruble from one user to another will occur by moving the digital code from one electronic wallet to another».

As a prerequisite for creating the digital ruble, the substantial growth in the share of electronic payments in Russia is noted: from 39% in 2016 to 70% in the first half of 2020.

Among other prerequisites, the authors named high mobile penetration and the use of smart contracts in the financial market (likely this technology will be applied to the digital ruble as well).

At the same time, the Bank of Russia reiterates that cryptocurrencies and stablecoins are not money. This aligns with the main constraint, established by the previously enacted Law on Digital Financial Assets (more about the law “On CFA” read here, here and here ).

In the report, it is repeatedly noted that, in terms of payments, the digital ruble should be made as close as possible to cash, but more traceable for the state:

“Put simply, the digital ruble can be described as traditional banknotes and coins that are issued and transmitted electronically. Each banknote and coin retains its uniqueness, and the digital ruble system allows tracing their movement.”

To enable the digital ruble to perform the role of “new cash,” offline transfers during direct settlements are being considered. In theory, this would occur between wallets on separate devices (for example, phones) using wireless technologies.

Among its notable properties is compatibility with digital currencies from other countries in cross-border transfers, which should speed up and reduce the cost of payments. It seems the Bank of Russia views the issue of CBDCs abroad as a sustained trend.

How and why central banks are creating digital currencies (CBDCs)

Payments under oversight

On data privacy, the Bank of Russia presents a contradictory picture.

On the one hand, transfers in CBDC will contain “less information about the purpose of the payment and its recipient than existing payment systems,” and therefore the likelihood that personal data will be used for targeted advertising is lower. Theoretically.

On the other hand, it is not hidden that transaction data will be accessible to the central bank and “financial intermediaries,” i.e., banks — “in the interests of society.”

In addition, the state may introduce smart contracts and the digital ruble into the sphere of public procurement. To control the targeted use of funds in the digital ruble, a special marker indicating permissible spending purposes may be attached.

The range of uses for such “tagged” money will be significantly limited. It is envisaged that government bodies will automatically track the movement of budget funds to carry out contracts and other payments:

“For example, if the state allocated funds to an organisation in the digital ruble for social benefits, they cannot be spent on purchasing office equipment.”

Overall, the authors are convinced that “one of the advantages of introducing the digital ruble is the ability to analyse large datasets on economic agents and their payments.” The collection of such data could be carried out by banks and other financial institutions that comply with KYC/AML rules and report to Rosfinmonitoring.

Scope of responsibility: the Bank of Russia and commercial banks

A separate question is who will be responsible for what in digital ruble operations. The Bank of Russia proposed three possible models:

- The central bank creates the digital currency platform and provides direct access to individuals and organisations. It also manages wallets itself and conducts payments without the participation of commercial banks.

- The Bank of Russia manages the wallets, but commercial banks initiate their opening or closing; they also conduct all operations with them and interact with clients. Although each client has only one wallet, access may be provided through any bank and its applications.

- The central bank opens wallets only for banks, and they themselves manage the wallets of individual citizens and organisations.

Technical implementation

The central bank is also interested in the technical implementation. To support the CBDC, a separate payments infrastructure will be needed, the authors of the report argue. They proposed three possible bases:

- Distributed ledger. Among its advantages is resilience to “various incidents” compared with centralized systems, while downsides include low throughput and lack of established reporting rules.

- Centralized ledger. This solution is easier to implement. It would make the digital ruble platform more efficient, but all responsibility for availability, operation and fault tolerance of the platform would fall on a single participant.

- Hybrid model. It appears to be the “golden mean,” as it is noted that its application would combine the “advantages of each technology where it is most appropriate for use.”

It would seem that the authors regard the third option as the most preferable.

CBDC — a boon for people or the state?

This report is a draft of the future concept of the digital ruble and will form the basis for subsequent public consultations.

According to the report, issuing and distributing the digital ruble would bring substantial benefits for residents and businesses in Russia. These include lower transfer costs, stronger competition among banks for clients, and impetus for the development of new financial technologies.

Such promises sound alluring, but one should not forget that, along with “digital cash,” the state plans to substantially increase surveillance of monetary movements, which is plainly evident from the document.

While the development of the digital ruble remains at an early stage, and the Bank of Russia appears to be looking to global conditions, it is already clear that the widespread issuance of a state digital currency is merely a question of time.

Draft for Public Consultations by ForkLog on Scribd

Subscribe to ForkLog’s news on Telegram: ForkLog Feed — the full news stream, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!