Analysts see firmer technical underpinnings for bitcoin’s current rally

Unlike December–January, the backdrop now looks sturdier for bitcoin to push beyond $100,000, according to CoinDesk.

Analysts presented six charts across different metrics to support their view.

Financial conditions

Compared with the start of the year, the combination of 10- and 30-year US Treasury yields and the dollar index provides a more favourable backdrop for risk appetite across global markets.

Stablecoins

The combined market value of USDT and USDC has hit a record $151bn, nearly 9% above the December–January average of $139bn. In other words, there is now more dry powder available for potential crypto purchases.

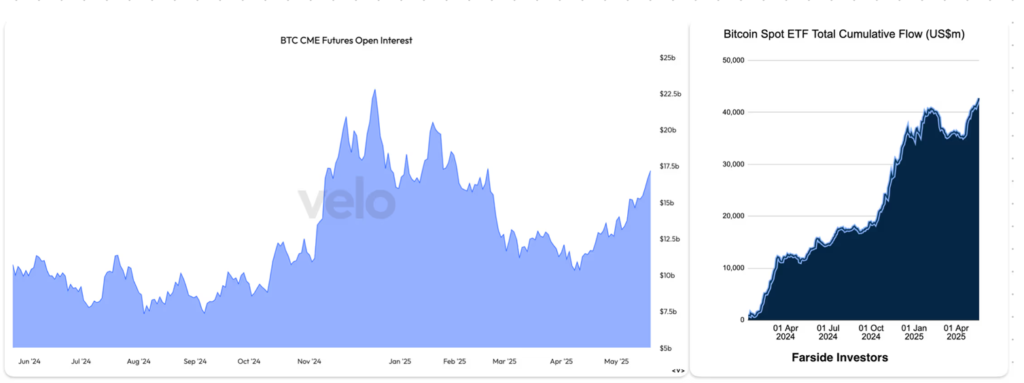

Institutional investors

Unlike December–January, institutional investors have shifted from hunting arbitrage to making outright bullish bets. That is reflected in an increase in inflows to BTC ETFs and a more restrained rise in open interest on CME.

The latter has risen to $17bn, below the December 2024 peak of $22.8bn. Cumulative inflows into BTC ETFs have jumped to a record $42.7bn, up from $39.8bn in January.

Lack of speculative froth

As a gauge of FOMO, the analysts point to the combined market capitalisation of two popular memecoins — SHIB and DOGE. This measure is well below January levels.

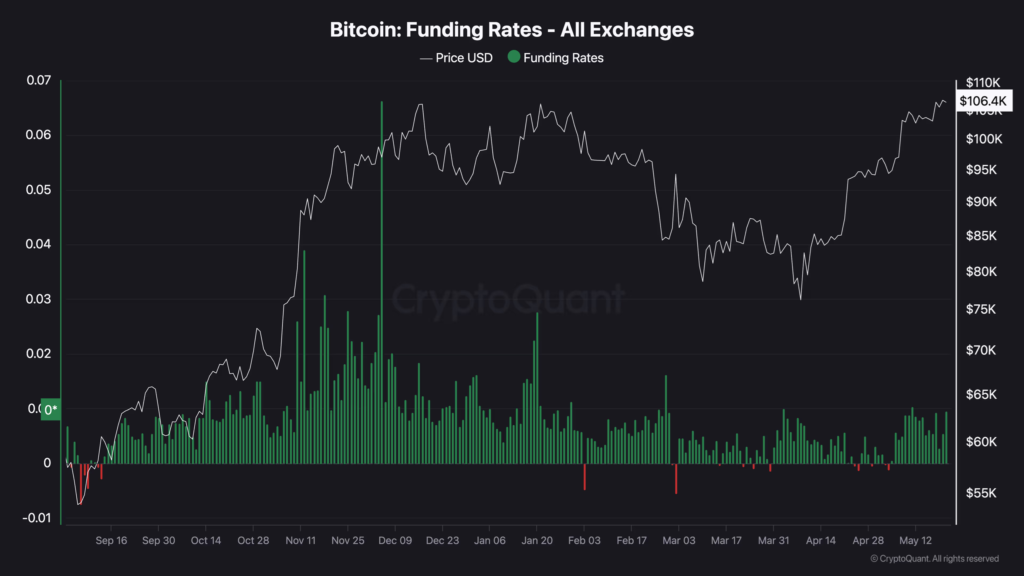

No signs of overheating

In perpetual futures on the leading cryptocurrency, funding rates are well below December highs.

Expectations of moderate volatility

Implied volatility on bitcoin options is far below the levels seen in December–January and in March 2024, when prices reached an ATH.

In other words, traders are not pricing in the extreme price swings and uncertainty that typically accompany an overheated market.

Standard Chartered urged investors to buy the leading cryptocurrency and forecast a rise to $120,000 in the second quarter.

JPMorgan expects bitcoin to outperform gold by year-end.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!