aPriori Team Vanishes Amid Airdrop Misappropriation Allegations

aPriori developers silent amid suspicious APR token airdrop discussions.

The developers of the aPriori project have gone silent amidst discussions of a suspicious airdrop of APR tokens, as reported by on-chain detective ZachXBT.

The expert reached out to the project’s founder, but received no response.

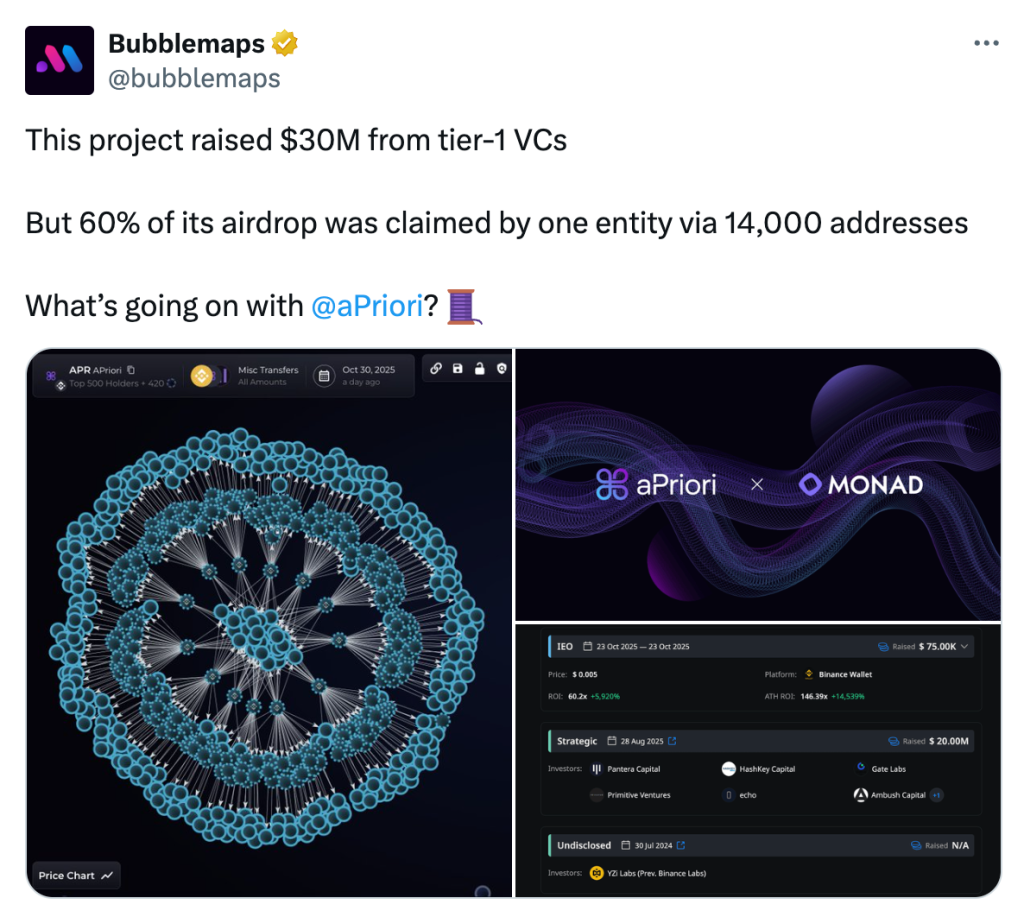

The issue arose following research by Bubblemaps, which revealed that approximately 60% of the airdropped coins were acquired by a single entity controlling 14,000 wallets.

Analysts noted that all addresses involved in the scheme were topped up with minimal amounts of 0.001 BNB via Binance. After receiving APR coins, they simultaneously transferred their shares to new wallets.

The unknown entity continued to create addresses even after the main distribution round, systematically increasing its share.

Earlier, the publication DL News highlighted suspicious activity, suggesting a Sybil attack and insider trading.

According to Bubblemaps, the team distributed the coins on October 23, shortly after BNB’s market cap exceeded $300 million. The airdrop accounted for 12% of APR’s total supply.

aPriori is one of the largest protocols on the L1 blockchain Monad, whose mainnet is set to launch on November 24. The project was launched in 2023 by former quantitative traders and engineers from Coinbase, Jump Trading, and Citadel Securities.

In August 2024, the platform raised $20 million to expand its trading infrastructure. The funding round included Pantera Capital, HashKey Capital, Primitive Ventures, and YZi Labs.

“An early TGE on a third-party platform without a functioning native blockchain is a classic red flag, indicating potential fraud,” noted ZachXBT.

At the time of writing, the APR token is trading around $0.2, having fallen over 10% in the past week.

According to CoinGecko, the asset’s market capitalization exceeds $48.7 million, with a daily trading volume of $7.9 million.

Back in April, it was revealed that the team behind the RWA project Mantra and partner market makers manipulated liquidity metrics of the collapsed OM token.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!