Bitcoin slips below $108,000

Bitcoin slips below $108,000 amid US–China trade tensions.

The price of the leading cryptocurrency fell below $108,000. The drop came amid macroeconomic risks, chiefly trade tensions between the US and China.

Over the past 24 hours, bitcoin has lost 3.2% and is trading around ~$108,000. On 20 October the asset briefly rose above $111,000.

In the view of BTSE chief operating officer Jeff May, volatility will persist. He linked it to trade tensions between the US and China. May believes the latest decline was driven by traders cutting risk ahead of a meeting between the countries’ leaders.

“Even if they reach an agreement, it is unlikely that the tensions will disappear completely,” he added.

Pressure spread to altcoins as well. Ethereum fell 4.8%, BNB 6%, and Solana 4.5%.

Spot crypto ETFs also recorded outflows. According to SoSoValue, $40.47 million was withdrawn from bitcoin funds, and $145.68 million from Ethereum-based instruments.

The Fear & Greed Index fell to 34.

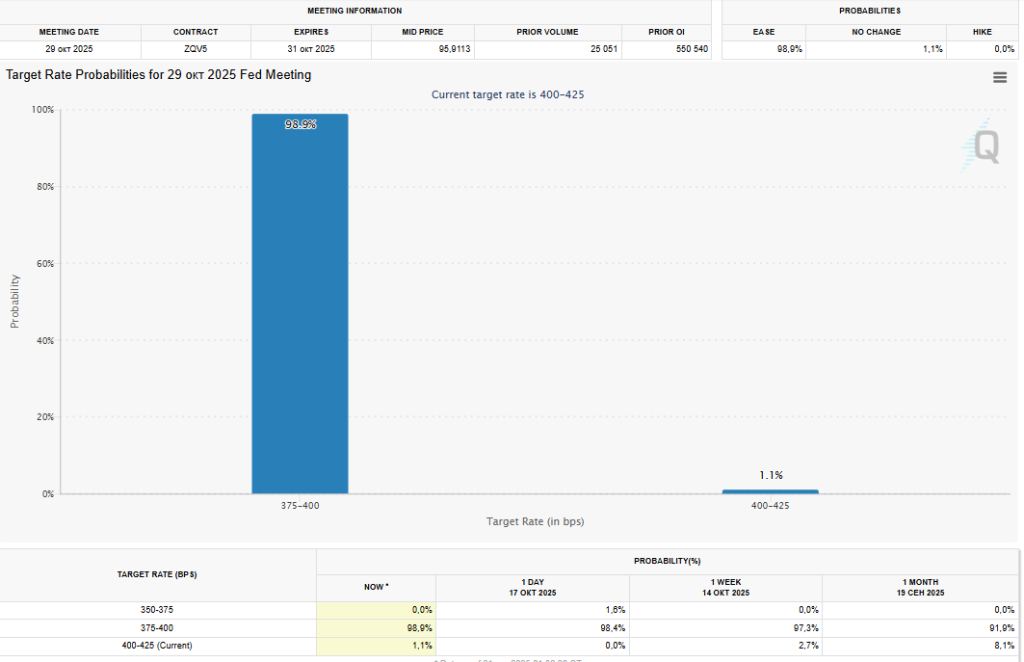

Traders now await the release of the consumer price index. The inflation print could influence the US Federal Reserve’s rate decision. According to the CME FedWatch tool, the probability of a 25-basis-point cut is 98.9%.

Liquidations

At the time of writing, total liquidations amounted to $322.59 million.

By comparison, the 11 October market plunge led to $19 billion of positions being liquidated. However, the episode showed that the digital-asset ecosystem can withstand shocks, said TD Cowen analysts.

“Although the recent episode caused financial hardship for many investors, we are struck by how well the underlying ecosystem functioned,” the experts wrote.

They stressed this was the largest one-day liquidation on record, yet most crypto exchanges operated with minimal disruption.

By their estimates, lesser-known tokens were “wiped out”, whereas bitcoin and Ethereum held their ground. For instance, the “digital gold” briefly fell to -15% at the lows but ended the day down only 8%.

TD Cowen analysts remain positive on the first cryptocurrency. They forecast bitcoin’s price will reach $141,000 by December.

Beyond market resilience, the experts noted ongoing global adoption of bitcoin. As an example, they cited Japan, where the number of registered digital-asset accounts has quadrupled to 7.9 million.

“This growth prompted the country’s Financial Services Agency to reconsider the long-standing ban on banks investing in digital assets such as bitcoin,” the analysts concluded.

Crypto winter

Analyst Willy Woo believes the next crypto bear market will differ from previous ones. In his view, it will be defined by a downturn in the business cycle, which the industry has not yet faced.

We had two 4y cycles superimposed

Now it’s only one; global M2 liquidity

Next bear IMO will be defined by another cycle people forget about → the business cycle

The last biz cycle downturns that really took hold was 2008 and 2001, from before crypto markets were invented pic.twitter.com/inHqQH7zWx

— Willy Woo (@woonomic) October 20, 2025

Previously, market cyclicality was set by bitcoin’s halving and central banks’ actions that influence global money supply. Now another factor will be added.

According to Woo, the key determinant will be recession. The last serious business-cycle downturns occurred in 2001 and 2008—before bitcoin existed.

The central question is how the first cryptocurrency will behave under such conditions.

“Will bitcoin fall like tech stocks, or behave like gold?” the analyst asked.

A recession is a period of economic contraction marked by falling GDP and rising unemployment. In Woo’s view, crypto markets are not insulated from these forces because they affect overall liquidity.

For example, during the dot-com bust in 2001 and the 2008 financial crisis, the S&P 500 fell by more than 50%.

The analyst noted that markets are speculative and price in future events ahead of time.

“Either bitcoin is already signalling to global markets that the peak has passed, or it still has catching up to do,” Woo concluded.

On 17 October, the price of the “digital gold” fell below $105,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!