DeFi TVL nears $80 billion

The total value locked (TVL) in DeFi protocols reached $78.7 billion. The rise was driven by projects built on the Binance Smart Chain, according to Defi Llama.

In the Ethereum network, TVL in March ranged from $38 billion to $45 billion, according to DeFi Pulse.

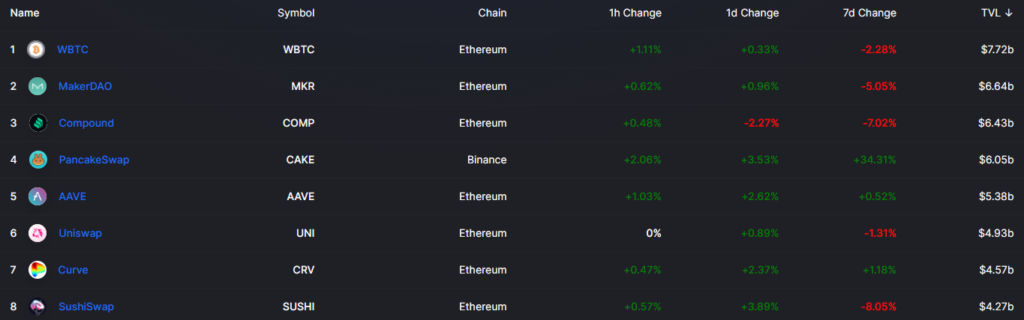

Defi Llama includes in the final figure a group of tokenised bitcoins. WBTC, with $7.72 billion, tops the list. hBTC with $1.56 billion sits in 16th place, renBTC with $687.7 million is 23rd.

WBTC, renBTC and HBTC — what are bitcoins on Ethereum and why are they needed?

In the top five TVL assets, PancakeSwap, with $6.05 billion on Binance Smart Chain (BSC), ranked fourth. The closest Ethereum-based rivals were Uniswap ($4.93 billion), Curve Finance ($4.57 billion), and SushiSwap ($4.27 billion) in sixth, seventh and eighth places, respectively.

Second, third and fifth places in the Defi Llama ranking are held by lending protocols MakerDAO ($6.64 billion), Compound ($6.43 billion) and Aave ($5.38 billion). They form the top trio of the DeFi Pulse ranking.

Over the past seven days, leaders among DeFi protocols on the Ethereum network showed little positive or negative momentum. Projects built on BSC registered a noticeable rise. PancakeSwap’s TVL increased by more than a third.

Over the same period, the aggregate value of 118 DeFi tokens rose by 1.31%, according to Messari.

In late March, Uniswap’s daily fees exceeded Bitcoin’s by $1.7 million.

High transaction fees led to migration of some users from Ethereum to BSC. In early March, PancakeSwap surpassed Uniswap in TVL.

Case: Binance Smart Chain — why users choose low fees over decentralisation

The Uniswap team previously announced the third version of the protocol, which is due to launch on May 5. Among the innovations are a three-tier structure for liquidity provider fees and the introduction of a second-layer solution, Optimism.

Subscribe to ForkLog news on VK!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!